Investing in stocks can seem overwhelming at first, but it’s one of the most effective ways to grow your wealth over time. Whether you’re saving for retirement, diversifying your financial portfolio, or working towards a short-term goal, learning where and how to invest in stocks is a critical first step. This guide will simplify the process and help you make informed decisions about your stock investments.

What Does It Mean to Invest in Stocks?

When you invest in stocks, you’re buying ownership shares of a company. By doing so, you’re betting on that company’s success in the long term. If the company performs well and grows, the value of your stock increases, giving you returns on your investment. However, it’s important to keep in mind that stock investments carry risks. The value of shares can fluctuate based on market conditions, potentially leading to losses as well as gains.

Where to Invest in Stocks

1. Brokerage Accounts

The most common way to invest in stocks is by opening a brokerage account. Brokerage accounts connect you to stock markets, allowing you to buy, sell, and track investments.

- Full-Service Brokers: Great for beginners who want personalized advice and a hands-on approach, though these services often come with higher fees.

- Discount Brokers: Cost-effective for self-directed investors who are comfortable managing their own trades. Platforms like Fidelity and Charles Schwab offer user-friendly tools with low fees.

- Robo-Advisors: If you’re looking for automatic portfolio management, robo-advisors like Betterment and Wealthfront can handle stock selections and asset allocation for you.

2. Retirement Accounts

For long-term goals like retirement, investing in stocks through IRAs (Individual Retirement Accounts) or 401(k)s is highly effective. These accounts provide tax advantages, helping your investments grow more efficiently over time.

3. Mobile Investment Apps

Apps like Robinhood, Webull, and Stash have made stock trading more accessible to beginners. With user-friendly interfaces, no commission fees, and the ability to buy fractional shares, they’re a great option if you’re just starting out.

4. Direct Stock Purchase Plans (DSPPs)

Some companies offer DSPPs that allow you to purchase shares directly from them without needing a broker. This is ideal if you want to support specific companies while avoiding intermediary fees.

5. Exchange-Traded Funds (ETFs) or Mutual Funds

If picking individual stocks feels daunting, ETFs or mutual funds are excellent alternatives. These funds pool money to invest in a diversified portfolio of stocks, which reduces the risk of relying on a single stock’s performance.

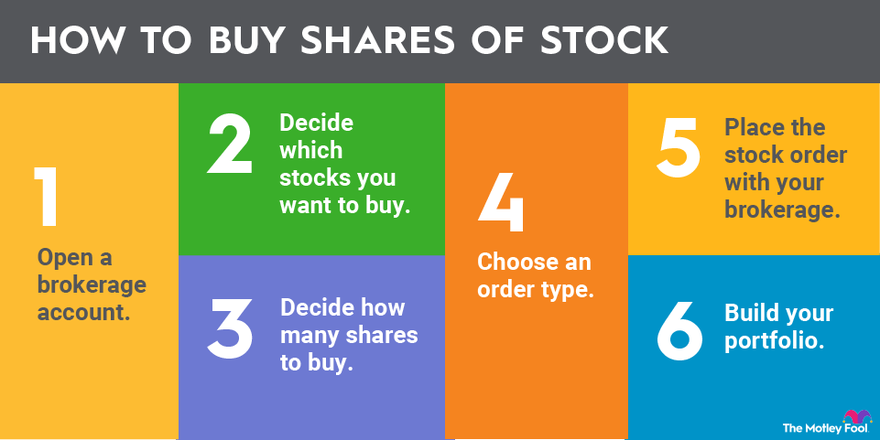

How to Get Started with Investing in Stocks

Step 1: Define Your Investment Goals

What are you investing for? Whether it’s a vacation in five years, a home down payment, or retirement, your goals will shape your stock investment strategy.

Step 2: Determine How Much You Can Afford to Invest

Before jumping in, assess your financial situation. Create a budget to ensure you’re investing money you won’t need in the short term. A solid emergency fund (3-6 months of expenses) is crucial to protect your finances.

Step 3: Understand Your Risk Tolerance

Investing in stocks comes with inherent risks. Determine your willingness to endure market fluctuations. Younger investors with longer time horizons can typically afford to take more risks, while those nearing retirement may prefer safer investments.

Step 4: Research and Choose Stocks

It’s vital to understand what you’re investing in. Focus on companies with consistent performance, strong finances, and promising industry prospects. You can also consider the following categories of stocks to start with:

- Blue-Chip Stocks: Shares of well-established, financially stable companies like Apple and Microsoft.

- Dividend Stocks: Stocks that pay regular dividends, providing steady income.

- Growth Stocks: Companies expected to grow above average, such as those in the tech sector.

Step 5: Diversify Your Portfolio

Avoid putting all your money into a single stock. Instead, diversify your investments across multiple industries or use ETFs to spread risk effectively.

Step 6: Monitor Your Investment Performance

Review your portfolio regularly to ensure it’s aligned with your goals. Keep an eye on market trends and adjust your strategy when necessary.

Key Tips for Successful Stock Investing

- Start Small: You don’t need thousands of dollars to begin. Many platforms allow investments as small as $5 through fractional shares.

- Avoid Emotional Decisions: Focus on long-term results instead of reacting to short-term market changes.

- Reinvest Dividends: Reinvesting earnings can maximize compound growth.

- Educate Yourself: Read books, follow financial news, and attend webinars to deepen your understanding of stock investments.

FAQs

Is it Risky to Invest in Stocks?

Yes, there’s always a level of risk. However, diversifying your investments and focusing on long-term goals can help mitigate potential losses.

How Much Money Do I Need to Start Investing?

With no account minimums on many platforms and fractional share options, you can start investing with as little as $5-$10.

Can I Invest in Stocks If I Know Nothing About the Market?

Absolutely. Robo-advisors and ETFs are ideal for beginners who are not ready to pick individual stocks. Many resources, like Investopedia’s stock simulators, can also help you practice and learn risk-free.

Final Thoughts

Knowing where to invest in stocks is just as important as understanding how to do it. Whether you choose a brokerage account, retirement plan, or an investment app, take the time to research your options and align them with your financial goals and comfort level. Remember, investing is a marathon, not a sprint. Stay patient, focused, and disciplined to see your wealth grow over the long term.

Are you ready to take the first step? Open an account with a trusted brokerage today and start building your financial future!