Taking out a loan can be a significant financial decision, whether you’re purchasing your first home, consolidating debt, or financing a major life expense. One of the biggest questions borrowers face is whether to opt for a fixed or variable interest rate. Among the two, fixed interest rate loans offer a unique set of benefits, making them an attractive option for many. But what is the benefit of having a fixed interest rate loan, and why should you consider one? Let’s explore.

What is a Fixed Interest Rate Loan?

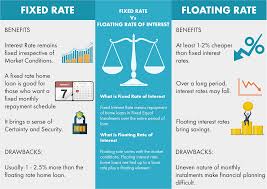

A fixed interest rate loan comes with an unchanging interest rate for either the entire life of the loan or a specific portion of it. Unlike variable interest loans, which fluctuate in response to market conditions, a fixed-rate loan guarantees that your rate will remain steady, regardless of economic shifts or changes in central bank rates.

Essentially, when you choose a fixed rate, you lock in a specific amount of interest you’ll pay throughout the loan term. This feature is particularly popular in mortgages, car loans, and personal loans.

Key Benefits of a Fixed Interest Rate Loan

1. Predictable Monthly Payments

Arguably the most significant advantage of a fixed interest rate loan is the predictability it brings. Your monthly payments remain consistent for the entire loan term, which makes budgeting much easier. For homeowners, this ensures you won’t be caught off guard by sudden increases in monthly mortgage payments due to market changes.

For example: Let’s say you take out a $300,000 30-year mortgage at a fixed interest rate of 4%. Your monthly payment will be approximately $1,432, and this amount stays the same until the loan is fully repaid. That reliability lets you confidently plan for other financial goals, such as savings or additional investments.

2. Protection Against Rising Interest Rates

A major downside of variable-rate loans is their vulnerability to market interest rate hikes. For instance, if you’re on a variable-rate mortgage and central banks decide to raise rates, your monthly payments could increase significantly.

With a fixed-rate loan, you’re protected from this risk. If interest rates go up, your payments stay the same, providing peace of mind and shielding you from unexpected financial strain.

3. Easier Long-Term Financial Planning

Because fixed-rate loans provide clarity on repayment amounts, they’re a great tool for long-term financial planning. Whether you’re a first-time buyer juggling a new mortgage or a business professional overseeing loan repayments, a predictable payment schedule allows you to allocate funds confidently toward other priorities, like building an emergency fund or saving for retirement.

4. Attractive in Low-Interest Environments

Locking in a fixed rate is particularly advantageous when market interest rates are low or near historical lows. By securing a fixed rate during a low-rate period, you ensure that you benefit from favorable conditions for the duration of your loan. Even if market rates rise significantly later, your rate stays locked, allowing you to enjoy consistent and affordable payments.

5. Simplified Loan Cost Calculation

A fixed interest rate makes it easier to calculate the total cost of borrowing over the life of your loan. Since the rate and payments are constant, you can determine precisely how much you’ll pay in interest over the years, avoiding surprises. This simplification is especially helpful for new borrowers who may be overwhelmed by financial decisions or those managing tight budgets.

6. Ideal for Risk-Averse Borrowers

If you value stability and prefer to minimize financial uncertainty, a fixed interest rate loan is likely the best choice for you. It eliminates the guesswork associated with market fluctuations, providing the consistency that many borrowers find comforting.

Considerations When Choosing a Fixed Interest Rate Loan

While fixed interest rate loans offer many benefits, there are a few factors to consider:

- Higher Initial Rates: Fixed-rate loans typically have slightly higher rates than variable-rate loans at the outset. This is because lenders charge a premium for the stability and reduced risk associated with fixed rates.

- Refinancing Costs: If market interest rates drop significantly after you’ve locked in a fixed rate, you may need to refinance your loan to take advantage of lower rates. However, refinancing can involve time-consuming processes and additional costs.

To decide whether a fixed-rate loan makes sense for your situation, weigh the benefits of long-term stability against the potential cost savings of opting for a variable rate.

Fixed Interest Rate Loans vs. Variable Interest Rate Loans

To further understand the unique value of fixed interest rate loans, here’s how they compare to variable-rate loans:

| Aspect | Fixed Interest Rate Loan | Variable Interest Rate Loan |

|---|---|---|

| Interest Consistency | Remains the same throughout the loan term | Changes based on market interest rates |

| Monthly Payments | Predictable and consistent | Fluctuates with market rates |

| Risk Level | Low risk, no surprises | Higher risk, as payments may increase |

| Long-Term Cost | Easy to calculate | Harder to predict |

| Ideal Environment | Best when interest rates are low | Best when rates are expected to decline |

Who Should Opt for a Fixed Interest Rate Loan?

A fixed interest rate loan is an excellent choice under specific conditions:

- You prefer predictable expenses and want stable payments.

- You are concerned about potential interest rate increases in the future.

- You’re borrowing during a low-interest rate environment and want to lock in a favorable rate.

- You need to manage a tight budget and cannot afford unexpected increases in payments.

- You are planning for the long term and need payment stability over the lifetime of the loan.

Is a Fixed Interest Rate Loan Right for You?

If stability, predictability, and financial peace of mind are your priorities, a fixed interest rate loan could be a great fit. It’s particularly beneficial for homeowners and first-time buyers who want manageable, consistent payments while avoiding unexpected financial burdens caused by fluctuating interest rates.

By understanding what is the benefit of having a fixed interest rate loan, you can make an informed borrowing decision that aligns with your personal financial goals.

Curious about your options? Use an online loan calculator to compare fixed and variable loan rates, or consult with a lender for personalized advice.