For anyone new to the world of accounting or business finance, you’ve probably come across the term “noncurrent assets.” Whether you’re an accounting student, a small business owner, or a finance professional seeking clarity, understanding noncurrent assets is key to navigating financial statements with confidence.

What are Noncurrent Assets?

Noncurrent assets, sometimes called long-term assets, are resources owned by a company that are not expected to be converted into cash within a year or an operating cycle. Unlike current assets (e.g., cash, inventory, accounts receivable)—which are liquid or can be turned into cash quickly—noncurrent assets are more illiquid and are meant to serve an organization’s operations over the long term.

These assets range from physical properties like buildings and equipment to intangible assets like patents and trademarks.

Key Attributes of Noncurrent Assets:

- Long-Term Value: Their contributions to the business stretch beyond a single accounting year.

- Illiquidity: They cannot easily or quickly be converted into cash.

- Capitalization: Costs associated with these assets are typically spread out over their useful life through processes like depreciation, amortization, or depletion.

Noncurrent assets are recorded on the balance sheet, categorized under specific headings, providing a snapshot of a company’s long-term investments.

Categories of Noncurrent Assets

Noncurrent assets are typically grouped into three main types, each playing an essential role in an organization’s operations.

1. Tangible Assets

These are physical, visible assets essential for producing goods or providing services.

- Examples include real estate, machinery, vehicles, and land.

- For instance, a manufacturing company might list factory buildings and production equipment under this category.

2. Intangible Assets

These are non-physical assets that hold value due to legal or intellectual properties.

- Examples include patents, trademarks, goodwill, and software licenses.

- Typically, these assets represent a company’s competitive advantages, like proprietary technology or brand reputation.

3. Natural Resources

Assets derived from nature that can be consumed or sold over time.

- Examples include timber, fossil fuels, and mineral rights.

- These assets are depleted as they are used, reducing their value over time.

Real-World Examples of Noncurrent Assets

- Property and Equipment (Tangible): A retail store might own its premises and use it for physical operations.

- Patents (Intangible): A tech company that developed original software would categorize its patents here.

- Oil Reserves (Natural Resources): An energy company might list these under noncurrent assets to reflect its long-term resources.

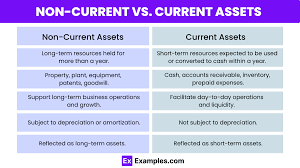

Noncurrent vs. Current Assets

The primary difference lies in their timeframe for conversion into cash. Here’s a simplified breakdown for comparison:

| Attribute | Noncurrent Assets | Current Assets |

|---|---|---|

| Usage Period | Over one year (Long-Term) | Within one year (Short-Term) |

| Conversion to Cash | Not easily convertible | Highly liquid |

| Examples | Real estate, patents, machinery | Cash, accounts receivable, inventory |

Accounting for Noncurrent Assets

Noncurrent assets are usually capitalized. This means that instead of expensing the total cost of the asset in the purchase year, the cost is allocated across its useful life. This allocation can be done via methods such as:

- Depreciation (e.g., for tangible assets like vehicles or equipment)

- Amortization (e.g., for intangible assets like patents or software licenses)

- Depletion (e.g., for natural resources like oil reserves or timber)

This approach ensures accurate financial reporting and reflects the ongoing utility of long-term assets.

Why are Noncurrent Assets Important?

Noncurrent assets play a foundational role in any business’s longevity and operational success. Here are a few reasons why they are vital:

- Operational backbone: Whether it’s physical equipment for production or patents to protect intellectual property, noncurrent assets form the infrastructure of a company.

- Investment in Growth: These assets often reflect strategic, long-term investments that enhance capacity and profitability.

- Financial Health Indicator: Analysts frequently assess the composition of a company’s assets to gauge liquidity and risk.

Examples of Industries and Asset Composition

Noncurrent asset-heavy industries usually require significant upfront investment. For instance:

- Capital-Intensive Industries: Oil refineries or automobile manufacturers may have a high proportion of noncurrent assets like specialized machinery, property, or pipelines.

- Service-Based Industries tend to rely less on tangible assets, instead allocating more toward intangible assets like software or brand goodwill.

Common Questions

What does a high proportion of noncurrent assets indicate?

It could highlight heavy investments or a reliance on fixed infrastructure—but it can also signal lower liquidity. Careful evaluation is required to understand the implications for financial flexibility.

Can prepaid expenses be noncurrent assets?

Yes, if the benefit of the prepaid expense extends beyond one year. For instance, rent paid in advance for 24 months might have 12 months classified as a current asset and the other 12 months as a noncurrent asset.

Final Thoughts

Understanding what noncurrent assets are is essential for anyone managing or analyzing a business. These long-term investments contribute significantly to growth, stability, and innovation, making them invaluable for an organization’s future.

Whether you’re an entrepreneur making your first balance sheet or an accounting student prepping for an exam, remember this rule of thumb about noncurrent assets: They are not just records on a financial statement but the backbone of a thriving business.

For more guidance on accounting principles or a deeper understanding of financial reporting, stay tuned for our expert insights!