If you’re looking to have more control over your investments, you might have come across the term “self-directed brokerage account” or SDBA. But what exactly is a self-directed brokerage account, and how can it help you achieve your investment goals? This article will break it down for you in simple terms and show you how this tool could fit into your financial strategy.

What is a Self-Directed Brokerage Account?

A self-directed brokerage account, often referred to as an SDBA, is a type of investment account that allows you to manage your own portfolio. Unlike standard brokerage accounts or those tied to your employer’s 401(k) plan with pre-selected investment options, an SDBA puts the power in your hands. It lets you choose from a broader range of investments such as individual stocks, bonds, ETFs (exchange-traded funds), mutual funds, and more.

You can think of it as a “do-it-yourself” investment option. Rather than leaving your portfolio in the hands of fund managers with limited investment options, you control the investment choices based on your individual goals and preferences.

These accounts are commonly offered as part of a 401(k) plan or retirement package, but many exist independently for general investing purposes.

Key Features of Self-Directed Brokerage Accounts:

- Wide Variety of Investment Choices: You can invest in many types of assets, ranging from stocks and bonds to niche options like sector-specific ETFs or emerging market funds.

- Higher Degree of Control: You decide which investments to pursue based on your goals, risk tolerance, and timeline.

- Requires Knowledge and Discipline: Since you’re in the driver’s seat, you’ll need a solid understanding of investing fundamentals to make smart financial decisions.

For retirement savers or beginner investors eager to diversify outside the typical mix of mutual funds, an SDBA could be a good option with appropriate research and planning.

Benefits of a Self-Directed Brokerage Account

Why would someone choose a self-directed brokerage account over other options? Here are some of the major advantages:

1. Wide Range of Investment Options

Unlike standard retirement accounts or traditional brokerage plans, which often restrict you to a pre-curated list of funds, SDBAs open the door to far more investing possibilities. Want to explore a niche market ETF? No problem. Interested in portfolio allocations that mirror your personal investment strategy? You have the freedom to do that.

This flexibility allows investors to fine-tune their portfolios, diversify their investments, and focus on sectors or trends that align with their interests or long-term goals.

2. Potential for Higher Returns

If you’re an experienced investor or willing to educate yourself, having the freedom to direct your own investments could mean higher returns compared to a traditional investment plan. For instance, you can choose individual stocks or funds with higher growth potential rather than sticking to low-risk, generalized options like a mutual fund.

3. Tailored to Your Investing Style

Are you a DIY investor who loves the challenge of picking stocks? Or perhaps you prefer socially responsible investing options? An SDBA allows you to align your investments with your personal philosophy, goals, and values, making it easier to construct a portfolio you truly believe in.

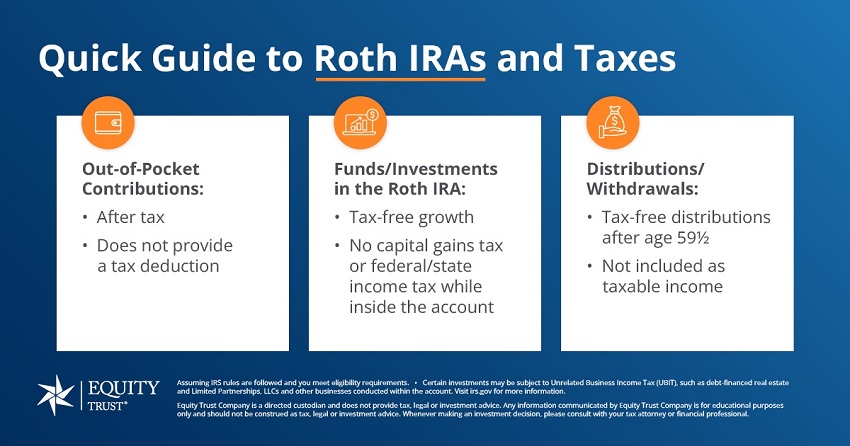

4. Opportunities for Tax Management

Many SDBAs, especially those tied to 401(k) plans, allow trading without immediate tax consequences. This means you can rebalance or experiment with certain investments while deferring capital gains taxes until retirement withdrawals, giving you more room to plan efficiently.

Risks & Drawbacks of Self-Directed Brokerage Accounts

While the idea of unlimited control sounds appealing, it’s important to note the potential downsides of SDBAs, especially for beginners:

1. Risk of Financial Loss

Investing always carries risk, and having the freedom to choose your own investments means you can also make mistakes. This is especially true for inexperienced investors who may not fully understand the assets they’re trading or the risks involved.

For example, an unwise trade in speculative stocks or timing issues during a downturn could lead to significant losses, potentially jeopardizing long-term financial plans.

2. Complexity and Time Commitment

Managing a self-directed brokerage account is not a set-it-and-forget-it strategy. To make the most out of this account, you’ll need to keep researching investments, monitoring market trends, and regularly reviewing your portfolio. Doing so requires serious time and effort.

3. Fees and Transaction Costs

Every trade you make typically comes with fees, such as transaction costs or commissions. While fees are relatively minor, frequent trading can quickly erode your profits. Some SDBA providers may also charge additional administrative fees for managing this type of account.

4. Lack of Professional Guidance

Unlike managed accounts, where professional fund managers curate investment options for you, an SDBA relies entirely on your decisions. If you trade based on emotions or lack the necessary expertise, you could make costly mistakes.

How Self-Directed Brokerage Accounts Work Inside a 401(k)

Some employers offer self-directed brokerage accounts as part of their 401(k) retirement plans, allowing individuals to allocate a portion of their funds for self-managed trades.

For instance, after meeting account minimums or plan restrictions, a participant can transfer money from their standard 401(k) portfolio into an SDBA. They can then invest in eligible securities such as stocks, bonds, and ETFs, just as they would with a normal brokerage account.

However, it’s worth noting that certain high-risk activities, such as buying on margin or trading options, are often prohibited within 401(k) SDBA plans.

Things to Keep in Mind:

- Plan Restrictions: Some plans only allow you to move a percentage of your contributions to the SDBA.

- Tax Advantages: Trading within a 401(k) SDBA typically doesn’t incur taxes until you withdraw funds in retirement.

- Suitable for Experienced Investors: Given the complexities, these options tend to favor participants with a higher level of financial knowledge.

Is a Self-Directed Brokerage Account Right for You?

Whether or not an SDBA is a good fit will depend largely on your experience, goals, and time commitment:

This may be a good choice if you:

- Have a solid understanding of investments and market trends.

- Want more control over your portfolio and a wider range of choices.

- Are comfortable with taking risks in pursuit of higher returns.

But think twice if you:

- Are new to investing or have limited market understanding.

- Prefer a low-maintenance, hands-off approach.

- Don’t have the time to actively manage a portfolio.

If you’re curious but unsure whether an SDBA aligns with your needs, consulting a financial advisor can help you weigh the pros and cons before taking the leap.

Final Thoughts on Self-Directed Brokerage Accounts

A self-directed brokerage account offers an exciting opportunity to take full control of your investments, allowing for diversification, personalized strategies, and potentially higher returns. However, its success depends entirely on your ability to make informed choices and manage risks carefully.

For beginner investors, this could be the first step toward learning the ropes of investment management. For seasoned traders, it may be a strategic tool to refine and optimize existing portfolios.

Still have questions about investing or how a self-directed brokerage account could work for you? A financial advisor can provide personalized insights into your best options.