A Flexible Spending Account (FSA) is a great tool for managing out-of-pocket healthcare or dependent care costs. It allows you to set aside pre-tax dollars for eligible expenses, which can lead to significant tax savings. However, FSAs often come with a “use it or lose it” rule, creating an urgency to carefully plan how you use the funds. When FSA money is not used, it can result in forfeiture of these valuable savings. Here’s a breakdown of what happens to unused FSA money and how to avoid losing it.

The “Use It or Lose It” Rule

The majority of FSAs operate under the “use it or lose it” rule. This means that if you don’t spend the money in your FSA account by the end of the plan year, you lose access to the remaining balance. Rather than rolling over to the next year (like a savings account might), unused FSA money is forfeited and returned to the employer who sponsors the plan.

Example:

If you contribute $1,500 to your FSA for the year but only use $1,000 on eligible expenses, the remaining $500 is lost if you don’t spend it by the deadline.

Are There Exceptions?

Certain plans may offer a couple of exceptions to provide more flexibility:

- Grace Period: Some employers allow a grace period of up to 2.5 months beyond the end of the plan year. For example, if the plan year ends on December 31, you may have until March 15 of the following year to use the funds.

- Carryover Option: Alternatively, some employers allow a small portion of unused FSA funds to carry over to the next plan year. For 2024, this carryover limit is $610.

It’s essential to check with your employer or FSA administrator to understand your plan’s specific rules.

What Happens to Forfeited Funds?

If your FSA money is not used and forfeited, the employer retains the funds. Employers often use these forfeited funds to offset FSA administrative costs or redistribute them across other employee benefits. Unfortunately, you cannot reclaim this money.

How to Avoid Losing FSA Money

Planning ahead is the most effective way to ensure you use your FSA funds and maximize the benefits. Here’s how you can avoid losing money:

1. Estimate Expenses Carefully

Before deciding on your annual contribution, review your historical spending on healthcare or dependent care costs. Think about upcoming expenses, such as medical procedures, childcare, or new glasses, to set a realistic contribution amount.

2. Track Your Balance

Regularly check your FSA balance to ensure you’re on track to use your funds. Many FSA plans have online portals or apps that make it easy to monitor your account.

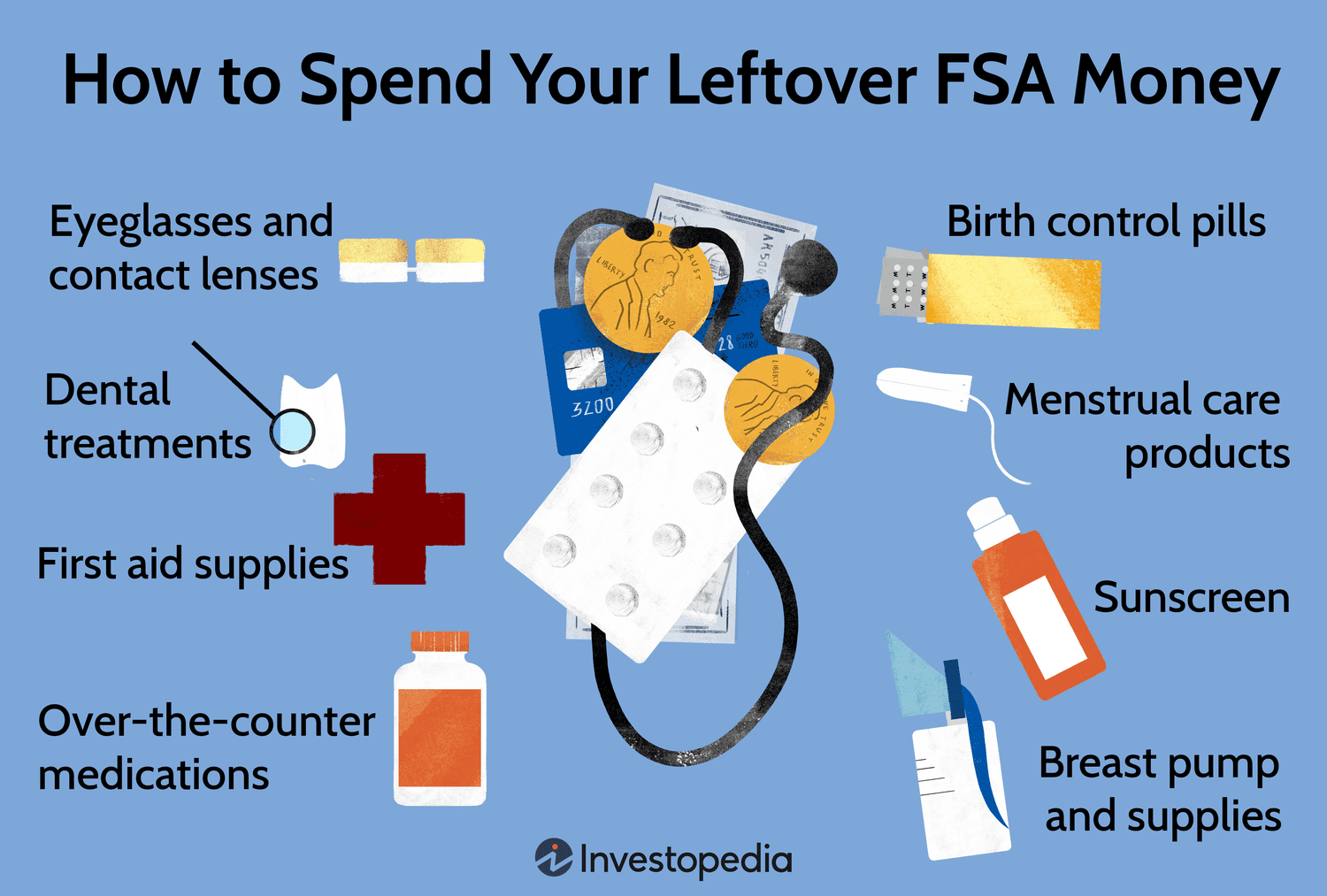

3. Understand Eligible Expenses

One of the most common reasons FSA money is not used is simply misunderstanding what expenses qualify. FSAs can be used for a wide range of eligible costs, including:

-

-

- Medical co-pays and deductibles

- Prescription medications

- Over-the-counter drugs approved by the IRS

- Medical devices like blood pressure monitors

- Dependent care costs for children or adults

-

Check IRS Publication 502 for a full list of eligible expenses, and keep receipts for reimbursement.

4. Plan Ahead for End-of-Year Spending

If your plan year is ending and you still have funds left, consider stocking up on essentials like first-aid supplies, prescription refills, or checkups that you’ve been putting off.

5. Ask About Rollovers or Grace Periods

Find out if your plan offers either a carryover option or a grace period. If one of these options is available, it can provide extra time to maximize the use of your funds.

6. Use Employer Tools

Many employers or plan administrators provide resources such as online tools, reminders, or suggested expenses to help you make the most of your FSA money.

Why It’s Important to Use FSA Funds Wisely

Losing FSA money is not just a financial loss—it’s also lost value on the income you could have saved from taxes. For example, an individual in a 24% tax bracket saves $24 in taxes for every $100 contributed to an FSA. If you don’t use that money, you not only lose access to the funds but also forego this financial benefit.

Final Thoughts

FSAs are a powerful tool for saving on medical and dependent care expenses, but they require proactive planning to avoid losing unused funds. By accurately estimating your expenses, understanding your plan’s rules, and using your balance strategically, you can fully utilize your FSA and prevent forfeiting your hard-earned money.

If you’re not sure how to manage your FSA funds effectively, consult your FSA provider or employer’s HR department. Remember, planning ahead ensures you maximize the value of your contributions without any unnecessary losses!