Certificates of deposit (CDs) are a popular choice for investors seeking stability and predictable returns. However, within the broad category of CDs lies a less conventional option known as a callable CD. If you’ve come across the term and wondered, “What does callable mean on a CD?”, this article will break it down into simple terms.

Callable CDs, while offering notable benefits, come with specific rules and risks that can significantly impact your investment strategy. Here’s everything you need to know.

What Is a Callable CD?

A callable CD is a type of certificate of deposit that includes a “callable” feature, allowing the issuing bank to redeem, or “call back,” the CD before its maturity date. This means the bank can return your principal investment along with any interest earned up to that point, effectively ending the agreement early.

By comparison, traditional CDs are not callable, meaning you’re guaranteed the agreed-upon interest rate for the entirety of the term. Callable CDs differ because they give the bank flexibility to cancel your contract when it becomes financially advantageous for them.

For example, if you purchase a callable CD with a five-year maturity period and a call date after one year, the bank has the right to end this arrangement any time after the one-year mark, depending on changes in the economic environment. This flexibility shifts some risk onto the investor.

Why Would a CD Be Called?

The main driver behind a callable CD being redeemed early is changing interest rates. Put simply, banks will assess whether keeping your CD active aligns with their financial goals.

- If interest rates decline

When market interest rates drop below the rate the bank promised you on your callable CD, the bank saves money by calling your CD, paying you back your initial investment and any accrued interest, and issuing new CDs at a lower rate. This protects the bank from overpaying for funds.

For example:

-

-

- You hold a 5% callable CD.

- Market rates drop to 3%.

- The bank calls your CD, as they can now issue new CDs at just 3%, saving on interest payouts.

-

- If interest rates rise

On the flip side, if rates go up, the bank will likely keep your callable CD active. Why? Because they’re earning more on your money than they would issuing a new CD at the higher market rate. This situation, however, creates a potential downside for you if you’d like to reinvest your funds at the new higher rate but are locked into the lower one from your callable CD.

These mechanisms introduce an important concept called reinvestment risk, which we’ll explore below.

Key Terms to Understand Callable CDs

To fully grasp callable CDs, it’s essential to understand some key terms:

1. Callable Date

The callable date is the earliest point at which the issuer (usually a bank) has the option to call back your CD. After this date, the bank can decide to redeem your CD based on its financial calculations and the prevailing interest rates.

For example, if your callable CD has a callable date after six months, the bank can review its options every six months thereafter and decide whether to continue or call the CD.

2. Maturity Date

The maturity date is the point where your investment officially ends, and you’re guaranteed to receive your principal plus the agreed-upon interest if the CD isn’t called early. Callable CDs often have longer maturity dates than traditional ones, ranging from several years to more than a decade.

It’s important to note that the maturity date doesn’t always align with the callable date. A callable CD with a two-year callable period might have a maturity date 10 or 20 years into the future.

Benefits of Callable CDs

Callable CDs can be attractive investments, particularly for those willing to accept a bit of risk. Here are their main advantages:

- Higher Interest Rates

Since callable CDs shift some of the interest rate risk to the investor, issuers typically offer higher interest rates than standard CDs. This can make them appealing if you’re looking to maximize returns.

- FDIC Insurance

Callable CDs, like standard CDs, are generally FDIC-insured (up to $250,000 per depositor per bank), making them a safe investment option in terms of principal protection.

- Predictable Returns (If Not Called)

While callable CDs introduce reinvestment risk, they still maintain predictable returns for the duration they remain active.

- Good for Stable or Rising Interest Environments

If market conditions are stable or rising, callable CDs can be a great tool to lock in higher yields that wouldn’t be obtainable from traditional CDs.

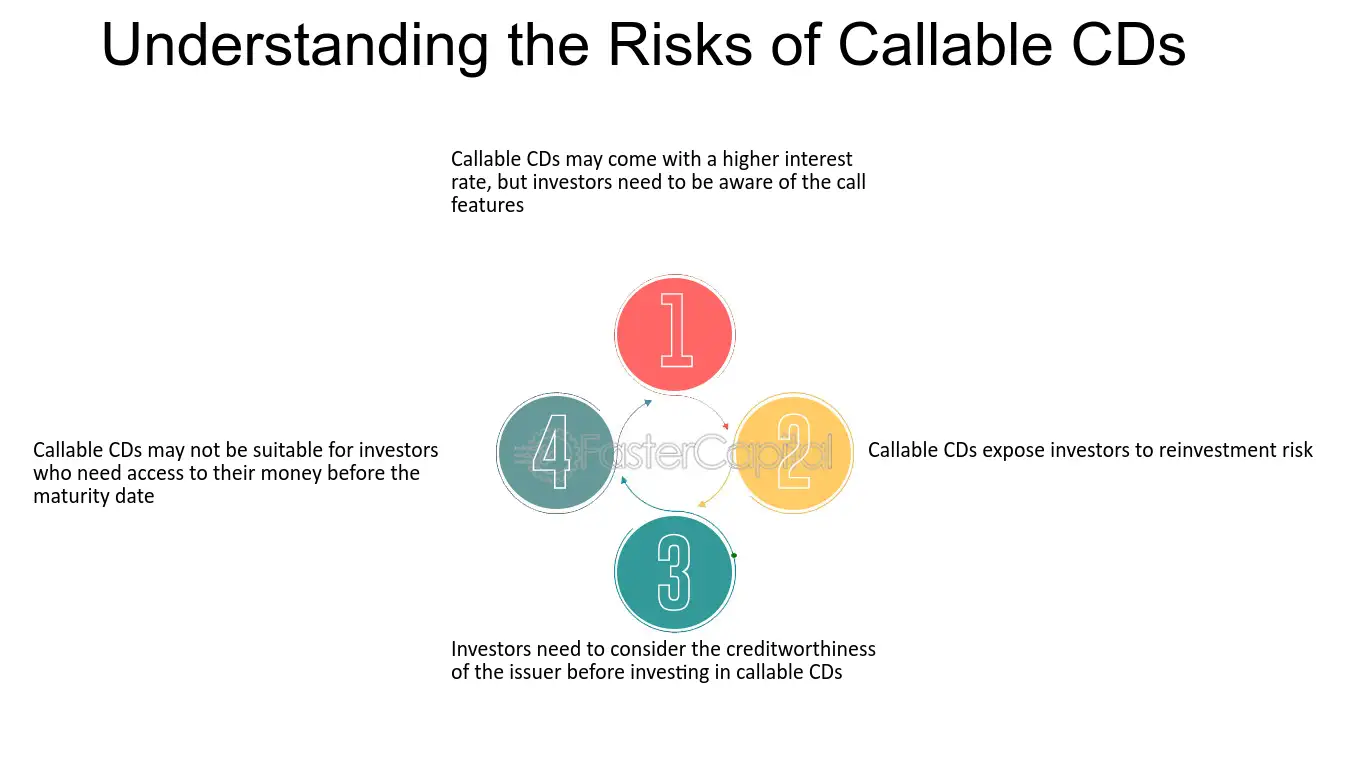

Risks of Callable CDs

Of course, callable CDs come with their downsides. Here are some key risks:

- Reinvestment Risk

One of the biggest risks is when a CD gets called in a low-interest-rate environment. You may be forced to reinvest your funds at a significantly lower rate than what you’d originally locked in, impacting your overall financial plans.

For example:

-

-

- You plan to earn 5% interest annually for five years.

- After one year (the callable date), the CD is called due to declining rates.

- Now, you’re likely stuck reinvesting at a much lower rate, reducing your returns.

-

- Longer Commitments

Callable CDs often come with longer maturity dates (up to 10–20 years), meaning your funds can potentially be inaccessible for extended periods unless you’re comfortable paying early withdrawal fees.

- Limited Upside if Rates Rise

Unlike other investment vehicles that benefit when interest rates rise, callable CDs lock you into a fixed rate unless you’re willing to pay surrender charges to withdraw your funds.

- Complexity and Fine Print

Understanding the specific terms of a callable CD, such as the callable date, surrender fees, and maturity, requires careful reading. Investors who overlook these details may face unexpected challenges.

Should You Invest in Callable CDs?

Whether a callable CD is a good fit depends on your financial goals and comfort with risk. They may be a smart choice for investors who:

- Seek higher yields than traditional CDs.

- Are confident that interest rates will remain stable or increase.

- Are comfortable with the potential for reinvestment risk.

However, if you prioritize simplicity, guaranteed returns throughout the investment term, or flexibility to reinvest in rising-rate environments, a traditional CD may be more suitable.

Before investing, compare rates and terms carefully, and always consider your broader financial strategy. Consulting with a financial advisor can also provide clarity on whether a callable CD aligns with your portfolio.

Final Thoughts

Understanding what callable means on a CD is key to making informed financial decisions. While callable CDs offer higher yields, they come with unique risks, including the potential early redemption by the issuer. For the right investor, they can be a powerful tool for achieving financial goals—but they aren’t for everyone.

Looking to invest more wisely? Start by speaking to your advisor or exploring detailed terms with potential institutions before making a decision. The higher returns are enticing, but knowing how to manage the attached risks can help ensure your money works for you.