The term Rocket Mortgage Scam has recently caught attention as consumers become more vigilant about potential fraud in financial services. However, it’s essential to differentiate between legitimate services like Rocket Mortgage and scams that may use its reputable name to deceive consumers. Mortgage scams, in general, can take various shapes, targeting those seeking financial solutions for housing. This article will analyze what a Rocket Mortgage Scam might entail, the signs to look out for, and how you can protect yourself during the mortgage process.

What is a Rocket Mortgage Scam?

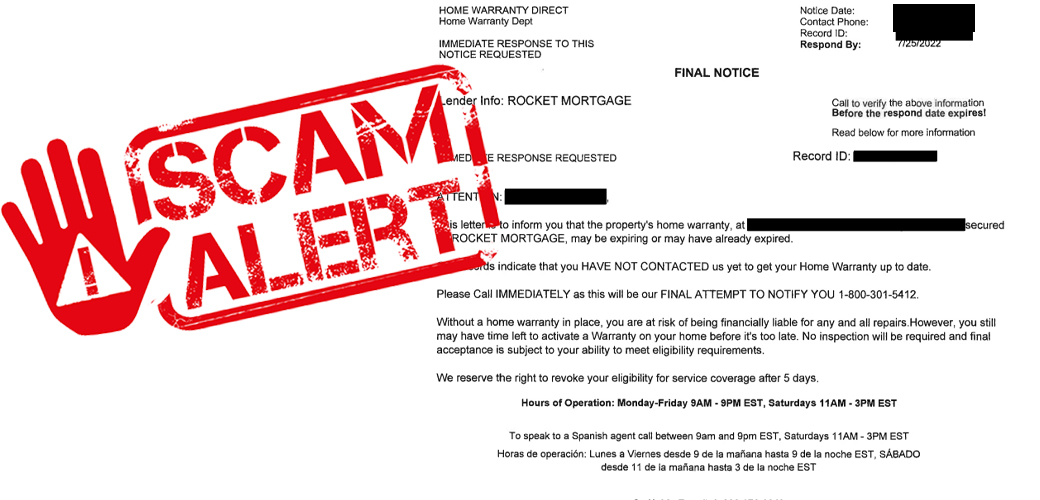

To clarify, Rocket Mortgage is a legitimate and widely trusted brand offering mortgage and refinancing solutions. However, like many reputable companies, impersonation scams may use their name to deceive unsuspecting consumers. A Rocket Mortgage Scam typically involves fraudsters pretending to represent the company through phishing emails, fake customer service numbers, or fraudulent loan offers. Their goal is often to steal personal information, redirect payments, or charge illegal upfront fees.

These scams are not directly linked to Rocket Mortgage but rather exploit their well-known brand name to gain trust quickly. Similar tactics have been reported with other major financial institutions as fraudsters leverage familiarity to lower their victims’ guard.

Common Mortgage Scam Types

Understanding the broader landscape of mortgage-related fraud can give insight into identifying fake “Rocket Mortgage” schemes. Here are some of the most common types of scams in the mortgage industry:

1. Loan Modification Scams

Scammers promise to modify the terms of your loan, often targeting those struggling financially, only to take your money and leave you worse off.

2. Phishing Scams

Fraudsters posing as legitimate lenders send fake emails or text messages to collect sensitive personal and financial information. These scams sometimes include fake Rocket Mortgage branding.

3. Wire Transfer Fraud

Scammers misdirect wire transfer payments for down payments or closing costs, rerouting funds into their accounts instead of the intended recipient.

4. Loan Flipping (Churning)

This involves persuading homeowners to refinance repeatedly, tacking on excessive fees each time, and ultimately benefiting the scammer at the homeowner’s expense.

5. Real Estate Fraud

Fake agents or fraudulent documents are used to trick buyers into purchasing properties under false terms or conditions.

Each of these methods could theoretically be disguised as a Rocket Mortgage Scam, making vigilance essential.

Red Flags That Indicate a Mortgage Scam

To protect yourself, it’s vital to recognize the signs of a scam early. Below are some common red flags to watch out for:

- Unsolicited Contact: Beware of unexpected phone calls or emails claiming to be from Rocket Mortgage or any other lender.

- Requests for Upfront Payments: Legitimate lenders do not charge fees before processing a loan or providing services.

- Pressure Tactics: Scammers often insist that you act fast, giving little time to research or consider the offer.

- Too-Good-to-Be-True Terms: Offers with unrealistically low interest rates or ignoring credit checks should raise suspicion.

- Emails from Suspicious Domains: Genuine communications will come from official company email addresses (e.g., @rocketmortgage.com).

- No Verification of Financial Information: A legitimate lender will assess your ability to pay before offering you a loan.

- Mismatched Payment Instructions: If you’re asked to wire money to an unusual account, proceed with caution.

How to Protect Yourself from Mortgage Scams

Protecting yourself from scams requires diligence at every step of the mortgage process. Here are some practical steps to safeguard your finances and personal information:

1. Verify Authenticity

Before engaging with anyone claiming to be from Rocket Mortgage, verify their credentials. Contact the company through their official website or customer service line to ensure you’re speaking with genuine representatives.

2. Secure Your Personal Information

Never share sensitive data like your Social Security number, bank account details, or tax information with unverified sources.

3. Review All Loan Offers

Carefully examine loan terms and documents. Ensure they align with industry standards, and don’t hesitate to question unclear clauses.

4. Consult Trusted Experts

If in doubt, consult with a HUD-approved housing counselor, attorney, or financial advisor who can guide you through the process.

5. Report Suspicious Activity

If you suspect a scam, report it to organizations like the Federal Trade Commission (FTC), the FBI, or your local law enforcement agency.

The Role of Education in Avoiding Mortgage Scams

One of the best defenses against scams is knowledge. Take time to educate yourself about potential warning signs and common fraudulent practices. Stay informed about legitimate businesses like Rocket Mortgage by visiting their official website and reading customer reviews.

Additionally, tap into community resources such as credit unions or local workshops focused on financial literacy. These platforms often provide valuable insights into identifying and avoiding scams.

What to Do If You’ve Been Scammed

Acting quickly is crucial if you believe you’ve fallen victim to any mortgage scam. Take the following steps immediately:

- Contact Your Lender:

Inform your current lender or servicer of any suspicious activity to prevent further damage.

- Alert Authorities:

Report the scam to the FTC, FBI, and Consumer Financial Protection Bureau (CFPB).

- Consult Legal Help:

Seek advice from professionals who can help you develop solutions or remedies for financial losses.

Final Thoughts on the “Rocket Mortgage Scam”

The term Rocket Mortgage Scam is most likely tied to the misuse of their name by fraudsters rather than actions taken by the company. Still, it underscores the necessity of vigilance in dealing with financial matters. Mortgage scams damage trust and create financial hardships, so being aware of warning signs and taking proactive measures is critical.

Your peace of mind and financial security depend on recognizing potential scams and taking the necessary precautions. Before entering any financial agreement, do your research thoroughly and rely on trusted, verified professionals.

By staying informed and cautious, you can enjoy the benefits of legitimate financial opportunities while steering clear of fraudulent schemes.