The world of cryptocurrency is characterized by its volatility and unpredictability, often leaving traders and investors questioning the direction of the market. One tool that has emerged as a useful indicator of market sentiment is the Crypto Greed Fear Index. But what exactly is this index, how does it work, and why should you pay attention to it? Here’s everything you need to know.

What Is the Crypto Greed Fear Index?

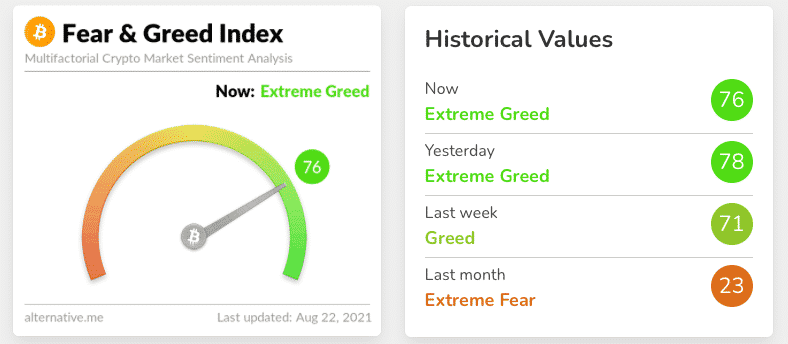

The Crypto Greed Fear Index measures the overall sentiment of the cryptocurrency market, ranging from “Extreme Fear” to “Extreme Greed”. It operates on a scale from 0 to 100, where:

- 0-24 indicates “Extreme Fear.”

- 25-49 indicates “Fear.”

- 50-74 indicates “Greed.”

- 75-100 indicates “Extreme Greed.”

This tool helps investors assess whether the market is driven by panic and hesitation or overconfidence and risk appetite. By understanding these emotions, traders can make more informed decisions.

The index uses a variety of data points, including market volatility, trading volume, social media sentiment, trends, and even Google search data, to assess the mood of the crypto sector. It’s similar to the Fear and Greed Index used in traditional stock markets, but tailored to the unique dynamics of cryptocurrency trading.

Why the Crypto Greed Fear Index Matters

Cryptocurrency markets are heavily influenced by the emotions of traders, which often swing between fear and greed. These emotions can result in massive price swings, creating opportunities or risks for investors.

Here’s why the index is essential:

- Insight Into Market Sentiment

During periods of extreme fear, the market may be oversold, potentially offering buying opportunities for long-term investors. Conversely, extreme greed often signals that prices are far above their intrinsic value, potentially indicating a bubble ready to burst.

- Timing Investment Decisions

The Greed Fear Index can give investors helpful context for when to buy, sell, or hold assets. For instance, “Extreme Fear” levels, like the Crypto Greed Fear Index dropping to 25 in February 2025, might hint at potential bargains.

- Early Warning System

The index acts as a sentiment tracker to predict and prepare for major market shifts. If the index moves suddenly, it can warn traders to brace for further declines or take advantage of price rallies.

How It Works

The Crypto Greed Fear Index gathers and weighs various factors to calculate its score:

- Market Volatility (~25% weight): Measures sudden and unusual market fluctuations.

- Volume and Momentum (~25% weight): Tracks buying and selling pressure in real-time.

- Social Media Sentiment (~15% weight): Analyzes posts, hashtags, and trends about cryptocurrency across platforms like Twitter and Reddit.

- Surveys (~15% weight): Collects feedback from a dedicated pool of traders (used less frequently nowadays).

- Dominance (~10% weight): Examines Bitcoin’s current dominance over the market.

- Search Trends (~10% weight): Looks at the frequency of related Google searches, such as “Bitcoin crash” or “crypto bull market.”

These combined metrics form a single number that reflects the market’s sentiment at any given period.

Recent Developments in the Crypto Greed Fear Index

On February 25, 2025, the Crypto Greed Fear Index dropped dramatically from 49 to 25, signaling Extreme Fear. This sudden shift followed a 10% drop in overall crypto market capitalization and significant declines in popular cryptocurrencies like Bitcoin and Solana.

Panic selling was reportedly triggered by large outflows from Bitcoin ETFs and a lack of positive catalysts to sustain the market’s momentum. However, “Extreme Fear” periods often offer a silver lining. Historically, such market conditions have been followed by notable rebounds, giving opportunistic traders a chance to buy assets at lower prices.

Using the Index in Your Strategy

Whether you’re a seasoned trader or just starting your crypto investment journey, the Crypto Greed Fear Index can be a valuable addition to your decision-making toolkit. Here’s how to use it effectively:

1. Identify Buying Opportunities

During periods of “Extreme Fear” (e.g., when the index is below 25), prices are often lower than their intrinsic value. This can be an excellent opportunity for long-term investors to enter the market.

2. Stay Cautious During Extreme Greed

When the index rises above 75, it often signals that the market is overheated. Consider re-evaluating your positions or taking profits to guard against potential corrections.

3. Combine With Other Indicators

The Crypto Greed Fear Index should not be used in isolation. Combine it with technical and fundamental analysis to get a comprehensive view of the market.

4. Plan for Volatility

Extreme shifts in the Index, like sharp drops or surges, can precede periods of heightened volatility. Use such moments to revisit your risk management strategies.

Beyond the Numbers: What To Keep in Mind

While the Crypto Greed Fear Index is a compelling tool, it’s crucial to remember that it represents a snapshot of the market’s emotions—not certainties. Factors like regulatory developments, macroeconomic trends, or even global events can quickly render sentiment-driven decisions obsolete.

Additionally, crypto markets don’t always behave predictably. For example, a period of “Extreme Fear” in the index could persist longer than expected or lead to even more fear before reversing.

Wrapping It Up

The Crypto Greed Fear Index offers a unique perspective into the emotional pulse of the cryptocurrency market. By using this tool alongside other research methods, investors can better understand prevailing market conditions, spot opportunities, and mitigate risks.

If you’re looking to stay ahead in the fast-paced world of cryptocurrency, staying informed about tools like the Crypto Greed Fear Index is crucial. The market may be unpredictable, but the right strategies and insights can help you thrive.

Want to learn more about the tools and tactics that successful investors use? Keep following our blog for expert tips and strategies in navigating the dynamic world of crypto.