When it comes to safeguarding your hard-earned money, “principal protection” is a term often highlighted in the world of finance and investing. This strategy offers peace of mind by ensuring that, at the very least, you will get back the original amount you invested. Let’s explore what principal protection is, how it works, and its potential benefits and risks.

What Is Principal Protection?

Principal protection refers to financial products or strategies designed to guarantee the return of your initial investment, regardless of market performance. This safety net ensures that even if your investment does not grow, your principal amount remains intact. These options are popular among risk-averse investors and those nearing retirement who prioritize preserving their capital over achieving high returns.

One of the most common financial instruments that offer this feature is Principal-Protected Notes (PPNs). These fixed-income securities guarantee the return of your initial investment at maturity. Other examples include certain structured products, guaranteed investment certificates (GICs), and some annuities.

How Does Principal Protection Work?

The mechanics of principal protection often involve a blend of financial strategies:

- Zero-Coupon Bonds: A portion of the investment is allocated to zero-coupon bonds, which mature to the principal amount over time. This ensures that the original investment is preserved by the time the bond matures.

- Options or Linked Investments: The remainder of the investment is typically allocated to higher-risk assets or options, offering the potential for growth. These components are linked to market-based returns, such as equity indices, commodities, or currencies.

By balancing these components, principal-protected products aim to provide both security and the potential for returns.

Benefits of Principal Protection

Principal protection offers several advantages, particularly for investors who value financial security:

- Capital Preservation:

The primary benefit of principal protection is the guarantee that your original investment will remain secure, even in volatile markets.

- Peace of Mind:

Knowing that you won’t lose your initial investment can make it easier to consider opportunities linked to variable, higher-risk assets without fear of losing everything.

- Access to Diverse Investments:

Principal-protected products often allow investors to gain exposure to different asset classes, such as equities or commodities, that they might typically avoid due to risk concerns.

- Customizable Duration:

These investments are available with various timeframes, allowing you to select one that suits your financial goals and liquidity needs.

Risks and Considerations

While principal protection may sound ideal, it comes with its own set of risks and limitations:

Interest Rate Risk

Changes in interest rates heavily influence these investments. For example, zero-coupon bonds are sensitive to fluctuations in interest rates, which can affect their overall value.

Zero-Return Risk

Although the principal is protected, you may still risk earning little to no returns. High inflation rates can erode purchasing power, resulting in a “real return” that is lower than anticipated.

High Fees

Principal-protected products often come with numerous fees, such as management fees, structuring fees, and early redemption fees. These can significantly reduce your overall returns and may not always be transparent upfront.

Liquidity Risk

Many principal-protected investment products require you to hold them until maturity. Exiting early can mean losing the principal protection, potentially leaving you with less than you invested.

Suitability

These products are complex and not suitable for all investors. Understanding the terms and underlying mechanics is essential to ensure they align with your financial objectives.

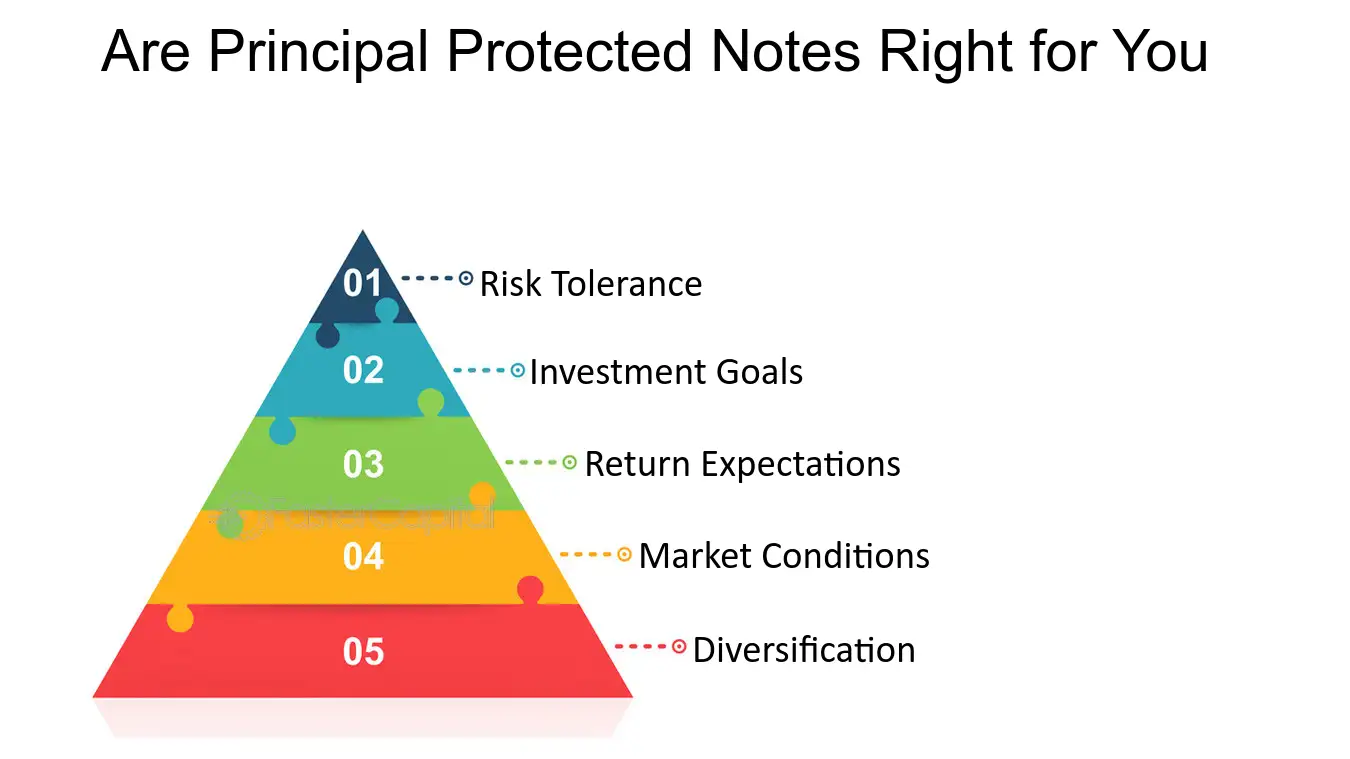

Should You Consider Principal Protection?

Principal protection may be a good fit for certain types of investors, including:

- Risk-Averse Individuals:

Those who prioritize capital preservation over aggressive growth strategies.

- Retirees or Near-Retirees:

Investors nearing retirement often cannot afford significant losses, making these products an attractive option.

- Cautious Market Participants:

Those who want exposure to potentially higher-yield investments without the full downside risk.

Before committing, carefully evaluate the associated risks, costs, and suitability relative to your financial goals. Consulting with a financial advisor or conducting thorough due diligence is highly recommended.

Alternatives to Principal-Protected Investments

While PPNs and other similar products are viable options for some, there are alternative ways to protect your principal:

- Diversification:

Building a diversified portfolio across asset classes can help minimize risks without incurring the high costs of principal-protected products.

- Low-Cost Bonds:

Investing directly in higher-quality bonds or Treasury securities might offer returns with reduced risks compared to equity investments.

- Bank Savings Products:

High-yield savings accounts or certificates of deposits (CDs) can offer fixed returns with FDIC insurance on deposits up to a specific limit.

- Annuities:

Certain types of annuities also offer principal protection along with guaranteed income, making them an attractive option for retirees.

The Bottom Line

Principal protection is an excellent strategy for those who value the security of their initial investment. Products like Principal-Protected Notes can shield your portfolio from downturns while still offering some upside potential. However, these benefits often come at the cost of high fees, limited liquidity, and capped returns. Before investing, make sure you fully understand the terms and assess whether the trade-off between risk and reward aligns with your broader financial goals.

If you’re ready to explore principal protection or want to know if these products are suitable for your portfolio, consult with a financial advisor to weigh your options effectively. Remember, a well-informed choice is your best investment.