For retirees, risk-averse investors, and financial planners, securing and stabilizing wealth is often at the forefront of financial planning. That’s where principal protection becomes an essential concept. Whether you’re stepping into retirement, planning for the future, or advising clients, this strategy offers a way to safeguard your initial investment while potentially growing your financial portfolio.

This article will explore principal protection, its benefits, risks, and practical applications to help you make better-informed financial decisions.

What is Principal Protection?

Principal protection refers to financial investment strategies and instruments that ensure the return of the original amount invested, regardless of market performance. Simply put, even if the investment doesn’t yield growth, it provides a safety net, ensuring the investor doesn’t lose their capital.

A common example of principal protection is Principal-Protected Notes (PPNs). These are fixed-income securities guaranteeing the return of the initial investment, even if there are fluctuations in the linked market assets. PPNs typically aim to combine two essential factors:

- Safeguarding Principal through structured financial guarantees or insurance mechanisms.

- Potential for Returns by linking the investment to underlying market assets such as stocks, commodities, or mutual funds.

This approach makes principal-protected investments an attractive option for those seeking stability in volatile markets.

Who Should Consider Principal Protection?

Principal protection strategies are particularly suitable for specific groups, including:

- Retirees: With limited earning years ahead, retirees often prioritize preserving their savings over pursuing high-risk growth.

- Risk-averse Investors: For individuals uncomfortable with market volatility or those relying heavily on their savings, principal protection provides peace of mind.

- Financial Planners: For clients aiming to grow their wealth cautiously, principal protection allows financial planners to offer lower-risk investment solutions while maintaining client trust.

Benefits of Principal Protection

Investing with principal protection comes with several advantages, particularly for those with low-risk tolerance or those aiming to minimize financial losses.

1. Guaranteed Capital Return

The most significant benefit of principal protection lies in the assurance that investors won’t lose their initial investment, which makes it a great choice for those seeking financial stability over aggressive growth.

2. Opportunity for Profit

Many principal-protected investments, such as PPNs, are tied to market-linked assets. If market conditions are favorable, there’s the potential for earning higher-than-expected returns, combining security with moderate growth.

3. Protection Against Market Volatility

For anyone hesitant to participate in volatile markets, principal protection offers a comfortable entry point. It mitigates fears of sudden drops in portfolio value, particularly during uncertain economic conditions.

4. Psychological Comfort

Knowing your capital is secure can ease financial stress, especially for retirees or individuals saving for specific life goals, such as higher education or a home purchase.

Risks and Considerations of Principal Protection

While principal protection offers a degree of financial safety, it’s not without its drawbacks. Being fully informed is critical to determining whether this approach fits your financial goals.

1. Limited Liquidity

Many principal-protected investments require long-term commitments, often locking funds for several years. Early withdrawals may lead to penalties, eliminating the “guarantee” element.

2. Hidden Fees

These investments tend to have higher fees compared to traditional stocks or mutual funds. Common fees include:

- Insurance premiums

- Performance fees

- Structuring costs

- Management expenses

Make sure you have a full breakdown of fees before committing your capital.

3. Risk of Zero Returns

If the linked market assets underperform or if the portfolio has high fees, the likelihood of achieving a substantial return decreases. Some investors may only see their initial capital returned without any actual profit, leading to a loss in purchasing power due to inflation.

4. Suitability and Complexity

Principal-protected investments, such as structured notes, often lack transparency and may be hard for retail investors to understand. They might not be the best fit for income-oriented investors who need predictable and regular payouts.

5. Counterparty Risk

The safety of principal protection relies on the financial stability of the issuer. If the issuer defaults or files for bankruptcy, even the guaranteed principal might not be returned.

Applications of Principal Protection in Investment Portfolios

Principal-protected strategies shine when applied within the broader context of portfolio diversification. Here are a few ways retirees, financial planners, and risk-averse investors can leverage them effectively:

1. Enhancing Portfolio Stability

Adding principal-protected investments to a diversified portfolio can reduce overall risk. For example, combining these investments with equities that offer higher growth potential creates a balance between risk and security.

2. Retirement Planning

For retirees, principal-protection strategies are excellent tools for minimizing volatility. By reserving part of their nest egg in principal-protected accounts, retirees shield their savings from immediate market fluctuations.

3. Long-term Financial Goals

Investors saving for goals ten or more years down the road (such as funding education or buying property) can benefit from a structured, no-loss approach with the possibility of moderate returns over time.

4. Exposure to Alternative Investments

Principal-protected investments are often tied to alternative assets (e.g., hedge funds, emerging markets) without directly exposing the investor to the risk of the underlying asset. This can diversify portfolios in a more managed, secure way.

How to Get Started with Principal Protection

- Research the Options: Principal-protected investments come in many forms, from PPNs and fixed annuities to certain government or corporate bond structures. Understand the terms, tenure, and associated risks.

- Factor in Fees: Don’t just focus on the advertised returns. Investigate the total costs associated with the investment to determine whether the returns justify the expense.

- Assess the Issuer’s Credibility: The financial health of the issuing organization is critical. Look for institutions with solid track records and credible ratings.

- Consider Professional Advice: If you’re unsure about the complexity of principal-protection investments, consult with a certified financial professional who specializes in building low-risk portfolios.

Final Thoughts

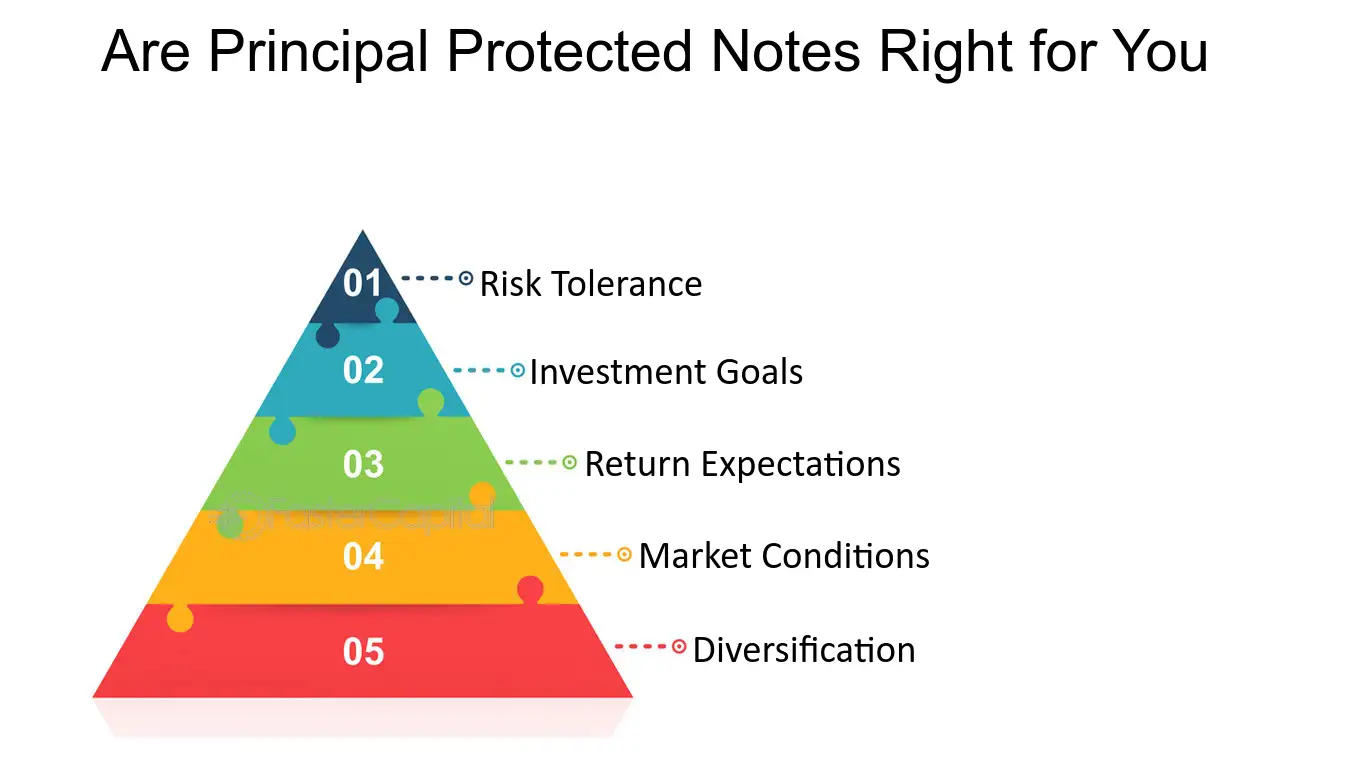

Principal protection is an ideal strategy for specific financial needs, particularly for those prioritizing safety and stability over aggressive growth. Retirees, risk-averse investors, and financial planners can all benefit from its ability to mitigate risks while maintaining the potential for modest earnings.

That being said, it’s vital to weigh the risks, fees, and liquidity challenges before adding these investments into your portfolio. Always ensure that your financial decisions align with your long-term goals and risk tolerance.

Are you ready to take the first step toward a secure financial future? Speak with a financial advisor to explore principal-protected options tailored to your unique goals.