For beginner forex traders and new investors looking to step into the exciting world of currency trading, the term “pip” might seem puzzling. However, understanding what a pip is and how it works is critical to mastering forex trading. This article will break down the pip meaning in forex, how it impacts your trades, and why it’s crucial for your success as a trader.

What is a Pip in Forex?

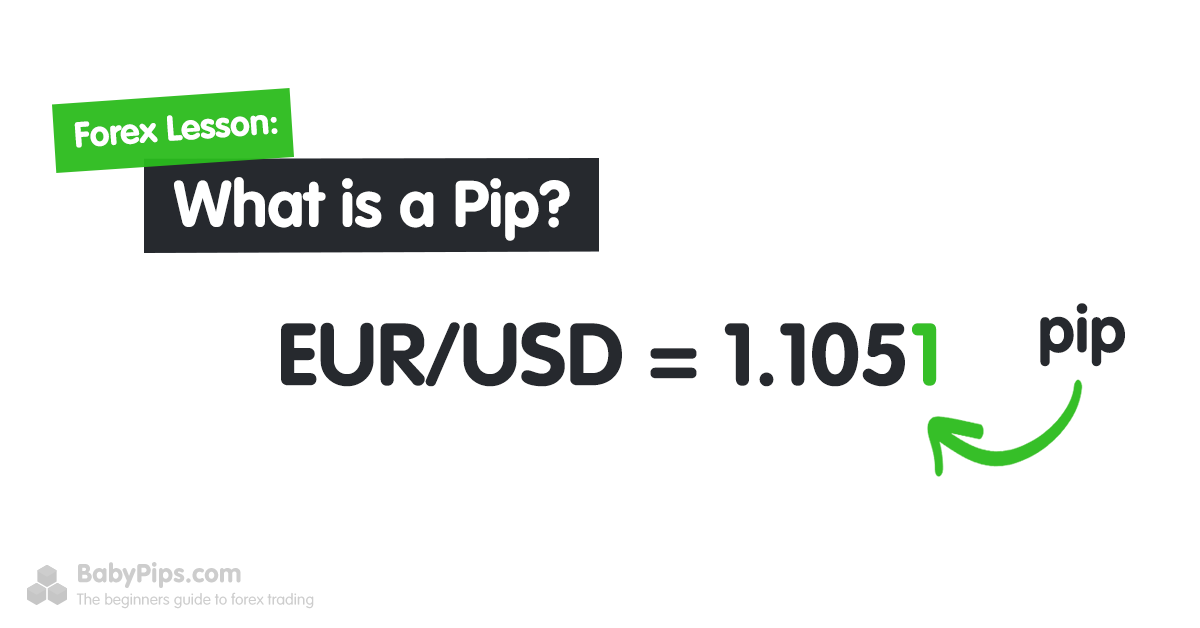

A “pip,” short for “percentage in point” or “price interest point,” represents the smallest price change in the value of a currency pair. It’s a standardized unit used by traders to measure and discuss price movements in the forex market.

The Basics:

- Currencies in forex are typically quoted to four decimal places.

- A pip refers to a movement in the fourth decimal point (0.0001). For example, if the EUR/USD currency pair moves from 1.1200 to 1.1201, we say it increased by 1 pip.

- For Japanese yen (JPY) currency pairs, a pip is measured at two decimal places (0.01), as they generally trade at a lower value.

Pips create a common language for traders to quantify price changes, regardless of the currency pair involved.

Why Do Pips Matter in Forex?

Pips are vital because they serve as a universal metric to calculate profit and loss in forex trades. For example:

- If you buy a currency pair like EUR/USD at 1.1835 and sell it at 1.1901, the difference would be 66 pips gained.

- Similarly, in a USD/JPY trade, if you sell at 112.06 and close at 112.01, you would gain 5 pips.

For beginner traders, understanding these movements is crucial to managing risk and formulating strategies. Small pip differences can lead to significant profits or losses, especially when trading in large lot sizes.

How to Calculate the Value of a Pip

The monetary value of a pip depends on three factors:

- Currency Pair: Different currency pairs will have varying pip values due to their exchange rates.

- Lot Size: Forex is typically traded in lots, with standard lots being 100,000 units. Traders can also trade mini lots (10,000 units) or micro lots (1,000 units).

- Exchange Rate: The current market rate of the currency pair also impacts pip value.

Formula:

To calculate the value of one pip:

- Divide 0.0001 (pip in decimal form) by the current exchange rate.

- Multiply by the trade amount (e.g., 100,000 for a standard lot).

For example, if the EUR/USD exchange rate is 1.1200:

- Value of one pip = (0.0001 / 1.1200) × 100,000 = $8.93 in euros.

- Convert this to USD by multiplying the pip value in euros by the exchange rate, resulting in $10.

This formula helps traders understand the monetary impact of each pip movement in their trades.

Major Currency Pairs and Pips

The most commonly traded currency pairs (known as “majors”) include:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

For these pairs, the pip values remain stable due to their high liquidity and consistent demand in the forex market. It’s essential for new traders to familiarize themselves with these pairs as they provide the best opportunities to learn.

How Pips Relate to Profitability

Your trading profits and losses are directly connected to pip movements. For instance:

- If you go long (buy) EUR/USD at 1.1200 and close your position at 1.1250, you earn 50 pips.

- If each pip is worth $10 (for a standard 100,000 unit trade), your profit would be 50 × $10 = $500.

On the flip side, if the trade moves against you, the same pip calculation would determine your losses. This is why managing risk through appropriate lot sizes and stop-loss orders is critical for success.

How Beginners Can Use Pip Knowledge to Improve Trading

Now that you’ve grasped the basic pip meaning in forex, here are some practical tips for integrating this knowledge into your trading:

- Start Small: Begin with micro or mini lots to limit your exposure to risk while you build your understanding.

- Use Demo Accounts: Practice calculating pip profits and losses in a risk-free environment using a demo trading account.

- Understand Currency Pair Behavior: Different pairs exhibit unique volatility levels, which can impact how frequently and significantly their values move in pips.

- Use Stop-Loss and Take-Profit Orders: Manage your risk by setting pre-determined pip levels where you’ll cut losses or secure profits.

Why Pips Are a Must-Know for Forex Learners

For forex beginners, understanding pips provides the foundation for managing trades effectively. Pips play a critical role in determining trade outcomes, evaluating risk, and planning strategies. Mistaking even small pip movements can make a big difference, particularly in high-volume trades. Mastering this concept early will set you up for long-term success in the forex market.

Final Thoughts

By now, you should have a clear understanding of the pip meaning in forex and its importance in trading. Pips are much more than just a tiny decimal point; they’re a vital metric for measuring and managing your trades. Whether you’re calculating potential profits or analyzing price movements, pips provide the consistency and clarity traders need in a fast-paced market.

If you’re new to forex trading, focus on learning to calculate pip values and integrate this knowledge into your trading strategies. The more confident you are with pips, the better equipped you’ll be to tackle the complexities of the forex market.

Happy Trading!