Real estate has long been one of the most reliable avenues for building wealth. With its dynamic nature and substantial earning potential, millions of investors have turned to real estate to generate income and achieve financial freedom. From property appreciation to creative investment strategies, there are numerous ways to make money in real estate. That said, determining the best way to make money in real estate depends on your financial goals, risk tolerance, and expertise.

This article explores proven strategies for making money in real estate and breaks down why each approach can work depending on your circumstances.

Why Real Estate is a Smart Choice for Earning Money

What makes real estate one of the most popular investment choices? Here are a few reasons:

- Tangible Asset: Unlike stocks, real estate provides you with a physical asset that can be used or appreciated over time.

- Multiple Income Streams: Real estate offers more than one way to make money, including rental income, property appreciation, and alternative investments.

- Hedge Against Inflation: Property values often rise in response to inflation, helping investors preserve and grow their capital.

With those benefits in mind, how do people turn real estate ownership into substantial profit? Here are the strategies you should consider.

1. Leverage Property Appreciation

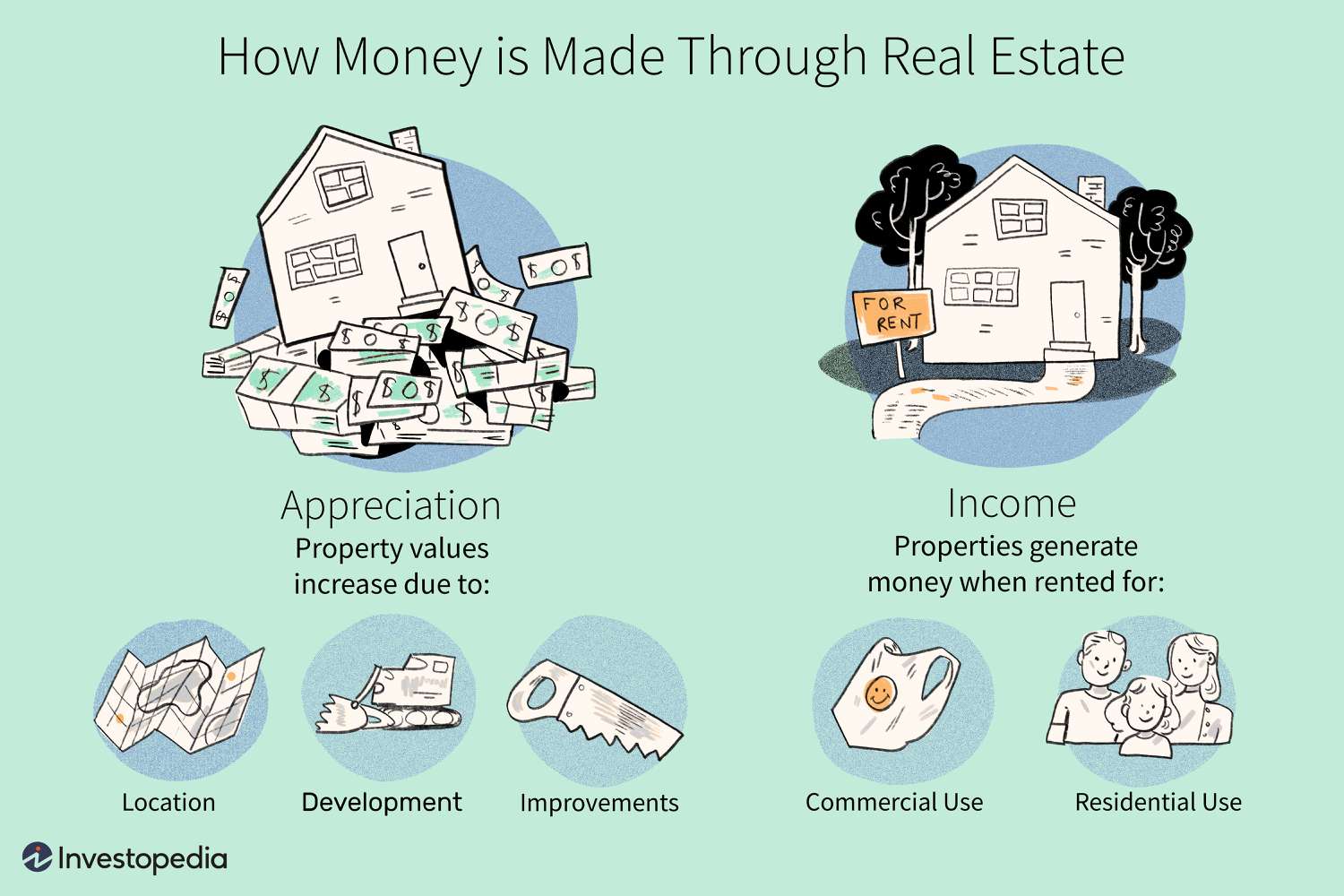

One of the most common ways to make money in real estate is through property appreciation, which is the increase in the property’s value over time. There are three primary factors that drive property appreciation:

- Improved Location: A house in a growing community with new schools, public transit, and amenities typically sees its value rise.

- Renovations and Upgrades: Remodeling kitchens, upgrading bathrooms, or adding new features can increase the property’s resale value.

- Economic Growth: Factors like local job growth and regional economic development boost market demand, leading to price increases.

The key to leveraging property appreciation lies in timing. You want to invest in growing areas or renovate at the strategic time to maximize your profits when you sell.

Example:

A property purchased for $300,000 in a developing neighborhood may appreciate to $450,000 over 10 years as the area grows. With strategic improvements like modern appliances or additional bedrooms, the value could increase further.

2. Generate Passive Income with Rental Properties

If you want a steady stream of income, owning residential or commercial rental property is one of the best ways to make money in real estate. Here’s how it works:

- Residential Rentals: Lease apartments, single-family homes, or duplexes to tenants. Living in one unit while renting out the others (house hacking) is a popular way to cut costs and build equity.

- Commercial Rentals: Lease office spaces, retail buildings, or warehouses to businesses. These properties often yield higher returns but require more capital upfront.

With rental income, your tenants essentially pay for your mortgage, leaving you with additional cash flow and eventual full ownership of the property.

Pro Tip:

Invest in properties in desirable locations with low vacancy rates, and screen potential tenants rigorously to ensure consistent revenue.

3. Try Flipping Properties

Property flipping involves buying undervalued properties, making high-value improvements, and selling them for a profit. This strategy is ideal for investors who:

- Have a strong understanding of the housing market.

- Possess skills or connections in renovation and construction.

- Are comfortable with shorter investment timelines.

While flipping properties can be lucrative, the risks are higher due to market changes and unanticipated renovation costs.

Example:

A flipper could purchase a distressed property for $200,000, invest $50,000 in renovations to make it modern and appealing, and then sell it for $300,000, resulting in a $50,000 profit (minus fees).

4. Invest in Real Estate Through REITs

Real Estate Investment Trusts (REITs) are a way for investors to make money in real estate without directly owning property. Through REITs, you can purchase shares of a company that owns, operates, or finances high-value properties (e.g., shopping centers, apartments, office buildings).

REITs are attractive because:

- They offer dividend payouts from rental income generated by the properties.

- They eliminate the need to deal with the logistics of property management.

- You can start investing with much smaller amounts compared to purchasing real estate directly.

Example:

An investor can buy shares in a commercial REIT on the stock market. If the REIT performs well, they can receive annual dividend payouts and benefit from the growth of their investment over time.

5. Explore Vacation Rentals

Platforms like Airbnb and Vrbo have made vacation rentals a lucrative opportunity for real estate investors. If you own a property in a tourist-heavy area or a city with a strong short-term rental market, you can rent out your property for significantly higher nightly rates.

Vacation rentals also allow for flexibility—you can rent part-time during peak seasons or even keep a property for personal use while earning money from others.

Note:

Be sure to review local laws and regulations regarding short-term rentals, as many areas require specific permits to operate legally.

6. Buy and Hold for the Long Term

The “buy and hold” strategy involves purchasing property and holding onto it for years to build equity and benefit from appreciation. During this time, you can generate rental income or use the property personally. This method is popular for retirement planning or long-term wealth building.

Example:

By holding a property for a decade or more, you can earn income through rents while waiting for substantial appreciation to maximize your profits when you finally sell.

7. Diversify with Real Estate Crowdfunding

For those who want alternative methods of real estate investment, crowdfunding platforms offer exciting opportunities. With real estate crowdfunding, multiple investors pool their funds to invest in larger commercial or residential projects. These platforms often allow investors to start with modest amounts, which makes them accessible to nearly anyone.

Benefits:

- You don’t need to manage the property.

- Your investment is typically spread across multiple projects, reducing risk.

Final Thoughts on the Best Way to Make Money in Real Estate

Real estate offers a world of opportunities to build wealth, but there’s no one-size-fits-all answer to finding the best way to make money in real estate. Your choice depends on your goals, financial resources, and how actively involved you wish to be.

Whether it’s managing rental properties for steady income, flipping houses for fast profits, or investing in REITs for passive earnings, success lies in research, planning, and execution.

If you’re ready to start your real estate investing journey, now is the time to take action. The options are limitless, but the key is to start today.