Whether you’re just starting your financial journey or exploring ways to expand your opportunities, understanding why access to credit is essential is a smart move. Credit is more than just a tool for spending—it’s a gateway to financial independence if used wisely. Below, we’ll list two reasons someone would want access to credit, especially for young adults, new borrowers, and financial beginners who are ready to take their first steps into the world of personal finance.

1. Building Credit History for the Future

One of the most significant reasons to access credit is to build credit history. Your credit history is like your financial report card—it tells lenders, landlords, and even businesses how trustworthy you are when it comes to managing money. A solid credit history opens the door to better financial opportunities, such as:

- Easier Loan Approvals

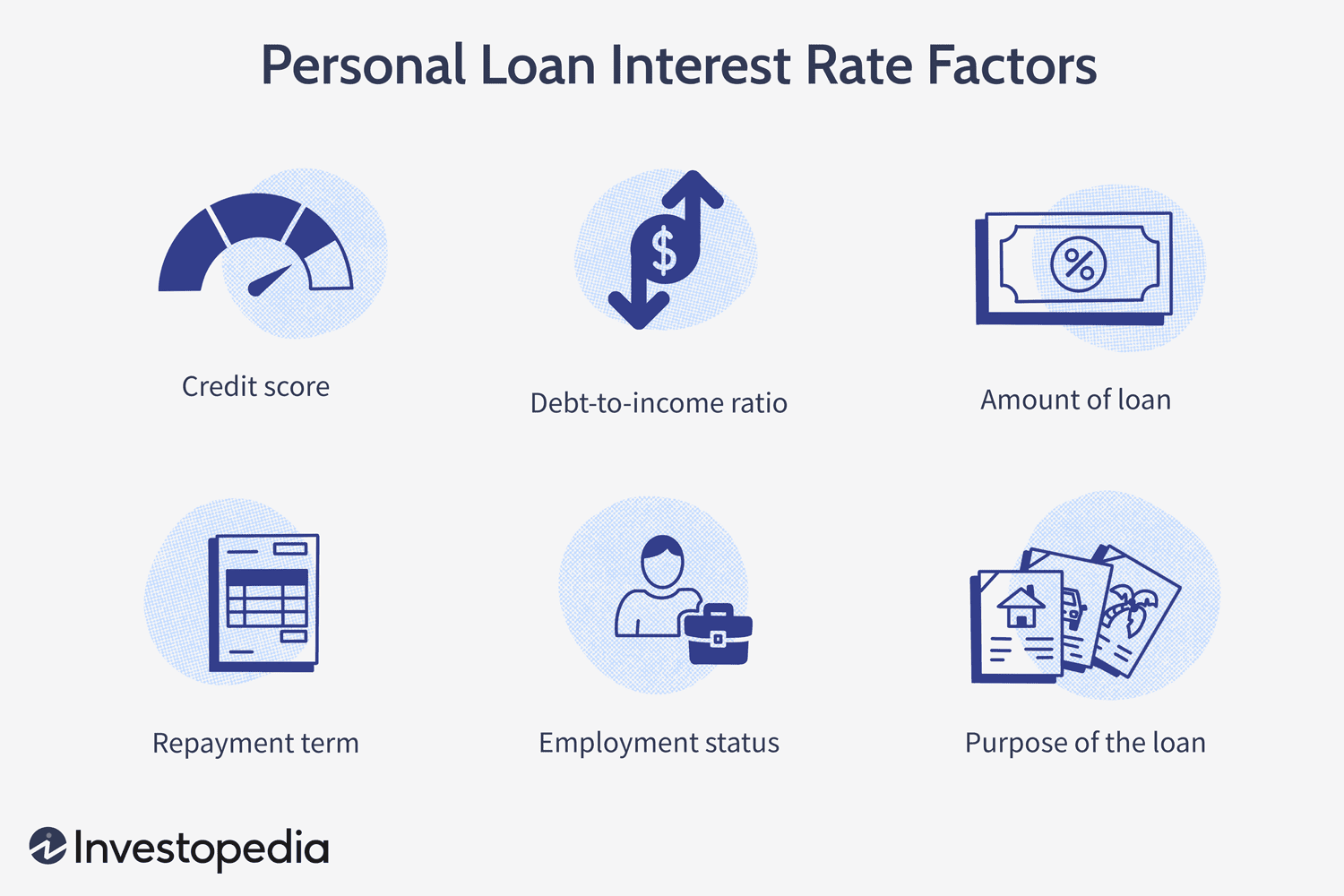

If you plan to buy a car, home, or even fund education, a positive credit history helps you secure loans more easily, often with lower interest rates. Lenders view someone with a strong credit score as reliable and less likely to default on payments.

- Lower Security Deposits

Did you know that credit scores can impact your living situation? A great credit history often means landlords will request smaller deposits (or no deposit at all) when renting an apartment. Utility companies might also waive deposit requirements for those with good credit.

- Access to Premium Credit Cards and Rewards

Good credit opens the door to premium credit card offers, which provide various perks such as cashback, travel points, and consumer protections. Without a solid credit history, you may not qualify for these rewards programs.

For young adults or new borrowers, starting with a simple credit card and consistently paying it off each month is a great way to establish a credit history. Even small transactions can make a big difference when handled responsibly.

2. Financial Flexibility and Emergency Preparedness

Life is unpredictable, and credit can act as a safety net when unexpected expenses come your way. From medical emergencies to urgent home repairs, having access to credit ensures you’re prepared for surprises without causing financial strain. Here are a few ways credit can offer flexibility:

- Managing Unplanned Expenses

Emergencies like a sudden car breakdown or a medical bill can feel overwhelming. Credit allows you to address these urgent issues upfront and pay them off over time, making life’s hiccups more manageable.

- Bridging Cash Flow Gaps

For those just starting their careers or running a small business, income might be irregular. Having credit available can help bridge the gap when waiting for your paycheck or invoice settlement, ensuring essential expenses are covered in the meantime.

- Making Large Purchases Through Installments

Instead of making a big one-time payment, credit enables you to spread the cost of an item over several months. This could apply to furniture for a new apartment, a high-quality laptop for work, or other investments that enhance your productivity or quality of life.

Of course, it’s crucial to use credit wisely when addressing financial needs. Credit should be managed with a plan for repayment to avoid accumulating debt, which can quickly spiral out of control if left unchecked.

Final Thoughts on Why Credit Matters

While we’ve listed two reasons someone would want access to credit—building credit history and having financial flexibility—it’s important to keep in mind that credit is a tool. When used properly, it empowers you to achieve milestones, handle emergencies, and unlock financial benefits.

If you’re a young adult or new borrower, consider starting your credit-building journey today. Whether it’s applying for your first credit card or taking a small personal loan, every step can contribute to creating a strong financial future. Remember, the key to benefiting from credit lies in understanding and practicing responsible spending habits.