Securing your family’s financial future is a concern that resonates with many. For families, professionals, and high-net-worth individuals, a one million dollar life insurance policy can be a powerful way to ensure financial stability and peace of mind. But is it the right choice for your unique needs and circumstances?

Here, we’ll explore what a one million dollar life insurance policy entails, who it’s best suited for, and key factors to consider when deciding if this type of policy aligns with your financial goals.

What Is a One Million Dollar Life Insurance Policy?

A one million dollar life insurance policy is a life insurance plan where the death benefit amount—the lump sum paid to your beneficiaries in the event of your passing—is set at one million dollars. This policy provides significant financial protection, making it a popular choice among families, professionals, and individuals with substantial financial obligations or long-term dependents.

There are several types of life insurance policies to support this coverage amount:

- Term Life Insurance: Provides coverage for a specific term (e.g., 10, 20, or 30 years). It’s typically more affordable and is ideal for temporary financial needs, such as paying off a mortgage or funding a child’s education.

- Permanent Life Insurance (e.g., whole life, universal life): Offers lifelong coverage and may include a cash value component that grows over time. This type of policy is ideal for estate planning or those seeking an investment component alongside life insurance.

Who Should Consider a One Million Dollar Life Insurance Policy?

While this amount of coverage may sound like a lot, for many people, it’s an appropriate choice for addressing their financial responsibilities. Here are some scenarios where a one million dollar policy might make sense:

1. Families Seeking Financial Security

For families, life insurance provides a safety net to replace lost income. A one million dollar policy ensures that your loved ones can maintain their standard of living, cover daily expenses, and pursue future goals like higher education.

This significant coverage amount can also help with:

- Paying off large debts such as mortgages or car loans

- Covering healthcare and childcare costs

- Building a fund to secure your family’s future lifestyle

2. Professionals Hedging Against Lost Income

If you’re a professional with a high earning potential, your income is likely a key contributor to your household’s financial wellbeing. A one million dollar life insurance policy can replace years of income, providing your family with time to adjust and stability during a challenging time.

Professionals often face the following scenarios:

- Protecting their income if they’re the sole provider

- Covering their children’s future educational costs

- Managing large financial obligations like private school fees or student loans

3. High-Net-Worth Individuals Engaged in Estate Planning

For individuals with substantial estates, a one million dollar life insurance policy can be vital in managing estate taxes and ensuring wealth is transferred smoothly to beneficiaries. The payout from this policy can reduce the financial burden on your heirs and help preserve your legacy.

Additionally, high-net-worth individuals use these policies to:

- Protect businesses in the event of their passing

- Provide liquidity to cover estate taxes

- Fund charitable giving initiatives

4. People with Significant Debts

If you’ve taken on considerable debts—such as a mortgage, business loans, or personal obligations—a one million dollar life insurance policy ensures these responsibilities don’t fall on your loved ones after your passing.

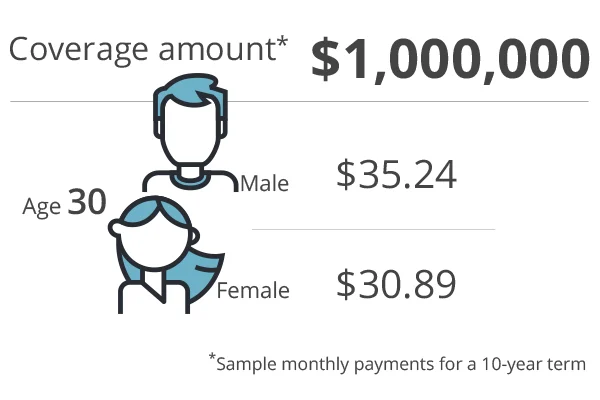

How Much Does a One Million Dollar Life Insurance Policy Cost?

The cost of a one million dollar life insurance policy varies depending on factors like age, gender, health, lifestyle, and the type of policy you choose.

For term life insurance, premiums are generally more affordable. For instance:

- A healthy 35-year-old could expect to pay $30–$40 per month for a 20-year term policy.

- For individuals in their 50s, premiums increase significantly, ranging from $100–$150 per month.

Permanent policies, on the other hand, are more expensive since they provide lifelong coverage and include an investment component. Monthly premiums can range from hundreds to thousands of dollars, depending on the policy structure and rider options.

Key Considerations When Choosing a One Million Dollar Life Insurance Policy

Before committing to this level of coverage, consider the following factors to ensure it’s the right fit:

- Your Financial Obligations

Add up your current debts, future expenses (like your children’s college tuition), and ongoing financial needs to determine if a one million dollar policy meets those demands.

- Your Income Replacement Needs

Multiply your annual income by the number of years your dependents would need financial support. For many individuals, policies valued at $500,000 to $1,000,000 prove adequate.

- Your Current Life Stage

Whether you’re newlyweds, parents, or retirees, your life stage impacts your insurance needs. For instance, younger families may need higher coverage due to significant financial commitments.

- The Duration of Your Coverage

Decide if you need coverage for a specific term or lifelong protection. Term policies offer cost-effective coverage for high-earning years, while permanent policies are better suited for long-term financial goals.

- Your Budget

Ensure that the premiums fit comfortably within your financial plan. Remember that it’s better to choose a lower coverage amount you can afford than to overcommit.

Is One Million Dollar Life Insurance Too Much—or Not Enough?

The answer depends on your individual needs and goals. For some, a one million dollar life insurance policy provides more coverage than necessary, while others may find it aligns perfectly with their financial responsibilities.

If you’re unsure of the right amount of life insurance coverage to purchase, consider consulting a financial advisor. They’ll help you evaluate your specific circumstances and future goals to ensure you’re making the best decision for your family or business.

The Bottom Line

For families, professionals, and high-net-worth individuals, a one million dollar life insurance policy can offer peace of mind, ensuring that your loved ones or successors are cared for financially, no matter what. Understanding your coverage needs, financial obligations, and budget is key to determining if this policy makes sense for your situation.

If you’re ready to explore your life insurance options, reach out to a trusted insurance provider who can guide you through the process and help you secure the best policy for your needs.