Claiming dependents on your tax return can significantly reduce your tax liability, opening doors to valuable tax credits and deductions. But when it comes to dependents, one of the most common questions is, “How old can a dependent be for taxes?” The answer depends on whether the dependent is a qualifying child or a qualifying relative. Here’s a clear guide to help you determine the age limits and requirements for each category.

What Is a Dependent?

First, let’s clarify what the IRS considers a dependent. A dependent is typically someone who relies on you financially, whether they’re your child or a relative, and who meets several criteria set by the IRS. Dependents generally fall into two categories, each with its own rules and benefits for tax purposes:

- Qualifying Child

- Qualifying Relative

Both types can help you unlock tax advantages like the Child Tax Credit or the Earned Income Credit, but age limits and other criteria vary between the two.

Age Limits for Qualifying Children

To claim someone as a qualifying child on your tax return, they must meet the IRS’s Age Test, along with five other requirements. Here’s how the age limits apply to qualifying children:

- Under the Age of 19: Your child must be under 19 years old at the end of the tax year (December 31) to qualify.

- Under the Age of 24 If a Full-Time Student: If the child is enrolled as a full-time student for at least five months during the tax year, the age limit increases to 24.

- No Age Limit for Those Who Are Disabled: If the dependent is permanently and totally disabled, there is no upper age restriction.

Additionally, the qualifying child must be younger than you (or your spouse if filing jointly) unless they meet the criteria for disability.

Special Notes for Tax Credits

Some tax credits have additional age requirements. For instance:

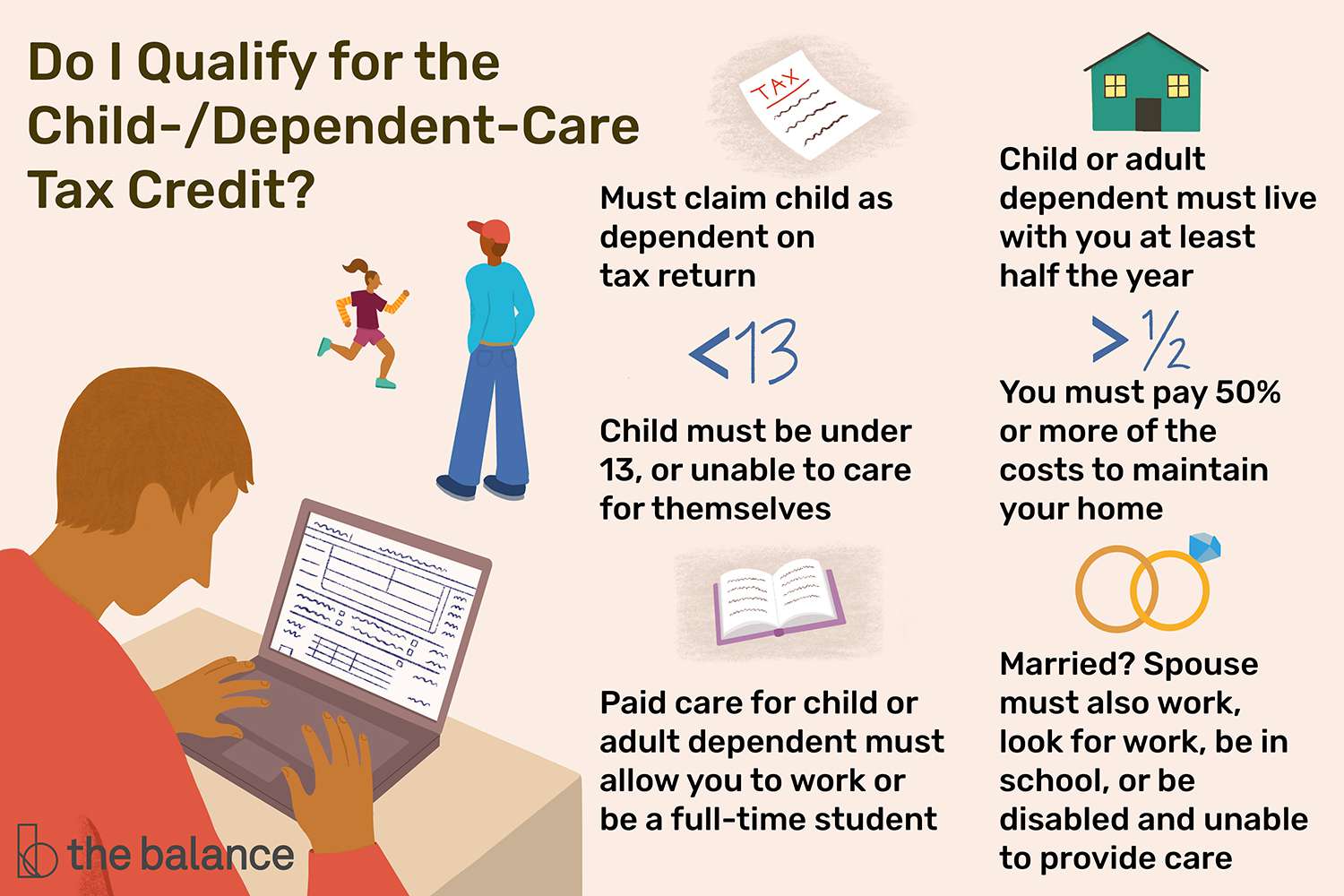

- Child and Dependent Care Credit: Dependents must generally be under age 13 unless they are disabled.

- Child Tax Credit: This credit is available for qualifying children under age 17 at the end of the tax year.

Age Limits for Qualifying Relatives

If someone doesn’t qualify as a “child” under IRS rules, they may still qualify as a relative. Unlike qualifying children, qualifying relatives have no age restrictions. However, they must meet different criteria:

- Gross Income Test: Their annual earnings should not exceed $5,050 in 2024.

- Support Test: You must provide more than half of their financial support.

Examples of qualifying relatives include siblings, parents, in-laws, and even unrelated individuals who live with you and rely on your support.

Summary Table of Age Requirements

| Category | Age Limit | Additional Details |

|---|---|---|

| Qualifying Child | Under 19 (or under 24 if a full-time student) | No age limit if disabled |

| Qualifying Relative | No age limit | Income and support tests apply |

| Child Tax Credit | Under 17 | Annual income limits apply |

Common Questions About Age and Dependents

Can I Claim My College-Aged Child?

Yes, as long as they are under 24 years old and enrolled as a full-time student for at least five months during the tax year.

Can I Claim a Parent as a Dependent?

Yes, there’s no age limit for qualifying relatives like parents, but they need to meet other IRS criteria, including the Gross Income Test and Support Test.

What Happens If I Claim Someone Incorrectly?

Claiming an ineligible dependent could lead to penalties or rejection of your tax return. Always review IRS guidelines or consult a tax professional if you’re uncertain.

How Dependents Can Benefit Your Taxes

Claiming dependents can lead to several financial benefits:

- Child Tax Credit: Up to $2,000 per child under age 17.

- Earned Income Credit (EIC): Provides financial relief based on family size and income, with specific age rules for dependents.

- Dependent Care Credit: Covers childcare costs but is only available for dependents under 13 or those with disabilities.

- Head of Household Filing Status: Claiming a dependent helps you qualify for this more favorable filing status.

Final Thoughts

Understanding how old a dependent can be for taxes is crucial to making accurate claims and maximizing your tax benefits. Age limits for dependents vary based on their category as a qualifying child or relative, along with the type of tax credits or deductions you seek.

If you’re still unsure about your specific situation, consider consulting a tax professional or referencing resources like IRS Publication 501. Accurate claims won’t just save you from potential penalties—they’ll help you make the most of the deductions and credits available to you.