GV stock, the ticker symbol for Visionary Holdings Inc., has been attracting attention from investors seeking to diversify their portfolios. Whether you’re new to the stock market or looking to expand your current holdings, understanding the performance, outlook, and key factors surrounding GV stock is essential. This article provides an in-depth look at GV stock, GV stock forecasts, and the company’s standing in the industry while incorporating insights into Alphabet stock comparisons.

What is GV Stock?

GV stock represents Visionary Holdings Inc., a company known for its innovative approach in its industry. With a firm commitment to delivering value and pioneering new solutions, Visionary Holdings has carved out a niche for itself in its market. The stock is traded on public exchanges, providing opportunities for traders and long-term investors alike.

Key features of GV stock include:

- Accessibility: GV stock is available for trading on various platforms, making it easy for investors to buy or sell shares. Platforms like Yahoo Finance provide real-time quotes, price history, news updates, and other resources to help investors stay informed.

- Growth Potential: Like other innovative companies, Visionary Holdings Inc. has shown potential for growth, which has sparked interest among investors searching for high-growth opportunities.

GV Stock Analysis

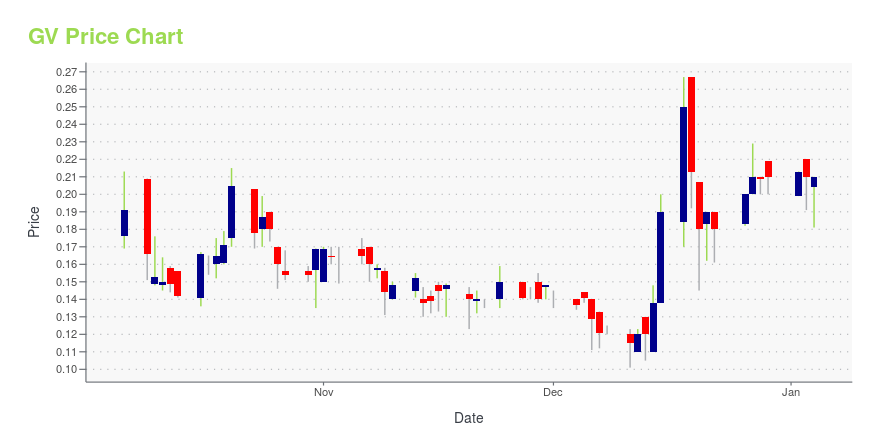

Analyzing GV stock requires a closer look at its technical and fundamental data. Historical trends, quarterly earnings reports, and growth indicators provide a clearer picture of the stock’s potential.

- Price Trends: Reviewing GV’s historical stock price helps investors identify patterns and make informed decisions. Metrics like price-to-earnings (P/E) ratio and market capitalization also provide valuable insights.

- Market Sentiment: The perception of investors, analysts, and the media significantly impacts GV stock’s price movement. Positive sentiment could drive growth, while negative news may lead to short-term volatility.

GV Stock Forecast

Forecasting GV stock’s future performance involves looking at market trends, industry developments, and company guidance, among other factors. Financial analysts often release projections for stocks like GV, offering insights into potential price targets and growth trajectories.

Using GV stock forecasts, investors can gauge where the company is headed over the short and long term. It’s important to keep in mind that such predictions are influenced by economic conditions, industry-specific shifts, and the company’s quarterly achievements.

Key Factors Impacting GV Stock Forecast:

- Financial Results: Consistent profit growth and exceeding earnings expectations can positively influence the forecast.

- Industry Environment: The performance of the industry as a whole affects Visionary Holdings Inc. and its positioning relative to competitors.

- Global Market Trends: Economic conditions, including inflation rates, policy changes, and global market trends, play a role in shaping GV stock’s future performance.

GV Stock vs. Alphabet Stock

Alphabet Inc. (the parent company of Google) is often discussed in financial circles alongside GV stock due to interest in high-performing stocks and innovation-driven companies. While Alphabet stock tends to appeal to investors looking for stability and a proven track record, GV stock might attract those seeking growth potential in emerging markets.

Here’s how the two compare:

- Market Capitalization:

-

- Alphabet stock has a significantly higher market cap, putting it in the league of tech giants.

- GV stock might appeal to those interested in smaller-cap investments with room to grow.

-

- Innovation and Positioning:

-

- Both companies are known for their unique approaches and innovation, but Alphabet operates in extensively established tech verticals, while Visionary Holdings focuses on its niche markets.

-

Is GV Stock Right for Your Portfolio?

GV stock could be a compelling option for investors who are seeking innovative companies with high growth potential. However, as with any investment, it’s critical to conduct thorough research and consider your financial goals, risk tolerance, and investment strategy.

Pros of Investing in GV Stock:

- Opportunities for growth in a competitive industry

- Increasing interest and attention from market analysts

- Diversification in a niche market area

Cons of Investing in GV Stock:

- Potential for higher volatility compared to more established players like Alphabet

- Dependence on the company’s ability to consistently meet market expectations

Final Thoughts

GV stock represents an exciting opportunity for investors looking to expand their portfolios with innovative, growth-driven companies. Whether you’re evaluating the latest GV stock forecast or comparing it to industry giants like Alphabet stock, keeping an eye on market trends and company performance is key.

For more updates and in-depth GV stock analysis, visit reputable platforms like Yahoo Finance to stay informed about Visionary Holdings Inc. and its market activity. Whether you’re a seasoned trader or a new investor, GV stock’s story is one worth following.