Understanding financial aid income limits is crucial for students and families navigating the college funding process. With the cost of higher education steadily rising, need-based financial aid has become a lifeline for many. However, misconceptions around income limits often prevent eligible families from applying. This article breaks down the facts about financial aid income limits and how they impact your eligibility.

What Are Financial Aid Income Limits?

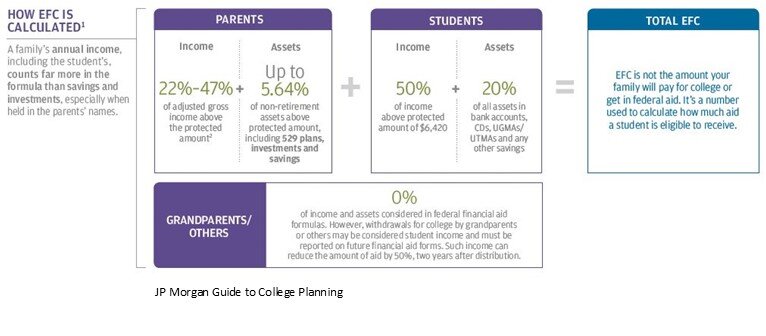

When determining eligibility for financial aid programs, colleges and the federal government primarily rely on an essential document called the Free Application for Federal Student Aid (FAFSA). This application uses the Student Aid Index (SAI)—formerly known as the Expected Family Contribution (EFC)—to evaluate your financial need.

Contrary to popular belief, there isn’t a strict income cut-off for qualifying for aid. While family income plays a significant role in calculating aid eligibility, the formula also takes other factors into account, such as family size, the number of household members attending college, and available assets.

It’s essential to remember that eligibility can vary widely depending on the type of aid program. For instance, federal Pell Grants often go to families with lower incomes, while federal loans and work-study programs cater to a broader pool of applicants across income brackets.

Key Facts About Financial Aid Income Limits

To dispel some common misconceptions about financial aid, here are some facts about income limits and how they function within various aid programs:

1. There’s No Hard and Fast Income Limit

Many families mistakenly believe that financial aid is only available to low-income households. However, the reality is more nuanced. While Pell Grants are targeted at families with financial need, programs like certain federal loans and merit-based scholarships often remain accessible to higher-earning families.

For instance, a household with an annual income over $100,000 could potentially qualify for limited types of need-based financial aid. The formula considers factors like multiple children in college or income adjustments due to high medical expenses.

2. Family Assets Are Also Considered

While FAFSA primarily focuses on income, family assets also influence aid calculations. Assets held in parents’ names often have a smaller impact on aid eligibility than those held in a student’s name. For example, funds in a 529 College Savings Plan owned by parents are treated more favorably than assets in a Uniform Gift to Minors Act (UGMA) account belonging to the student.

3. State Programs Have Their Own Rules

Many state governments offer additional grants or scholarships and often use FAFSA as a starting point. However, these programs may have their own income limits or specific criteria. Families should look into state-level opportunities to maximize their potential funding.

4. Early Filing Can Increase Your Chances

Some aid programs operate on a first-come, first-served basis, regardless of income. Submitting your FAFSA as soon as possible after October 1 can help secure funding, especially for state and institutional grants where timing can mean the difference between acceptance and rejection.

5. Income Adjustments Are Possible

If a family has experienced significant financial hardship—such as a job loss, health crisis, or natural disaster—their current financial situation may not align with what their most recent tax records indicate. Families in such circumstances can appeal to the financial aid office for an income adjustment, which can improve their eligibility under the aid formula.

Tips to Maximize Financial Aid Eligibility

Now that you understand key facts about financial aid income limits, here are expert tips to improve your chances of qualifying for assistance:

1. Minimize Taxable Income

Reducing taxable income in the base year (the tax year that FAFSA reviews) is one way to increase your aid eligibility. Families can subtly adjust their approach by deferring bonuses, avoiding untimely asset sales, or postponing withdrawals from retirement accounts.

2. File Your FAFSA Early

As mentioned earlier, submitting FAFSA early is vital. Federal, state, and institutional aid often have limited funds, and late applications may forfeit available grants or low-interest loans.

3. Organize Assets Thoughtfully

Parents should place savings in accounts like 529 Plans that weigh more favorably in FAFSA calculations. Avoid keeping significant college savings in a child’s name, as those are assessed at a higher rate when calculating aid eligibility.

4. Don’t Assume You Won’t Qualify

Families across all income brackets should complete FAFSA. Even if you don’t qualify for grants, filling it out can open doors to loans, work-study opportunities, or institutional scholarships. Many colleges use FAFSA to determine funding for all types of aid, not just need-based.

5. Choose Colleges Strategically

Some colleges are more generous with financial aid than others. Schools with significant endowments often offer more competitive aid packages to attract outstanding students, regardless of financial need.

Frequently Asked Questions

Do Financial Aid Programs Have Fixed Income Limits?

The short answer is no. Income limits vary depending on the type of financial aid. For example, a Pell Grant has stricter guidelines than federal student loans or merit-based scholarships.

How Does FAFSA Calculate Financial Need?

FAFSA calculates your Student Aid Index (SAI) using a formula that considers income, assets, family size, and the number of college-going dependents. This index determines the level of need-based aid you’re eligible to receive.

Can Middle-Income Families Qualify for Aid?

Yes. Many middle-income households qualify for at least some financial aid, such as federal loans or work-study programs. Factors like high medical expenses and multiple students in college can also improve eligibility.

What Is the Role of Assets in Aid Calculations?

Assets owned by parents are typically assessed at a much lower rate than those owned by the student. Strategically organizing college savings in parent-owned 529 Plans can reduce their impact on aid eligibility.

Final Thoughts

When it comes to college financial aid, understanding the facts about income limits is essential. While income is a significant factor, it’s far from the only one. Knowing how assets, timely filing, institutional formulas, and state-specific programs interplay ensures families get the aid they deserve.

Most importantly, never assume you won’t qualify for aid. Filling out FAFSA each year and exploring available options can lead to financial support that makes higher education more accessible. If you’re proactive and informed, there’s a strong chance of getting the financial aid needed to offset the high cost of college.

Navigating financial aid isn’t always straightforward, but being armed with the right knowledge will lead you toward success. Start early and maximize your opportunities!