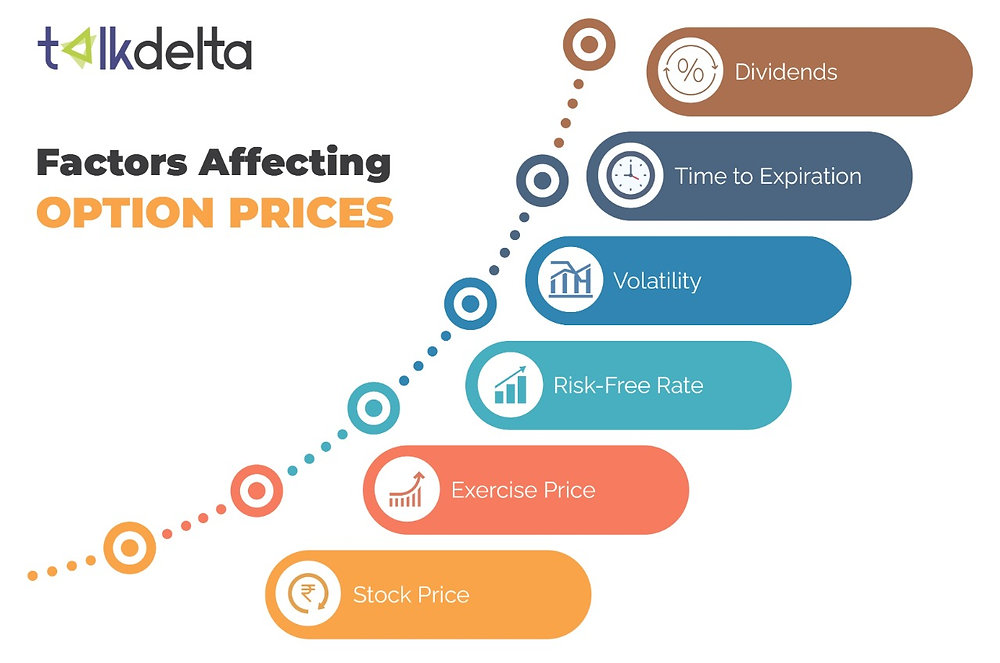

Options trading is one of the most dynamic and strategic areas of the financial markets, offering traders and investors opportunities to leverage their predictions about an asset’s future price. However, understanding how option prices are determined is crucial for success. Multiple factors interplay to decide the price of an option, and grasping these can make or break your trading strategies.

This article explores the factors affecting option prices and provides insights tailored to options traders, finance students, and investors.

What Are Options and Their Pricing Components?

An option is a financial derivative that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) by a specific expiration date.

The price (or premium) of an option breaks down into two components:

- Intrinsic Value

-

-

- The intrinsic value is the difference between the asset’s current market price and the strike price of the option. For instance, if a call option has a strike price of $50 and the market price of the stock is $60, the intrinsic value is $10.

- It represents the inherent “in-the-money” value of the option.

-

- Extrinsic Value (Time Value)

-

-

- Extrinsic value measures the premium over the intrinsic value, factoring in elements like time until expiration and market volatility.

-

With this foundation, let’s unpack the factors affecting option prices.

1. Underlying Asset Price

The price of the underlying asset directly affects the price of an option.

- For call options, the higher the underlying asset price (relative to the strike price), the more expensive the option.

- For put options, the inverse relationship holds true; a decline in the underlying price increases the put option’s value.

This price movement impacts the intrinsic value of the option, making the underlying asset price a core determinant.

Example

If Stock XYZ is trading at $70:

- A call option with a strike price of $60 will have a significant intrinsic value of $10.

- Conversely, a put option with the same strike price will be “out of the money.”

Understanding how the underlying price influences your options is foundational for making profitable trades.

2. Strike Price

The relationship between the strike price and the underlying asset price determines whether an option is in the money (ITM), at the money (ATM), or out of the money (OTM).

- Call Options: The closer the strike price is to the current market price, or if it is below the market price, the higher the option’s intrinsic value.

- Put Options: The opposite applies; the higher the strike price relative to the current market price, the greater the intrinsic value.

Traders must carefully consider strike price when purchasing options, as it defines the potential for intrinsic value creation.

3. Time to Expiration

Options are time-sensitive instruments, and the amount of time remaining before expiration significantly impacts their pricing.

- The more time left until expiration, the higher the time value component of the premium.

- Time decay, also known as theta, reduces the extrinsic value of the option as expiration approaches. For this reason, options lose value faster the closer they are to their expiration date.

Insight for Traders

If you’re speculating on a short-term price movement, be mindful of how quickly time decay might erode your option’s premium.

4. Volatility

Implied Volatility (IV) is a key factor in options pricing, reflecting the market’s forecast of future price fluctuations in the underlying asset.

- Higher implied volatility leads to higher option premiums, as there’s a greater chance the option could become profitable before expiration.

- Conversely, if market volatility decreases, option premiums may shrink even if the underlying asset price remains unchanged.

Example

Before an earnings announcement, stocks often experience a volatility increase. Buying options during these periods means you’ll pay a premium, but post-announcement volatility tends to drop sharply (a phenomenon known as volatility crush).

Understanding volatility and its effects on pricing can help traders time their entries and exits effectively.

5. Interest Rates

Interest rates also impact option pricing, although this factor may seem less significant compared to volatility or asset price.

- When interest rates increase, call options become slightly more expensive, while put options become slightly cheaper.

- This is because higher rates raise the cost of holding the underlying asset, thereby influencing call and put pricing dynamics.

While it’s not the primary factor for most traders, interest rates shouldn’t be overlooked, especially in environments of fluctuating monetary policy.

6. Dividends

For options on stocks, dividend payments can affect pricing, particularly for American-style options that can be exercised before expiration.

- Anticipated dividends decrease the price of call options since they lower the price of the underlying stock when paid.

- Conversely, they increase the value of put options.

Traders holding options must consider the ex-dividend date when predicting option value changes.

Understanding the Greeks

To further grasp how these factors interact, options traders rely on the “Greeks,” which quantify the sensitivity of an option’s price to these variables.

- Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price.

- Theta reflects time decay and its impact on option value.

- Vega measures sensitivity to changes in volatility.

- Rho evaluates sensitivity to interest rate changes.

Each Greek provides practical insights into how changes in specific factors may affect your options trade.

Key Takeaways for Options Traders

By understanding what drives option prices, traders can make more informed decisions:

- Pay close attention to asset price movements, time decay, and volatility.

- Consider how strike price and time-to-expiration align with your goals.

- Use the Greeks to assess risk and forecast potential price changes.

Options trading can be complex, but with a solid foundation in these factors, you’ll be well-equipped to craft strategies that maximize your chances of success.

Are you ready to step up your options trading game? Learn how to incorporate these pricing factors into your strategies for greater trading precision.