When it comes to navigating the world of investing, BlackRock model portfolios offer a comprehensive, expertly managed solution for investors seeking to optimize their asset allocation. With the recent addition of crypto assets and a deep focus on diverse and alternative investments, these portfolios enable a well-rounded and dynamic investment approach suitable for a range of risk preferences and financial objectives.

This article dives into what makes BlackRock model portfolios a valuable asset allocation strategy, how they function, and key considerations in their application.

What Are BlackRock Model Portfolios?

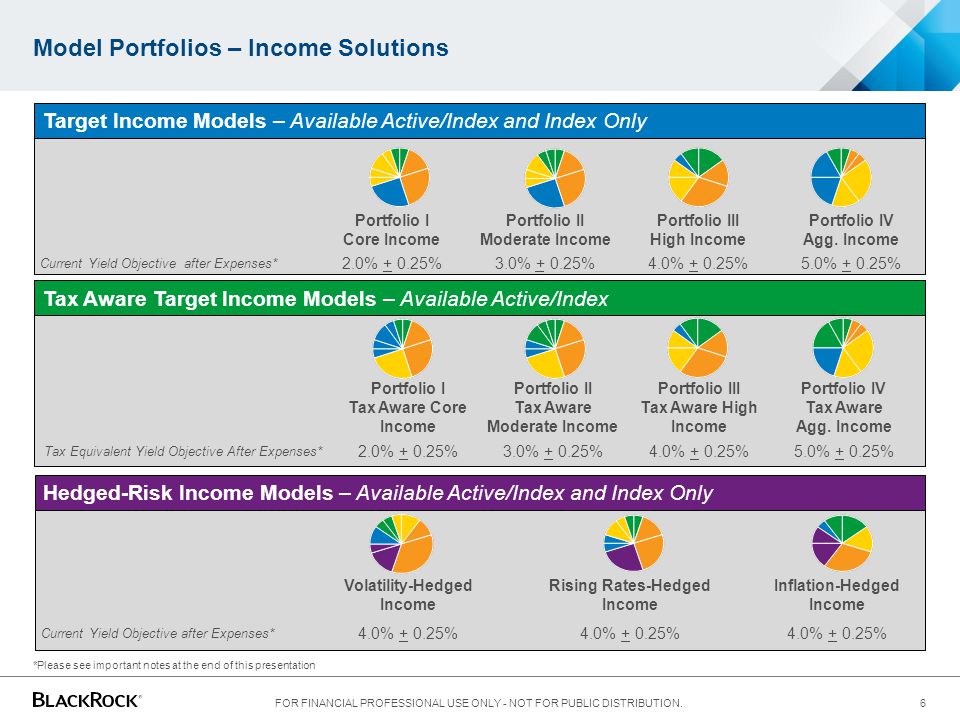

BlackRock model portfolios are curated investment templates designed by the world’s largest asset manager, BlackRock. These portfolios provide financial advisors and individual investors with a roadmap to diversify their investments strategically. They blend equities, fixed income, and alternative asset classes, aiming to create balanced, high-performing, and risk-adjusted investment strategies.

Each portfolio is systematically rebalanced to match evolving market conditions, providing the flexibility investors need to stay ahead. Model portfolios target varying investment goals, such as capital appreciation, income generation, or a combination of both, and cater to diverse levels of risk tolerance.

Key Features of BlackRock Model Portfolios

1. Professional Expertise

BlackRock leverages its deep bench of financial experts to craft these model portfolios. Using insights from global markets, the portfolios are designed to provide investors with optimized exposure to various asset classes.

2. Diversified Asset Allocation

BlackRock model portfolios incorporate a wide range of asset types, including stocks, bonds, and ETFs. Recently, there’s been a notable shift to include alternative investment options, such as cryptocurrencies. For instance, BlackRock introduced a 1% to 2% allocation of the iShares Bitcoin Trust (IBIT) to one of its alternative target allocation portfolios. This move highlights the increasing adoption of cryptocurrency in institutional investing.

3. Customizability

Although BlackRock provides pre-designed portfolios as guides, financial advisors and platforms can request adjustments tailored to their specific investment goals or those of their clients.

4. Data-Driven Decisions

BlackRock uses cutting-edge technology, algorithms, and data analytics to inform portfolio construction and management. This ensures that the portfolios are not only relevant but also adaptive to the complexities of the financial market.

Why Choose BlackRock Model Portfolios?

Simplified Investing Process

BlackRock model portfolios take the guesswork out of building and maintaining a diversified investment portfolio. With expert-curated asset allocations, investors can save time and avoid the pitfalls of manual portfolio management.

Institutional Quality for Individual Investors

Access to BlackRock’s extensive suite of resources allows everyday investors to experience the same level of risk management and strategy previously reserved for institutional clients.

Dynamic Rebalancing

Markets are unpredictable, and portfolios require frequent adjustments to respond to market conditions. BlackRock’s model portfolios are continually rebalanced to maintain the optimal mix of assets.

Proven Track Record

BlackRock, with almost $150 billion in assets managed through its model portfolios (as of December 2024), has demonstrated the capacity to deliver robust results for investors across a wide variety of market conditions.

BlackRock’s Adoption of Alternative Investments

One of the most intriguing developments in BlackRock’s model portfolios is the addition of alternative investments. Most notably, BlackRock incorporated the iShares Bitcoin Trust (IBIT), marking its first foray into including cryptocurrency in its model portfolios. This decision reflects a growing recognition of bitcoin’s potential as:

- A hedge against dollar hegemony and political instability,

- A novel store of value,

- A proxy for the transition from offline to online goods and services.

While the IBIT inclusion represents a relatively small allocation of 1%–2% in an alternative asset portfolio, it underscores the growing influence of cryptocurrency in institutional investing. The move is expected to spark further interest from financial advisors and investors seeking diversified, forward-looking strategies.

How Are BlackRock Model Portfolios Used?

These portfolios are particularly beneficial for financial advisors who manage client investments. Advisors can leverage the pre-designed templates or customize them to suit the needs of individual clients. By following BlackRock’s established frameworks, advisors can:

- Simplify the asset allocation process,

- Reduce decision-making biases,

- Deliver high-value financial solutions efficiently.

Additionally, individual investors and platforms tracking these portfolios gain insights into institutional-grade portfolio strategies that can guide their investment choices.

Limitations and Considerations

While BlackRock model portfolios offer undeniable benefits, investors should be aware of some key limitations:

- Not One-Size-Fits-All

Although tailored options are available, BlackRock model portfolios may not capture the unique goals or circumstances of every investor. Customization may still be required.

- Market Risk

Like any investment, these portfolios are subject to market volatility. While the diversified approach mitigates risk, it doesn’t eliminate it entirely.

- Fees

Investors using BlackRock model portfolios should understand the associated fees, which may include management costs for ETFs and other underlying assets.

- Emerging Asset Classes

The inclusion of alternative investments, like Bitcoin ETFs, introduces assets with higher volatility. Investors should evaluate their risk tolerance before committing to these options.

What Does the Future Hold for BlackRock Model Portfolios?

The ongoing evolution of financial markets is likely to push BlackRock to innovate further in its portfolio offerings. The integration of cryptocurrencies and other alternative assets is expected to expand, aligning with the shifting landscape of institutional and retail investor preferences.

Additionally, as ESG (Environmental, Social, Governance) investing continues to gain traction, we can anticipate more environmentally and socially responsible features being integrated into BlackRock model portfolios.

Final Thoughts on BlackRock Model Portfolios

BlackRock model portfolios are a game-changer for investors looking for expert management, diversification, and adaptability. By leveraging the research and expertise of the world’s largest asset manager, investors gain access to sophisticated strategies, personalized for their financial goals and risk tolerance.

The inclusion of alternative assets like the iShares Bitcoin Trust signals BlackRock’s forward-thinking approach, catering to the future of investment needs. Whether you’re a financial advisor managing a client’s wealth or an individual investor seeking comprehensive guidance, BlackRock model portfolios offer an excellent starting point for building a solid investment strategy.

Invest smart with BlackRock model portfolios. Explore how they can fit into your financial goals today.