When purchasing or owning a home, you’re bound to come across the term “home warranty.” But do you really have to have one? While home warranties offer a layer of protection against costly repairs for specific home systems and appliances, they are not mandatory for homeowners. However, whether or not you need a home warranty depends on your preferences, budget, and specific circumstances. This article will break down what a home warranty is, its benefits and drawbacks, and help you decide if it’s right for you.

What Is a Home Warranty?

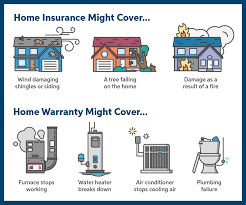

A home warranty is a service contract between you and a warranty provider. It covers the repair or replacement of major home systems like plumbing, HVAC, and electrical, as well as appliances such as refrigerators, washers, and dryers. Unlike homeowners insurance, which protects against perils like fire, floods, or theft, a home warranty focuses on wear-and-tear repairs. For instance, if your air conditioning unit stops working or your dishwasher breaks down, a home warranty could cover the costs.

Is a Home Warranty Required?

The simple answer is no, you do not have to have a home warranty—it is entirely optional. Unlike homeowners insurance, which is usually required by lenders to protect the home as collateral for a mortgage, no one will force you to get a home warranty. However, many homebuyers and existing homeowners still consider one, and here’s why.

When Should You Consider a Home Warranty?

Here are a few scenarios where a home warranty might make sense:

- Purchasing an Older Home

If you’re moving into an older property with aging systems or appliances, a home warranty can provide peace of mind. You may not know how well-maintained these systems are, and a warranty could save you from unexpected expenses.

- Limited Savings or Emergency Fund

For new homeowners who have recently depleted their savings to buy a home, handling a surprise $2,000 furnace repair may not be feasible. A home warranty can act as a financial buffer when unexpected repairs pop up.

- Not Handy with Repairs

If you’re not a DIY enthusiast or don’t know where to find reliable contractors, a home warranty could simplify repairs by arranging for approved service providers to handle the work.

- Selling Your Home

Home sellers often include a one-year home warranty with the sale to offer buyers peace of mind and reduce post-sale complaints about appliance or system failures.

- Expensive Appliances or Systems

If you’ve invested in high-end appliances or specialized systems, a warranty might help with their repair or replacement costs, keeping overall maintenance expenses in check.

Pros of Having a Home Warranty

- Peace of Mind

A home warranty offers reassurance that you’re covered for unexpected appliance breakdowns or system failures. This can be especially beneficial for first-time homeowners or buyers unfamiliar with maintaining a house.

- Convenience

Instead of hunting down repair professionals, your warranty provider acts as a middleman, sending pre-approved contractors to solve your problem.

- Budget Control

With a warranty, you pay predictable costs upfront—such as an annual premium and a service fee—helping you avoid large, unexpected repair bills.

- Appeals to Buyers

Including a home warranty in real estate transactions can make your property more appealing to potential buyers and allow a smoother sale.

Cons of Having a Home Warranty

- Not All Repairs Are Covered

Home warranties usually have exclusions. For example, pre-existing conditions or items not maintained properly may not be eligible for claims. Furthermore, warranties often set dollar caps on covered repairs or replacements.

- Service Fees Add Up

While the upfront cost of a warranty may sound reasonable, you might still pay service fees (typically $75–$125) for every contractor visit. If multiple issues arise, these fees can quickly add up.

- Lack of Control Over Repairs

Most warranties require you to use their approved contractors, which means you can’t choose your own repair professional. Additionally, the warranty may provide replacements or repairs with products or services you have little choice over.

- Opportunity Cost

Instead of paying for a home warranty, setting up an emergency repair fund might provide better financial value if major repairs are infrequent.

Alternatives to a Home Warranty

While a home warranty may offer convenience, it’s not the only way to prepare for home maintenance costs. Here are two alternatives:

- Emergency Savings Fund

Set aside money for unexpected repairs. By saving the equivalent of a warranty’s premium each year, you’ll have funds available to pay for repairs when needed, without restrictions on contractors or parts.

- Regular Maintenance

Preventive care can go a long way in avoiding large repair bills. Schedule annual HVAC tune-ups, clean gutters, and check for small issues early to avoid costly repairs down the line.

How to Decide if You Need a Home Warranty

Ask yourself these questions to gauge whether a home warranty is worth it for you:

- Are you comfortable handling potential repair costs out-of-pocket?

- Do you have a reliable emergency fund already in place?

- How old are the systems and appliances in your home?

- Can you dedicate time to finding contractors for repairs?

- Are you purchasing a home without much knowledge of its maintenance history?

Bottom Line – Do You Have to Have a Home Warranty?

No, you don’t have to get a home warranty, but for some homeowners, it can act as a financial safety net. The decision depends on your budget, the condition of your home, your ability to handle repairs yourself, and your personal preference for peace of mind.

Before purchasing a home warranty, make sure to:

- Research reputable warranty providers.

- Read the contract thoroughly, especially the fine print and exclusions.

- Compare the cost of the warranty to your financial preparedness for unexpected expenses.

Ultimately, whether to invest in a home warranty or not is a personal decision. If you’re looking for coverage to ease your worries about home maintenance, a home warranty could be a sound option. But if you’re financially prepared for what might go wrong, it might make more sense to skip the warranty and save those funds for your own repair emergencies.