If you’ve recently sold coins or are planning to sell some, you may be wondering, “Do I have to pay taxes on coins I sell?” The short answer is yes, in most cases. The IRS considers profits from selling coins as taxable income, but there are nuances to these rules. This guide will help you understand the tax implications of selling coins, what factors affect your tax liability, and how to ensure compliance with tax regulations.

Understanding Taxation on Coin Sales

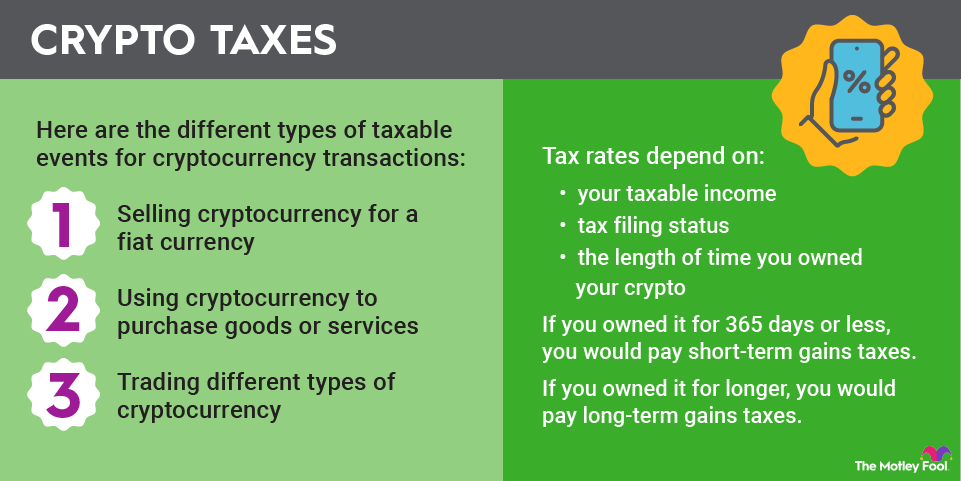

The IRS treats coins, whether they are rare collectibles or precious metal coins, as taxable assets. When you sell these coins for more than their original purchase price, the profit is subject to capital gains tax. However, the specifics depend on several factors, such as how long you held the coins and their classification.

Coins as Collectibles

Coins, especially those made from precious metals like gold and silver, are often classified as “collectibles” by the IRS. This classification impacts how the capital gains tax is applied:

- Short-Term Gains (held for one year or less): Profits are taxed as ordinary income, with rates depending on your tax bracket.

- Long-Term Gains (held for more than one year): Gains are taxed at a maximum rate of 28%, which is higher than the typical long-term capital gains tax rates for other assets.

Knowing how your coins are classified and how long you’ve held them can help you better plan for tax obligations.

Calculating Capital Gains on Coin Sales

The taxable amount, or capital gain, is calculated as the difference between the sale price of the coin and its “cost basis.” The cost basis includes what you originally paid for the coin, along with any additional expenses like appraisal or storage fees. The formula looks like this:

Capital Gain = Sale Price – (Purchase Price + Additional Costs)

For example, if you bought a rare silver coin for $500 and paid $50 in appraisal costs, your total cost basis is $550. If you later sell the coin for $800, your taxable capital gain would be $250.

Coins Received as Gifts or Inheritance

If the coins were gifted to you, the cost basis may be the original purchase price paid by the person who gifted them, or the fair market value at the time of the gift, depending on the circumstances. For inherited coins, the cost basis is typically the fair market value of the coins at the time of the original owner’s death.

Reporting Coin Sales on Taxes

When you sell coins, you must report the transaction on your tax return. Here’s how to do it:

- Form 1040 & Schedule D

Use Schedule D to report capital gains or losses from coin sales. Include the sale price, cost basis, and your calculated profit or loss.

- Form 1099-B

If the sale meets certain thresholds, the dealer or broker may issue a Form 1099-B, which will also be sent to the IRS. For example, this filing is often required for:

-

-

- Sales of $1,000 face value of U.S. 90% silver dimes, quarters, or half-dollars.

- Sales of 25 or more coins like Gold Krugerrands or Gold Maple Leafs.

-

- Document Everything

Keep records of purchase receipts, sale invoices, and any appraisals or associated costs. These documents are crucial in case the IRS audits your tax return.

Reducing Your Tax Liability

While paying taxes on coin sales is mandatory, there are ways to reduce the amount you owe:

- Offset Gains with Losses

If you’ve incurred losses from other investments, you can use them to offset gains from selling coins. Up to $3,000 of excess losses can also offset other taxable income.

- Hold for Over a Year

To benefit from the lower (but still capped) 28% long-term capital gains tax rate, consider holding onto your coins for more than a year before selling them.

- Track Expenses

Keep receipts for additional costs like storage, insurance, or appraisals, as these can be added to your cost basis and reduce your taxable gains.

Special Rules for Precious Metal Coins

Coins made from precious metals like gold, silver, platinum, or palladium fall under specific rules due to their classification as collectibles. Here’s what you need to know:

- The maximum long-term capital gains tax rate is 28%, higher than the standard 15-20% for most investments.

- Special reporting requirements apply for certain coin transactions, such as sales of large quantities or certain coin types.

Are There Tax-Free Coin Sales?

There are limited cases where you may not owe taxes on the sale of coins. For example:

- Selling Coins at a Loss

If you sell coins for less than their cost basis, you won’t owe taxes on the sale. Instead, you can use the loss to offset other gains.

- Coins Held in Certain Retirement Accounts

If coins are held in self-directed IRAs, they aren’t taxable until distributions are taken, at which point they’ll be taxed as ordinary income.

Make sure to consult your financial advisor for specifics, as laws regarding retirement accounts and collectibles can vary.

Final Thoughts

To answer the question, “Do I have to pay taxes on coins I sell?”—yes, you do if you make a profit. Coins are subject to capital gains taxes, and ensuring proper reporting is essential to staying compliant with IRS regulations.

If you’re planning to sell coins, take the time to calculate your cost basis, document expenses, and ensure you’re holding them long enough to benefit from favorable long-term rates. Taxes don’t have to be overwhelming as long as you stay organized and informed.

For those with a complex coin portfolio or large-scale transactions, consider consulting a tax professional for personalized guidance. Understanding these tax rules upfront will save you a lot of hassle (and stress) down the road.