When it comes to managing money, understanding the debit and credit difference is crucial. Whether you’re a seasoned accountant or someone just beginning to explore financial literacy, knowing how these terms work and differ can significantly enhance your ability to manage personal or business finances.

What are Debit and Credit?

Debits

A debit is an entry that increases asset or expense accounts and decreases liability or equity accounts. Think of it as money going outwards from an account. For example:

- When you withdraw cash from your account using a debit card, your bank reduces the balance of your checking account.

- If you purchase an item with a debit card, money is immediately deducted from your available funds.

Credits

A credit is an accounting entry that increases liability or equity accounts and decreases asset or expense accounts. Essentially, it is the opposite of a debit. For instance:

- When you swipe a credit card, the bank lends you money that you’ll pay back later.

- A credit increases your obligations (credit card balance) but doesn’t reduce your checking or savings account immediately.

Although debit and credit sound similar, their financial implications are vastly different, especially in how they handle funds and obligations.

Key Differences between Debit and Credit

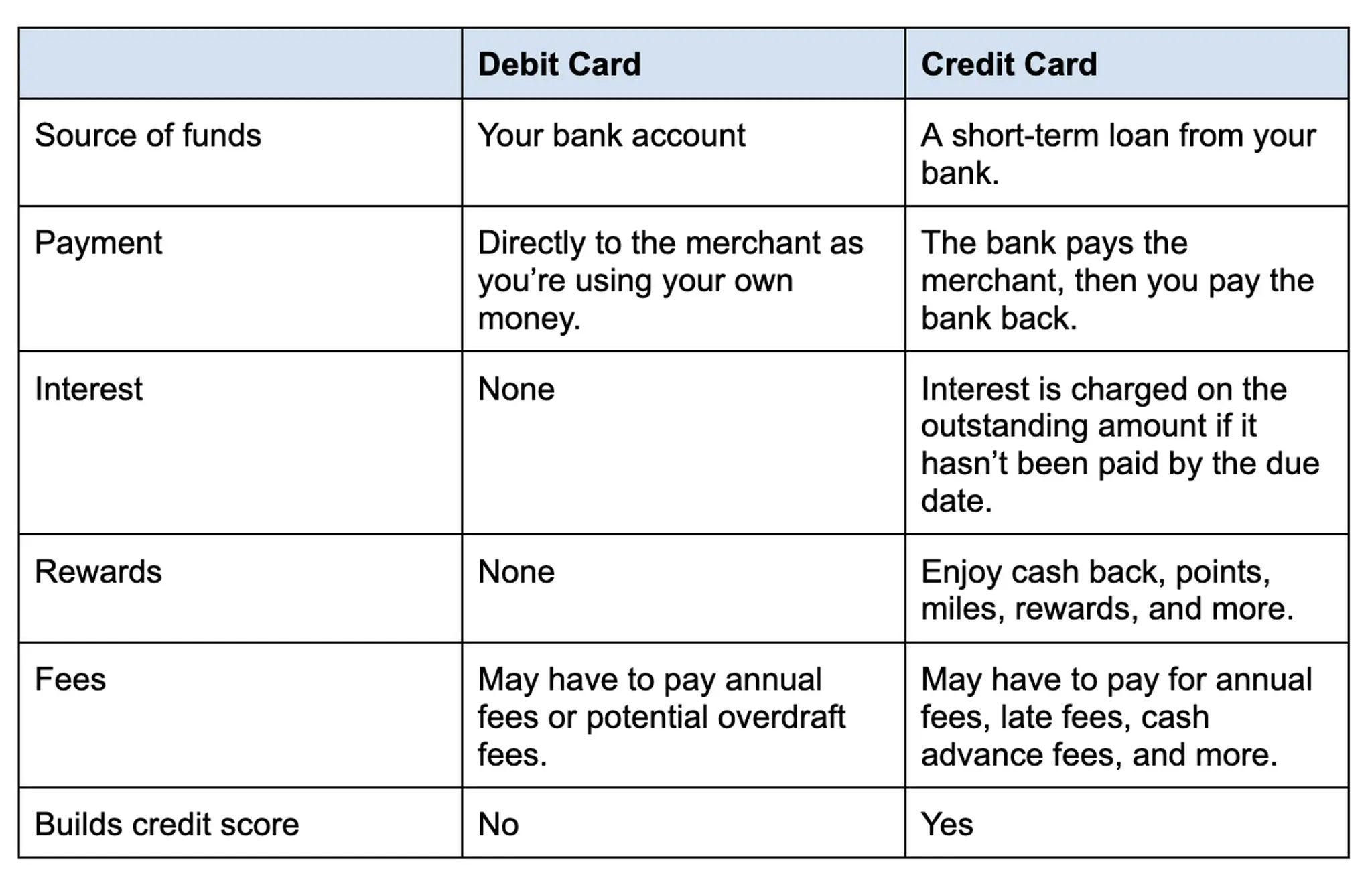

| Feature | Debit | Credit |

|---|---|---|

| Definition | Money is deducted directly from your account. | Borrowed money that must be repaid later. |

| Fund Source | Linked directly to a bank account or prepaid funds. | Comes from a credit limit provided by the issuer. |

| Fraud Protection | Limited protection depending on the time of reporting fraud. | Stronger protection, typically capped liability. |

| Potential for Debt | No debt incurred; you can only use what you have. | High potential for accruing debt through interest and late fees. |

| Building Credit History | No effect on your credit score. | Helps build (or damage) your credit history. |

| Usage Limits | Transaction is limited to available account funds. | Limited to credit card limit; interest applies if balance is unpaid. |

| Annual Fees | Free for most accounts; minimal fees apply (e.g., overdraft). | May include annual fees, late payment penalties, and interest rates. |

| Earning Rewards | Rare or minimal rewards (some accounts provide cashback). | Earn rewards like cashback, points, or miles. |

Now that you have an overview, let’s break these key differences into detail.

1. Where the Money Comes From

With a debit card, money is drawn directly from a checking or prepaid account. If you don’t have enough balance, the transaction may be declined (or incur an overdraft fee). On the other hand, a credit card offers you a line of credit that allows you to make purchases up to an authorized limit and pay later—with or without interest, depending on when you clear the balance.

2. Fraud Protection

Credit cards generally provide better fraud protection compared to debit cards. Under the Fair Credit Billing Act, liability for unauthorized credit card transactions is capped at $50. Debit cards, however, fall under the Electronic Funds Transfer Act, which sets stricter deadlines for reporting stolen funds. Delays in reporting could cost you significantly.

3. Debt and Credit History

Debit cards are simple tools for spending only what you have, making them excellent for people keen to avoid debt. However, they do not contribute to building your credit score. Credit cards, by contrast, allow users to build a credit history when used responsibly. This can be vital for securing future loans, renting apartments, or even landing certain jobs.

4. Fees and Rewards

Debit cards generally have lower annual fees and costs. Credit cards, depending on the type, may include annual fees, late payment penalties, and interest rates on outstanding balances. However, credit cards often provide lucrative rewards programs, such as cashback, travel miles, and points for purchases.

When to Use Debit vs. Credit

When Debit Is Better

- You’re trying to stick to a budget and avoid debt.

- You’re making daily purchases like groceries or small expenses.

- You prefer straightforward transactions with no interest worries.

- You want to curb spending temptation.

When Credit Is Better

- You need to make large purchases and pay them off over time.

- You want to earn rewards or cashback for spending.

- You’re aiming to build or improve your credit score.

- You need stronger fraud and purchase protections.

Why Learn the Difference?

Understanding the difference between debit and credit empowers you to make smarter financial decisions. Both tools have their unique benefits and limitations, and they can complement each other when used correctly. For example, you might use your debit card for everyday purchases but rely on your credit card to earn rewards on larger expenditures or protect major transactions.

Final Thoughts

Mastering the debit and credit difference is fundamental for effective financial management. Whether you’re ensuring daily monetary control with a debit card or leveraging rewards and credit-building opportunities with a credit card, understanding how each works will help maximize their advantages while avoiding unnecessary pitfalls.

When in doubt, choose the option that aligns best with your current financial goals and discipline. After all, both debit and credit cards are incredibly powerful tools when used responsibly.