Cryptocurrency

Investing in cryptocurrency differs from trading in that it focuses on the long term, typically spanning years or even decades. Long-term investing is one of the key strategies for building wealth and achieving financial stability. Cryptocurrency investors aim to benefit from the potential appreciation of digital assets over time by analyzing market trends and fundamental factors that influence their value.

About Cryptocurrency

To begin investing in cryptocurrency, follow these steps:

- Choose a reliable cryptocurrency exchange (e.g., Binance, Coinbase, Kraken).

- Create an account and complete identity verification.

- Deposit funds using a bank transfer, credit card, or other accepted payment methods.

- Research different cryptocurrencies and decide which ones to invest in.

- Store your assets securely in a cryptocurrency wallet (hot or cold storage).

Popular cryptocurrencies for investment include:

- Bitcoin (BTC) – The first and most widely recognized cryptocurrency.

- Ethereum (ETH) – Known for its smart contract capabilities and blockchain applications.

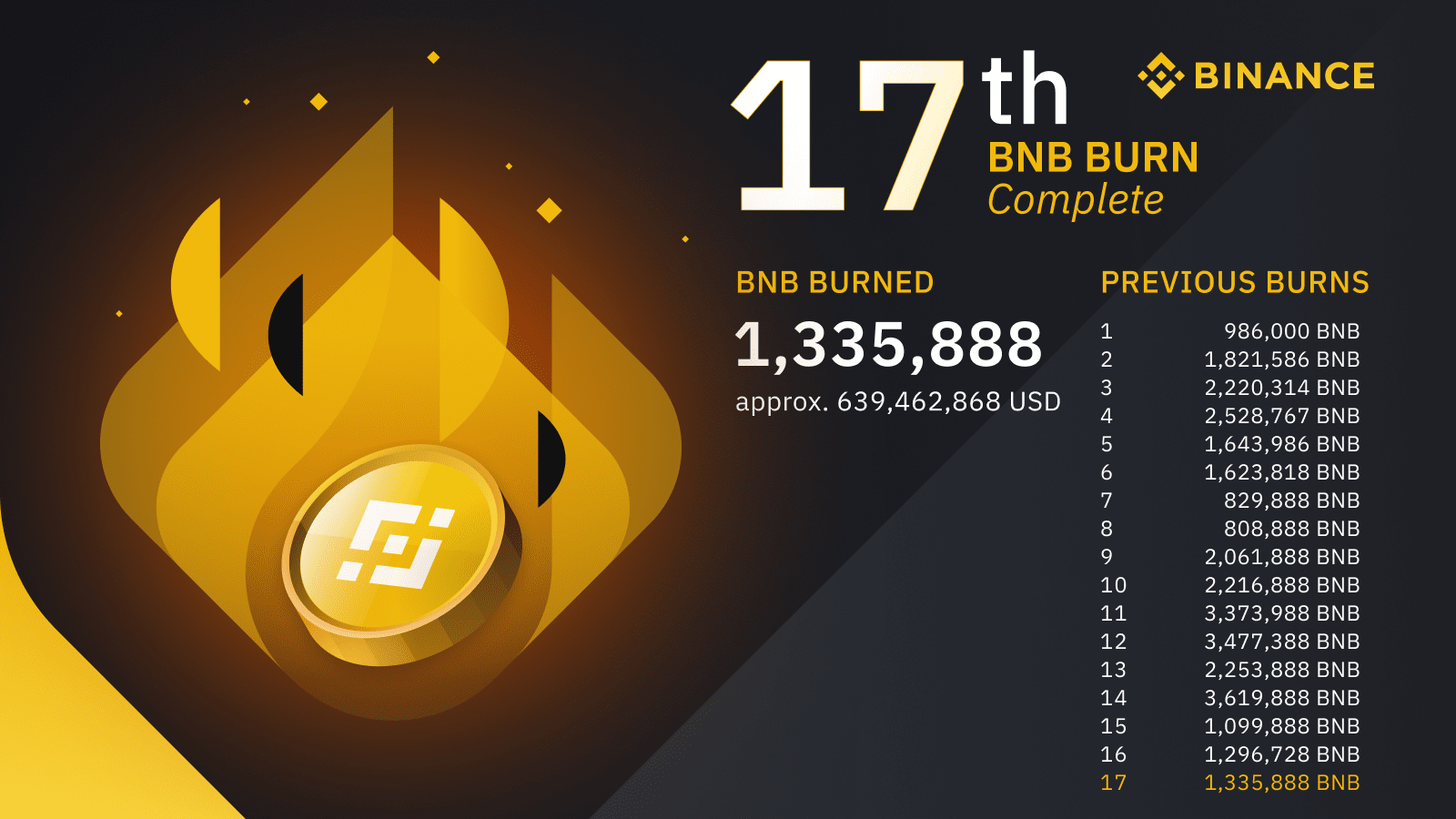

- Binance Coin (BNB) – Used within the Binance ecosystem.

- Solana (SOL) – Known for fast transactions and low fees.

- Cardano (ADA) – A blockchain focused on sustainability and scalability.

While these are among the top choices, investors should always research market trends, technological developments, and real-world adoption before investing.

To protect your crypto assets, consider these storage options:

- Hot Wallets (Online Wallets): Convenient for frequent trading but vulnerable to hacking (e.g., MetaMask, Trust Wallet).

- Cold Wallets (Hardware Wallets): More secure as they are offline (e.g., Ledger, Trezor).

- Exchange Wallets: Convenient for trading but riskier since exchanges can be hacked.

For maximum security, investors should use hardware wallets for long-term storage, enable two-factor authentication (2FA), and avoid sharing private keys.