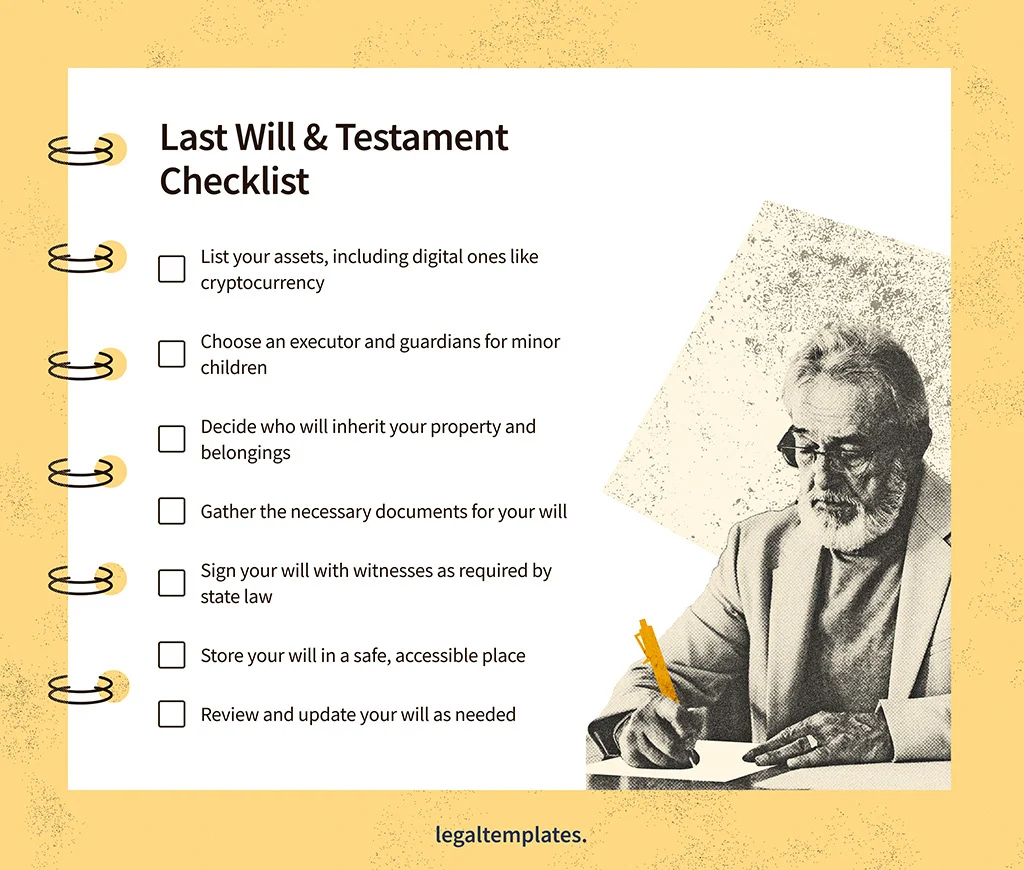

When it comes to estate planning, drafting a will is one of the most important steps you can take to ensure that your assets are distributed according to your wishes. However, to make a will effective, one key component often gets overlooked—a thorough and accurate list of assets. Without a clear inventory, your beneficiaries may face confusion, delays, or even disputes. If you’re crafting a will or planning to start, this guide will help you understand what to include in a list of assets for a will template to make the process efficient and straightforward.

What is a List of Assets for a Will Template?

A list of assets for a will template is a structured inventory of everything you own, both tangible and intangible, that you wish to include in your will. Think of it as a roadmap for your estate executor—this list ensures they know exactly what you’ve left behind and where to find it. It’s not just about expensive items like real estate or investments; even personal mementos and digital assets can have value to your loved ones.

Why is it Important to Have a List of Assets?

An accurate list of assets ensures a smooth estate planning process and efficient execution of your will. Here’s how it helps:

- Minimizes Disputes: Avoid disagreements among beneficiaries by clearly outlining who receives what.

- Simplifies the Executor’s Role: A detailed inventory saves time and effort for the person managing your estate.

- Ensures No Asset is Overlooked: From family heirlooms to digital subscriptions, nothing gets left behind.

- Avoids Legal and Financial Issues: Proper documentation reduces the chances of probate complications or assets going unclaimed.

Now that we’ve covered the importance of an asset list, here’s how you can create one for your will.

What to Include in a List of Assets for a Will Template

To make your will as comprehensive as possible, your list of assets should cover various categories of wealth and possessions. Below, we’ve broken down the types of assets you should document.

1. Physical or Tangible Assets

This includes anything you can physically see, touch, or hold. Add details like descriptions, locations, and estimated values where possible.

- Real Estate:

- Primary residence

- Vacation homes or rental properties

- Land or undeveloped property

- Vehicles:

- Cars, motorcycles, or boats (include registration details)

- Personal Belongings:

- Jewelry, watches, and accessories

- Art collections, antiques, or collectibles

- Electronics like laptops or televisions

- Furniture or other items of significant value

- Sentimental Items:

- Family photo albums

- Heirlooms or keepsakes

- Any other items with personal or historical significance

2. Non-Physical or Intangible Assets

Non-physical assets often hold substantial financial value and must be clearly listed with account numbers, beneficiary details, or institutions managing them.

- Financial Accounts:

- Checking and savings accounts

- Certificates of deposit (CDs)

- Retirement accounts (e.g., 401(k), IRA)

- Investments:

- Stocks, bonds, and mutual funds

- Brokerage accounts

- Insurance Policies:

- Life insurance

- Long-term care or disability insurance

- Benefits:

- Pension plans

- Social security benefits

- Digital Assets:

- Cryptocurrencies like Bitcoin or Ethereum

- Payment apps like PayPal or Venmo

- Subscription services and online accounts (Netflix, Amazon, etc.)

3. Debts & Liabilities

It’s equally important to document these obligations. Compiling this list helps ensure your estate executor settles them properly.

- Mortgages

- Credit card balances

- Auto loans

- Personal loans or other debts

- Outstanding bills or utilities

4. Business Interests

If you own or have a stake in a business, include these details:

- Ownership Documents:

- Shareholder agreements

- Partnership agreements

- Business Accounts:

- Bank accounts belonging to the business

- Outstanding receivables or debts owed to you

- Intellectual Property:

- Trademarks, patents, or copyrights

5. Memberships and Charitable Contributions

Some memberships or organizations might come with unexpected perks for beneficiaries. Be sure to note:

- Memberships in alumni associations, professional organizations, or clubs.

- Charitable donations you’d like in your memory.

- Automatic contributions to charities that your estate should manage or discontinue.

6. Digital and Online Presence

Don’t forget about your digital footprint. These often hold immense sentimental or monetary value:

- Social media accounts such as Facebook, Instagram, Twitter, and LinkedIn.

- Email accounts along with associated passwords.

- Digital files stored on the cloud.

- Domain names or websites you own.

7. Miscellaneous Items

Lastly, think about unique categories that don’t fit neatly into others:

- Lottery winnings

- Prepaid funeral or burial arrangements

- Frequent flyer miles or travel reward points

How to Organize Your List of Assets

Follow these tips to ensure your asset list is clear and accessible:

- Be Detailed: Include descriptions, locations, and values for every item.

- Update Regularly: Revisit your list every year or after significant life events (e.g., marriage, divorce, or purchasing new assets).

- Make Copies: Provide a copy to your estate executor, a trusted family member, and your attorney.

- Use a Secure Location: Store the original in a safe deposit box, home safe, or secure digital file.

Start Your Estate Planning Today

Creating a list of assets for a will template might take some effort, but the peace of mind it provides is invaluable. By accounting for everything you own—tangible, intangible, and even digital—you ensure your loved ones are cared for and your legacy is preserved.

If this process feels overwhelming, consider hiring an estate attorney or using online tools to help organize your assets. No matter your approach, remember that procrastination is the enemy of estate planning.

Taking this important step today ensures clarity and security for your family tomorrow.