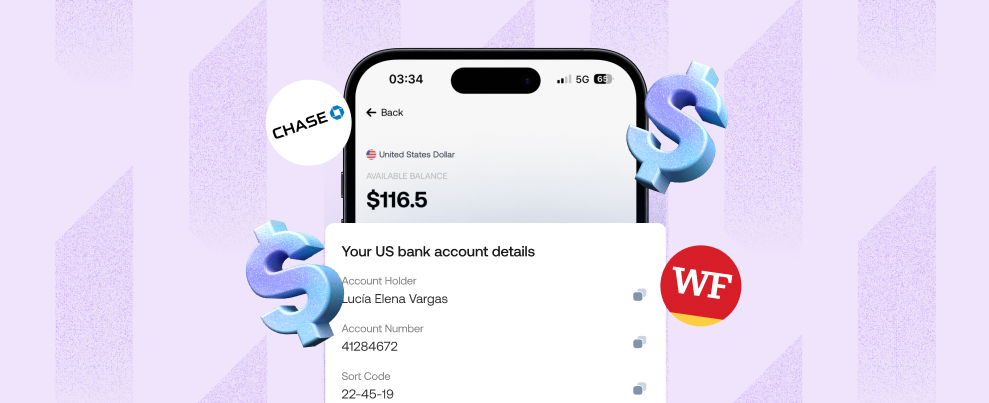

Many individuals from around the globe aspire to open a U.S. bank account, which offers a range of benefits such as easy money transfers, accessibility during travels, and online shopping conveniences. Chase Bank, one of the largest and most reputable financial institutions in the United States, delivers several banking solutions. But what does this mean for non-U.S. citizens? This article will walk you through everything you need to know about opening a Chase Bank account as a non-U.S. citizen and how it can benefit you.

Why Open a Chase Bank Account as a Non-U.S. Citizen?

If you’re a foreign student, an expat, or someone who frequently travels to the United States, having a U.S. bank account with a trusted institution like Chase Bank can simplify your financial management. Here are some reasons why opening a Chase Bank account is a great option for non-U.S. citizens:

- Convenience: Easily manage your funds through a robust online banking platform and a wide network of physical branches.

- Access Numerous ATMs: Chase offers access to thousands of ATMs across the U.S., eliminating withdrawal hassles.

- Global Payments: Handle global transactions, payments, and money transfers efficiently.

- Safe and Secure: Enjoy peace of mind with secured banking and fraud protection measures.

- Building Credit: If you’re planning to stay in the U.S. long-term, a Chase account is a step toward building your financial credit history.

Can Non-U.S. Citizens Open a Chase Bank Account?

Good news! Chase Bank allows non-U.S. citizens to open bank accounts. However, you’ll need to meet specific requirements and provide the necessary documentation to complete the process. Chase’s flexibility in catering to non-citizens is one of the reasons it stands out as a preferred banking institution.

What You’ll Need to Open a Chase Bank Account

To open a Chase Bank account as a non-U.S. citizen, you must typically supply the following documents:

- Government-Issued Identification

-

-

- Passport (valid)

- U.S. visa or Permanent Resident Card (if applicable)

-

- Secondary Documentation

-

-

- Individual Taxpayer Identification Number (ITIN)

- Social Security Number (SSN) (if available)

-

- Proof of Address

-

-

- Utility bills or lease agreements reflecting your current address in the U.S.

-

- Minimum Deposit

-

-

- Some accounts require a minimum deposit to get started, so be prepared with the necessary funds.

-

It’s best to check with a Chase branch directly for a complete and accurate list of requirements, as they may vary based on your circumstances.

Types of Chase Accounts for Non-U.S. Citizens

Chase Bank offers a variety of account types, but here are some of the most popular options suitable for non-U.S. citizens:

- Chase Total Checking

Perfect for everyday transactions, this account comes with low fees and full access to their online platform and mobile app.

- Chase Student Checking

Tailored for international students, this account includes perks such as waived monthly service fees during your education.

- Chase Savings Accounts

If you’re looking to save money, Chase offers savings accounts with competitive interest rates and automated saving tools.

- Chase Premier Plus Checking

This account combines the flexibility of a basic checking account with benefits like no fees on select services.

Steps to Open a Chase Bank Account for Non-U.S. Citizens

Here’s a simple step-by-step guide to opening your Chase Bank account:

1. Gather All Required Documents

Ensure you have all the necessary documentation, including your identification, proof of U.S. address, and applicable visa/ITIN.

2. Choose the Right Account Type

Visit the Chase website or speak to a representative to select the account that best fits your needs.

3. Visit a Chase Branch

While some accounts can be opened online, non-U.S. citizens will likely need to visit a branch in person to complete the setup due to verification requirements.

4. Make Your Initial Deposit

Meet the minimum funding requirement for your chosen account to activate it.

5. Access Your Account

Once created, you’ll have full access to Chase’s online banking, mobile app, and customer support services to manage your finances.

Benefits of Choosing Chase Bank as a Non-U.S. Citizen

- User-Friendly Mobile App

Chase’s banking app offers intuitive features to manage accounts, pay bills, transfer money, set up alerts, and track expenses—even for first-time users.

- Access to Financial Tools and Services

Beyond basic banking services, Chase offers tools for budgeting, saving, and loans as your financial needs grow.

- Customer Support

Chase provides multilingual customer service, making communication seamless for international clients.

- Global Trust

Chase is recognized globally, offering non-U.S. citizens the assurance of reliable banking with robust security systems.

Things to Keep in Mind

While Chase Bank is an excellent choice for non-U.S. citizens, here are a few things to consider:

- Account Maintenance Fees: Some accounts may have monthly maintenance fees, though these may be waived by maintaining a minimum balance.

- ATM Fees Abroad: While Chase excels in U.S. ATM access, international ATM withdrawals may come with fees for non-network machines.

- Verification Process: Be prepared for additional identity and documentation verifications as a non-U.S. citizen.

Final Thoughts

A Chase bank account for non-U.S. citizens opens doors to financial ease and opportunity in the United States. Whether you’re a foreign student managing tuition expenses, an expat working abroad, or someone new to U.S. banking, Chase’s wide array of features, accessibility, and global trust make it an ideal choice.

Take the first step toward hassle-free banking in the U.S. by opening your Chase Bank account today. Visit a Chase branch or learn more on their website to get started.