Creating a reliable source of passive income is a dream for many, especially retirees, income-focused investors, and those new to investing. One of the most popular strategies to achieve this is by constructing a dividend portfolio for monthly income. This method allows you to earn regular payouts from some of the world’s most stable companies while potentially growing your investments over time.

Whether you’re a beginner just starting to explore dividends or an experienced investor seeking to optimize your portfolio, this guide breaks down the benefits of dividend investing and provides actionable advice on how to start building a portfolio that generates consistent monthly income.

What is a Dividend Portfolio for Monthly Income?

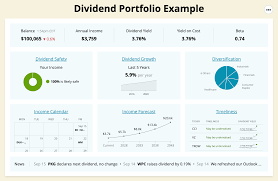

A dividend portfolio is a collection of investments in dividend-paying stocks, exchange-traded funds (ETFs), or real estate investment trusts (REITs) designed to generate passive income. For those seeking a steady income stream, the goal is to create a diversified group of assets that pays out dividends across different intervals, ensuring you receive income every month.

Dividend-paying companies are often well-established businesses with consistent cash flows. Think of industry giants like Coca-Cola, Johnson & Johnson, and Procter & Gamble. These “dividend aristocrats” are known for increasing their payouts year after year, making them ideal for building a stable portfolio.

But why focus on dividends specifically? Let’s take a look at the benefits.

Benefits of Building a Dividend Portfolio

- Steady Income Stream

Dividends provide a reliable and predictable income, which makes them particularly attractive for retirees or those seeking additional passive income. By structuring your portfolio properly, you can enjoy payouts every month.

- Capital Growth Potential

Many dividend stocks not only offer regular cash payments but also have the potential to appreciate over time. This dual benefit of income and growth makes them a valuable long-term investment.

- Reinvestment Opportunities

Reinvesting your dividends can compound your returns. Over time, this strategy allows your portfolio to grow exponentially, even if you start with a modest investment.

- Portfolio Stability

Dividend-paying companies are often more stable and less volatile compared to non-dividend-paying stocks. They are typically leaders in their industries, making them a safer option, especially for conservative investors.

- Tax Advantages

Qualified dividends often qualify for lower tax rates compared to ordinary income, depending on your jurisdiction. This can mean higher after-tax returns compared to other types of income.

Now that you understand the benefits, let’s explore the steps to create a dividend portfolio for monthly income.

How to Build a Dividend Portfolio for Monthly Income

Follow these six practical steps to create a diversified dividend portfolio and achieve consistent passive income.

1. Define Your Monthly Income Goal

Before you start, determine how much monthly income you’d like to generate. This income goal will dictate the size of your portfolio and the types of investments you need.

For example:

- If you aim for $1,000 per month and target an average dividend yield of 4%, you’ll need a portfolio worth approximately $300,000 ($12,000 annually divided by 4%).

2. Choose Dividend Stocks with Reliable Payouts

Look for companies that have a long history of consistent or growing dividends. These are often referred to as “dividend aristocrats.” Examples include:

- Johnson & Johnson (JNJ)

- Coca-Cola (KO)

- Procter & Gamble (PG)

You can also consider high-yield stocks like Real Estate Investment Trusts (REITs) or dividend-focused ETFs. Just ensure the yield is sustainable to avoid risks of cuts to payouts.

3. Diversify Across Sectors

Avoid putting all your eggs in one basket. Diversify your portfolio across different industries, such as:

- Consumer staples (e.g., food and household goods)

- Healthcare

- Utilities

- Financials

- Real estate

Diversification reduces your risk and protects your income if one sector underperforms or experiences cuts in dividends.

4. Set Up a Monthly Payment Schedule

Not all dividends are paid monthly. Many companies pay them quarterly, meaning payouts may not align perfectly with your desired regular income.

To achieve monthly cash flow, you can:

- Invest in dividend-paying stocks with staggered payment schedules.

- Choose monthly-paying investments like certain REITs or ETFs.

5. Leverage Dividend ETFs for a Hands-Off Approach

If managing individual stock selection feels overwhelming, dividend ETFs can simplify the process. These funds pool together high-yield stocks and manage diversification for you. For example:

- Nasdaq-100 High Income ETF (IQQQ) offers an annual yield of around 9%.

With ETFs, you can benefit from passive income without spending significant time researching individual companies.

6. Reinvest Early, Withdraw Later

If monthly income isn’t an immediate need, reinvest your dividends to compound your portfolio’s growth. Many brokerages offer automatic dividend reinvestment plans (DRIPs), which purchase additional shares with your payouts, increasing future income.

Once your portfolio reaches your targeted size, start withdrawing dividends as income while leaving the principal invested.

Common Pitfalls to Avoid

While building a dividend portfolio is achievable, there are a few mistakes to sidestep along the way:

- Chasing High Yields: Be cautious of stocks with yields that seem too good to be true. They could indicate financial instability.

- Ignoring Diversification: A concentrated portfolio increases the risk of income cuts if one company reduces or eliminates dividends.

- Overlooking Costs: Look out for fees associated with ETFs or funds, as they can eat into your returns.

Is a Dividend Portfolio Right for You?

A dividend portfolio for monthly income is a powerful tool for achieving financial independence and ensuring a stable retirement. It’s an attractive option for retirees seeking a steady income, income-focused investors, and beginners aiming to grow wealth sustainably.

However, success requires planning, consistent contributions, and patience. You don’t need to start with a large amount—but by reinvesting dividends and building gradually, you can achieve meaningful monthly income in the long term.

Take the First Step

If you’re ready to take control of your financial future, now’s the time to start building your dividend portfolio. Educate yourself, diversify wisely, and set achievable goals. Remember, the sooner you begin, the more time your investments will have to grow.

Looking for tools to streamline your investment process? Explore our expert-curated list of the best dividend-paying stocks and ETFs to help you get started on your monthly income plan today.