For investors new to the market, navigating the vast array of financial products can be daunting. One popular choice that offers diversified exposure to the stock market is the BlackRock iShares S&P 500 Index Fund (IVV). This fund is particularly attractive for those looking to invest in the strength of the U.S. economy through the performance of its leading companies.

Here’s everything beginners, finance students, and curious investors need to know about the BlackRock iShares S&P 500 Index Fund.

What is the BlackRock iShares S&P 500 Index Fund?

The BlackRock iShares S&P 500 Index Fund (ticker symbol IVV) is an Exchange-Traded Fund (ETF) that passively tracks the S&P 500 Index, one of the most well-known benchmarks of the U.S. stock market. The S&P 500 Index represents 500 of the largest publicly traded companies across various sectors, including technology, healthcare, finance, and consumer goods.

By investing in the iShares S&P 500 Index Fund, you’re essentially buying a slice of the U.S. economy. The fund mirrors the performance of the S&P 500, allowing you to benefit from its collective growth without the need to buy individual stocks.

Why Choose the BlackRock iShares S&P 500 Index Fund?

When considering an S&P 500 ETF, it’s essential to evaluate factors like expense ratio, liquidity, and performance consistency. The BlackRock iShares S&P 500 Fund stands out for several features:

1. Low Expense Ratio

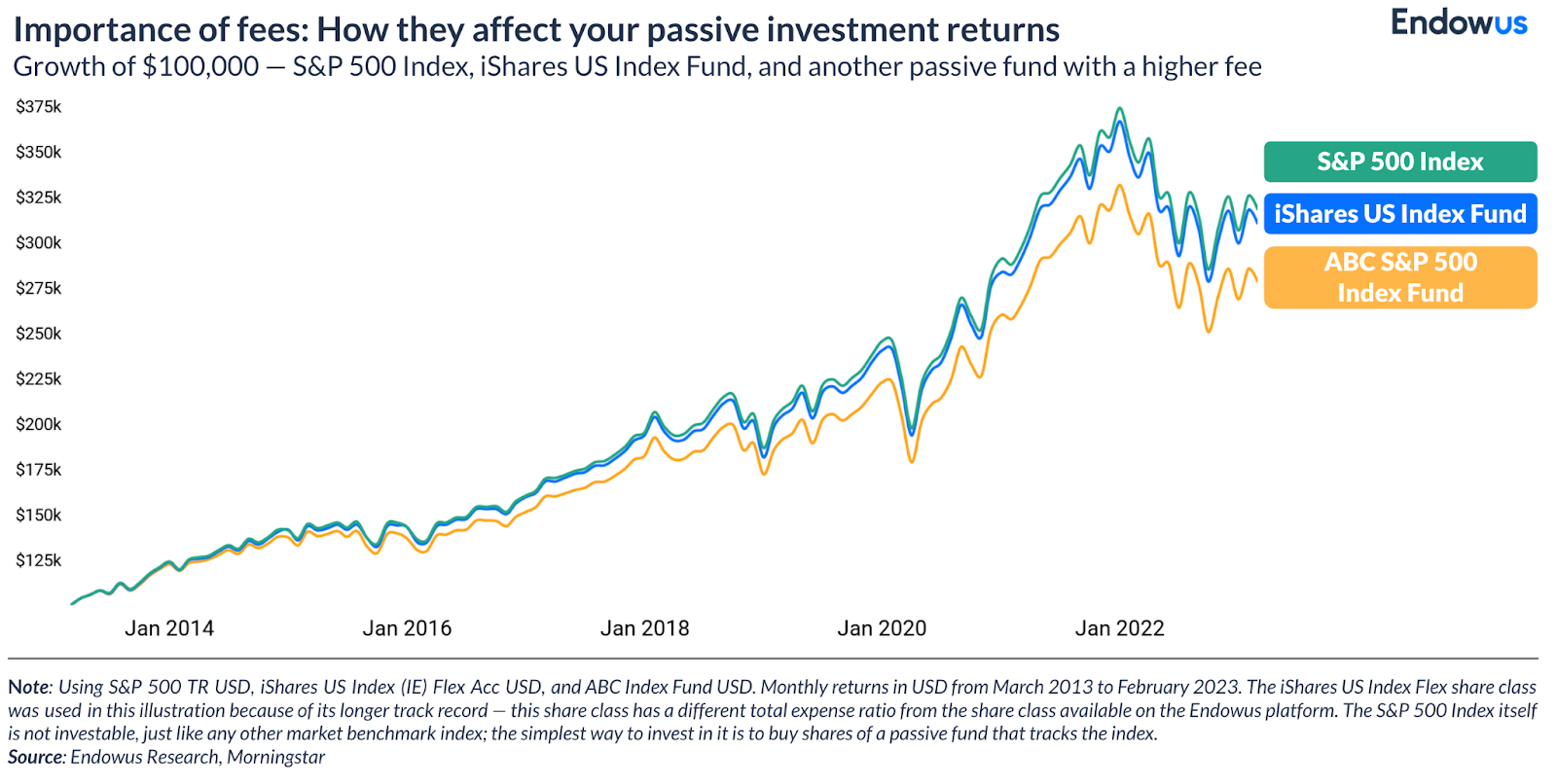

The expense ratio for the IVV fund is just 0.03%, making it highly cost-effective. This means for every $10,000 invested annually, you’ll pay only $3 in fees. Over time, these savings can have a significant impact on your portfolio’s growth.

2. Diversification

The BlackRock iShares S&P 500 ETF provides instant diversification by including stocks from multiple sectors. Between Apple, Walmart, Johnson & Johnson, and hundreds of other industry leaders, diversification helps mitigate risk and enhance stability.

3. Strong Track Record

The fund is managed by BlackRock, one of the world’s largest and most reputable investment firms. Since its launch, the product’s performance has consistently aligned closely with the S&P 500 Index.

4. Dividends

Investors benefit not just from capital appreciation but also from quarterly dividend payouts. These payouts include income derived from the profits of S&P 500 companies.

5. Easy Access

Being an ETF, the iShares S&P 500 is traded like a stock on the exchange. This makes it more liquid compared to mutual funds, and you can buy or sell shares throughout the day at market prices.

How Does the iShares S&P 500 Compare to Other ETFs?

The three biggest players in the S&P 500 ETF market are BlackRock iShares (IVV), SPDR by State Street (SPY), and Vanguard S&P 500 ETF (VOO). While all three ETFs aim to replicate the index performance, there are subtle differences:

- iShares IVV and Vanguard VOO share the same competitive expense ratio of 0.03%, while SPY’s expense ratio is 0.0945%.

- SPY has the highest liquidity, making it the best option for active traders. However, for long-term investors, IVV and VOO’s cost advantages often make them more appealing.

Benefits of Investing in the BlackRock iShares S&P 500 Index Fund

1. Affordability

With its minimal expense ratio, this fund allows you to maximize your returns by keeping fees low. It’s ideal for beginners who are cost-conscious.

2. Diversified Exposure

Through a single investment, the fund gives you exposure to the top 500 U.S. companies across various industries, reducing the risk associated with investing in individual stocks.

3. Simplicity

The fund is perfect for passive investors. By simply holding IVV, your portfolio tracks the U.S. economy without requiring constant management or rebalancing.

4. Long-Term Growth

Historically, the S&P 500 Index has delivered steady growth over the long term, making it a reliable option for wealth-building.

5. Market Representation

Since the S&P 500 Index reflects the health of the largest companies in the U.S., investing in the BlackRock iShares S&P 500 Fund means you’re effectively hitching your wagon to the performance of the domestic economy.

Key Considerations Before Investing

Before adding the iShares S&P 500 Fund (or any ETF) to your portfolio, take these factors into account:

- Risk Tolerance:

While the S&P 500 Index is relatively stable, it can still fluctuate, especially during periods of economic uncertainty. Beginners should be prepared for some level of short-term volatility.

- Investment Goals:

The iShares S&P 500 Fund is best suited for long-term investors seeking slow, steady growth rather than instant returns.

- Tracking Error:

Although minimal, some ETFs experience slight differences between their performance and that of the index they track due to management processes.

- Dividend Use:

Decide whether to reinvest dividends (to compound returns) or take them as cash to generate passive income.

How to Invest in the BlackRock iShares S&P 500 Index Fund

Getting started with the iShares S&P 500 is easy:

- Open a Brokerage Account:

Choose a reliable platform that offers access to BlackRock’s ETFs.

- Research the Fund:

Familiarize yourself with the fund’s historical performance and any associated terms.

- Decide on Your Investment Amount:

Assess your budget and allocate a portion of your portfolio to the ETF.

- Place Your Order:

Purchase shares of IVV on the exchange, just as you would buy any other stock.

- Monitor Performance:

While minimal oversight is needed, keep track of how the fund aligns with your financial goals.

Final Word

The BlackRock iShares S&P 500 Index Fund (IVV) offers an accessible, low-cost way for beginners and seasoned investors alike to tap into the growth of the U.S. economy. Its combination of diversification, affordability, and proven performance makes it one of the top choices in the world of ETFs.

Whether you’re a novice investor taking your first steps or a finance student exploring practical applications of market instruments, this fund is a powerful tool to include in your learning (and earning) portfolio.

To unlock the potential of passive investing, consider exploring the BlackRock iShares S&P 500 Index Fund for your portfolio today. Simple, stable, and growth-oriented, it’s a financial vehicle that keeps delivering value year after year.