Investors are steadily shifting their focus toward clean and sustainable energy, and with this trend has come increasing interest in companies like Power Metals Corp., trading under the ticker PWRMF. This article takes an in-depth look at PWRMF stock, its performance, and its potential within a competitive market.

What is Power Metals Corp.?

Power Metals Corp. is a Canadian-based exploration company specializing in identifying and developing high-potential lithium, cesium, and tantalum deposits. The company has positioned itself as a key player in the growing lithium sector, driven by expanding electric vehicle (EV) production and renewable energy storage solutions.

The company’s flagship project, Case Lake in Ontario, Canada, is considered one of the most significant exploration projects for hard-rock lithium in North America. This exclusive focus on key battery materials makes PWRMF stock an appealing option for investors seeking exposure to the growing demand for lithium and other essential minerals.

Why Investors Are Paying Attention to PWRMF Stock

Interest in PWRMF stock has been increasing as the global EV market continues to grow exponentially. Countries around the globe have made clear commitments to phase out internal combustion engines and transition to cleaner energy, with lithium-ion batteries playing a critical role in this transformation.

Here are the key factors influencing investor sentiment toward Power Metals Corp.:

1. Lithium Demand Boom

Lithium demand is surging, not only for EVs but also for renewable energy storage and other tech fields. This makes companies like Power Metals Corp. a central piece of the clean energy revolution.

2. Strategic Project Locations

The company’s Case Lake property provides proximity to key infrastructure, which significantly reduces operational costs. Canada’s favorable mining regulations and resource-rich geology also boost the company’s long-term outlook.

3. Sector Growth and Dependency

With the broader mining and clean energy sectors showing strong growth potential, Power Metals is strategically positioned in a niche market with significant global demand.

4. Exploration Potential

While still in early stages compared to larger lithium producers, exploration success at Case Lake and other projects could deliver meaningful gains for investors in PWRMF stock.

PWRMF Stock Performance

The stock has shown moderate performance relative to its peers in the lithium space. While not yet a heavyweight on the trading floor, Power Metals Corp. represents an opportunity for investors looking to invest early in promising exploration companies. Here are a few noteworthy aspects of its recent performance:

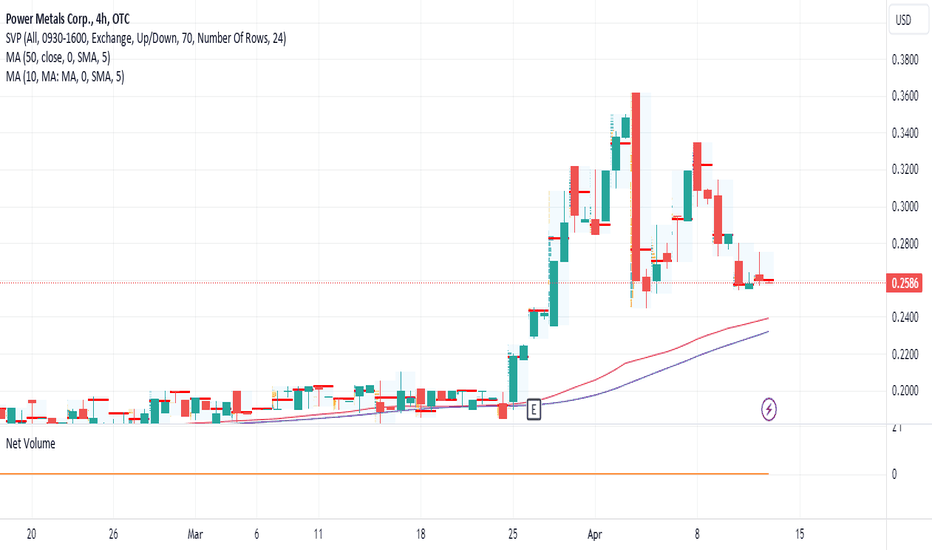

- Share Price Stability: Although the stock price has undergone fluctuations typical of junior mining companies, it has shown resilience amidst broader sector volatility.

- Volume Trends: PWRMF stock has seen an uptick in trading volume, signaling increasing investor interest.

- Market Outlook: Analysts remain cautiously optimistic about the stock, highlighting its growth potential as exploration progresses and lithium demand rises.

Challenges for PWRMF Stock

While the growth prospects of Power Metals Corp. are enticing, it’s important for potential investors to consider the risks:

- Exploration Risk: Being an exploration-stage company, Power Metals faces significant uncertainties. Success in identifying commercially viable deposits is not guaranteed.

- Market Competition: The lithium mining sector has become increasingly crowded, with larger players dominating and setting competitive market standards.

- Stock Volatility: Like many resource-focused junior exploration companies, PWRMF stock can be highly volatile, with share prices reacting strongly to exploration updates, commodity price shifts, and global market sentiment.

Is PWRMF Stock a Buy?

Whether or not PWRMF stock is a worthwhile investment depends largely on your risk tolerance and investment strategy. If you’re looking to capitalize on the growing demand for lithium and are comfortable navigating the higher risks associated with junior exploration companies, PWRMF may offer significant upside potential.

Investors should also consider Power Metals’ focus on sustainability and its role in supporting the clean energy economy. Companies producing essential minerals for EVs and battery storage are well-positioned in a rapidly evolving global energy market.

Final Thoughts

With its clear strategy and strong position in a sector poised for long-term growth, Power Metals Corp. has earned its place on the watchlist for savvy investors. However, the nature of junior mining projects calls for careful due diligence.

If you’re considering investing in PWRMF stock, staying updated on exploration results, lithium price trends, and company news is essential. Understanding both the opportunities and limitations of the stock will help you make an informed decision.

Keep an eye on the developments at Power Metals Corp., as the clean energy revolution gives rise to new players shaping the future.