Real estate investment trusts (REITs) provide investors with an essential avenue for diversifying their portfolios while earning steady income. Among the different REIT categories, Mortgage REITs (mREITs) stand out for their unique focus on real estate debt, offering opportunities for consistent income through dividends. If you’re an investor or financial enthusiast looking to explore the mortgage REIT space, this guide will help you understand what they are, why they matter, and how to explore a mortgage REITs list to identify top performers.

What Are Mortgage REITs?

Mortgage REITs specialize in managing real estate-related debt. Unlike traditional equity REITs that invest in and manage physical properties, mREITs focus on purchasing or originating mortgages and mortgage-backed securities. These investments generate income primarily through the interest earned on their holdings.

How mREITs Work

- Income Generation: Mortgage REITs purchase large pools of real estate loans or mortgage-backed securities. They earn income from the interest payments made on these loans.

- Leverage Strategies: To enhance their yields, mREITs often use borrowed funds, meaning changes in interest rates can significantly influence their profitability.

Benefits of Investing in mREITs

Mortgage REITs offer notable advantages, making them a popular choice for income-seeking investors:

- High-Yield Dividends

By law, REITs must distribute at least 90% of their taxable income to shareholders. This requirement leads to higher-than-average dividend yields compared to most stocks.

- Diversified Investment

Mortgage REITs provide exposure to real estate without requiring the management of physical properties or direct property ownership.

- Liquidity

Unlike directly owning real estate, mREITs are publicly traded, allowing investors to buy and sell their shares with ease.

- Portfolio Diversification

Mortgage REITs tend to react differently to market movements compared to traditional stocks or bonds, adding balance to your investment portfolio.

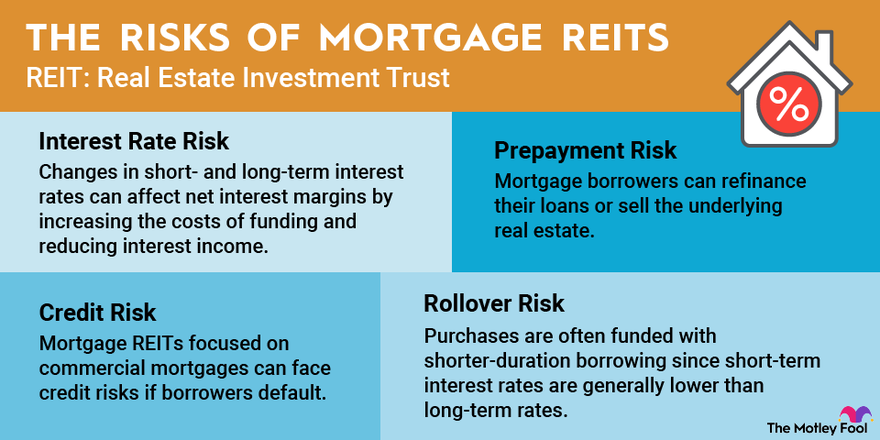

Risks to Consider Before Investing in mREITs

Although there are clear benefits, mortgage REITs come with their own set of risks to evaluate:

- Sensitivity to Interest Rates

Mortgage REITs are highly sensitive to interest rate fluctuations. Rising interest rates can lower the value of their assets and increase borrowing costs.

- Leverage Risks

The reliance on borrowed funds to enhance returns creates exposure to potential losses during market downturns or periods of rising interest rates.

- Economic Vulnerabilities

Mortgage REITs’ performance is influenced by economic stability, housing markets, and borrower defaults, all of which can affect their profitability.

Top Mortgage REITs List to Watch in 2024

Choosing the right mortgage REIT from a reliable mortgage REITs list can make all the difference in achieving a strong return on investment. The list below includes notable players in the mREIT market that have demonstrated consistent performance and shareholder value.

1. AGNC Investment Corp (AGNC)

AGNC specializes in agency mortgage-backed securities (MBS) and has been a leader in providing high dividend yields. Its disciplined investment strategies and commitment to shareholders make it a top pick for income-oriented investors.

2. Annaly Capital Management (NLY)

One of the largest mortgage REITs, Annaly focuses on diversifying its investments across agency MBS, residential real estate, and middle-market lending. It’s a solid choice for those seeking portfolio diversification.

3. Starwood Property Trust (STWD)

Starwood takes a unique approach by investing in both real estate assets and real estate debt. Its diversified portfolio provides stability and protection against market volatility.

4. Blackstone Mortgage Trust (BXMT)

Managed by Blackstone, this mREIT offers an institutional-level approach to real estate financing. Its focus on commercial real estate loans ensures strong risk management and high returns.

5. New Residential Investment Corp (NRZ)

With its diversified investment strategies across residential mortgage servicing, advance financing, and real estate securities, NRZ offers a comprehensive approach to delivering value to shareholders.

6. PennyMac Mortgage Investment Trust (PMT)

PennyMac focuses on both residential mortgages and government-backed securities, appealing to investors seeking stability and consistent income.

How to Evaluate Mortgage REITs

When analyzing options from a mortgage REITs list, consider these key factors to make informed investment decisions:

- Dividend Yields vs. Payout Ratios

Look for sustainable dividend yields and examine the payout ratio. A higher ratio might indicate financial strain.

- Net Asset Value (NAV)

Evaluate the REIT’s NAV to ensure it’s trading at a fair valuation compared to its assets and liabilities.

- Debt-to-Equity Ratio

A low debt-to-equity ratio generally signifies a stronger financial position and less vulnerability to rising interest rates.

- Management Expertise

Experienced managers with a track record of navigating economic cycles are crucial in the volatile mREIT sector.

- Portfolio Composition

Understand whether the REIT focuses on agency-backed securities, which are government-guaranteed, or non-agency MBS, which may carry higher risks and returns.

Tips for Investing in mREITs

For investors considering mortgage REITs, here are some strategies to get started:

- Research and Compare

Use a comprehensive mortgage REITs list to evaluate performance metrics, dividend yields, and risk profiles.

- Diversify Your Exposure

Avoid concentrating your portfolio in one REIT by exploring ETFs or mutual funds that focus on mortgage REITs for diversification.

- Monitor Economic Indicators

Keep an eye on interest rates, housing market trends, and Federal Reserve policies, as these factors directly impact mREIT performance.

- Long-Term Perspective

While mortgage REITs offer high yield potential, they also carry volatility. Maintain a long-term outlook to benefit from reinvested dividends and price appreciation.

The Bottom Line

Mortgage REITs remain a compelling investment vehicle for those seeking high-yield income and diversification in their portfolios. While they offer attractive dividends, understanding the risks associated with interest rates and leverage is critical for long-term success.

Before making any decisions, conduct thorough research using a reliable mortgage REITs list to identify opportunities that align with your financial goals. Remember, investing in mortgage REITs can be a powerful way to gain exposure to the real estate sector without owning physical properties.

Are you ready to elevate your investment expertise? Explore top-performing REITs today to unlock the potential of this dynamic market!