Tetras Capital was once a name that generated significant buzz in the crypto space. Founded in 2017, during the height of cryptocurrency mania, Tetras Capital positioned itself as a hedge fund focusing on altcoins (alternative cryptocurrencies)—a space still in its infancy at the time.

With a strong lineup of experienced co-founders, including Alex Sunnarborg, Brendan Bernstein, and Thomas Garrambone—all of whom hailed from esteemed financial institutions such as Goldman Sachs, JPMorgan, Deutsche Bank, and Torreya Partners—Tetras Capital aimed to help investors capitalize on the growing world of digital assets.

However, by 2020, the narrative around Tetras Capital drastically shifted, and the fund ultimately shuttered its doors after experiencing a 75% life-to-date loss. This article will analyze the rise and fall of Tetras Capital, while exploring its relevance in the wider context of cryptocurrency hedge funds.

The Rise of Tetras Capital

Founding Vision

Launched during the cryptocurrency bull market of 2017, Tetras Capital began with a focus on altcoins, reflecting a desire to diversify beyond Bitcoin’s dominance. Altcoins such as Ether (ETH) and various other digital assets were at the forefront of their investment strategy.

The fund gained attention for its ambition and high-profile leadership, attracting upwards of $33 million from over 60 investors. Each of these investors contributed at least $100,000, creating a pool of significant capital to allocate into the altcoin market.

Bold Investments

Tetras’ strategy combined a mix of long and short positions within the cryptocurrency space. Notably, the fund gained recognition for its bold decision to short Ethereum (ETH) at $700 in May 2018. This trade would later prove profitable, as Ether declined to below $100 in the following year.

However, the broader crypto market downturn that followed the 2017 peak proved unrelenting, dragging most altcoins into prolonged declines. This was the environment Tetras Capital had to contend with as it aimed to deliver returns in a maturing yet undeniably volatile asset class.

The Struggles and Closure of Tetras Capital

Prolonged Market Decline

Altcoins, which were at the heart of the Tetras Capital strategy, experienced steep corrections after their meteoric rises in 2017. Prices of many altcoins dropped substantially, with Bitcoin’s dominance in the market reasserting itself. The over-reliance on altcoin-focused strategies created challenges as these assets failed to recover, shrinking investor confidence.

Tetras reported approximately a 75% life-to-date loss, a figure that proved unsustainable despite its earlier strategic wins.

External Pressures and Market Trends

Tetras Capital’s struggles were not unique. According to Crypto Fund Research, 68 crypto hedge funds worldwide were forced to close in 2019, almost double the number from the previous year. This wave of closures underscored the broader challenges faced by the still-nascent crypto hedge fund industry, where extreme market volatility and regulatory uncertainty created unrelenting headwinds.

Final Decision

By 2020, Tetras Capital made the decision to shut down and return what remained of its investors’ capital. The team likely grappled with the reality of prolonged unprofitability combined with the difficulty of raising new funds in a cautious market environment.

The decision marked the end of Tetras Capital’s relatively short stint as one of the well-known names in crypto hedge funds. While requests for comments from the founders went unanswered, the fund’s story speaks volumes about the challenges of managing risk in an asset class as unconventional as cryptocurrency.

The Legacy of Tetras Capital

Lessons for Hedge Funds and Investors

The closure of Tetras Capital highlights several key takeaways for both crypto hedge fund managers and investors:

- Volatility is the Rule, Not the Exception

The crypto market is notoriously volatile, and altcoins are particularly prone to sharp fluctuations. Tetras’ heavy reliance on altcoins exposed the inherent risks of such a strategy.

- Diversification is Crucial

Betting on one major segment of the cryptocurrency market (such as altcoins) can exacerbate risks during downturns. The experience of Tetras Capital underscores the importance of diversified investment strategies in weathering market cycles.

- Understanding Market Maturity

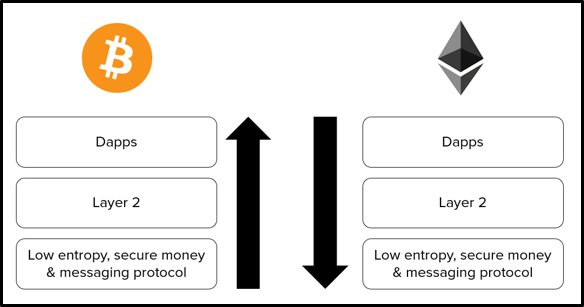

By focusing on niche digital assets before the market had adequately matured, Tetras Capital may have overestimated the long-term resilience of altcoins. Investors and funds today are increasingly pivoting toward Bitcoin or stablecoin strategies to minimize risks.

- Investor Sentiment

The crypto hedge fund space relies on investor confidence, which can wane quickly during periods of sustained losses. Hedge funds with consistent communication and a clear strategy are generally better equipped to maintain that trust.

Impact on the Crypto Hedge Fund Landscape

Though Tetras Capital is no longer an active player, its rise and fall offer valuable insights into the early days of crypto hedge fund experimentation. It was part of a movement that sought to professionalize crypto investing, blending traditional finance expertise with blockchain technology.

Today, more mature hedge funds, such as Pantera Capital and Grayscale Investments, have learned from the challenges faced by firms like Tetras. Furthermore, institutional interest in cryptocurrency continues to grow, driven by a more robust understanding of digital assets.

What’s Next for Crypto Hedge Funds?

While Tetras Capital is a cautionary tale, the cryptocurrency hedge fund realm continues to evolve. The lessons from earlier ventures are steering funds toward greater transparency, better risk management, and diversified portfolios.

For institutional and retail investors looking to enter this high-risk, high-reward space, the story of Tetras Capital serves as a reminder of the importance of due diligence and a clear understanding of the unique dynamics of cryptocurrency markets.

By continuing to innovate and adapt, crypto hedge funds may yet fulfill their potential to bridge the gap between traditional finance and decentralized assets. For those willing to take calculated risks, the future of this sector remains a compelling and evolving frontier.