Tax efficiency is a critical component of building wealth, and non-taxable investments are key tools for achieving it. Smart investors understand that keeping more of your hard-earned returns means navigating the complexities of tax laws and regulations. This guide will help you understand what non-taxable investments are, their benefits, and how to incorporate them into your portfolio for long-term financial growth.

What Are Non-Taxable Investments?

Non-taxable investments are financial instruments that provide returns exempt from certain types of taxes, either partially or entirely. This could mean no state or local taxes, no federal taxes, or no taxes until you start withdrawing funds (as in tax-deferred accounts).

Non-taxable investments are excellent options for individuals looking to maximize the value of their returns or reduce the burden of taxes over time. They are particularly useful for retirement planning, estate planning, and wealth preservation.

Types of Non-Taxable Investments

When it comes to non-taxable investments, there are several options available. Each has unique tax advantages suited to different kinds of financial goals. Below are the most common non-taxable investments you should consider:

1. Municipal Bonds

Municipal bonds, or “munis,” are debt securities issued by government entities like cities or states to finance public projects. The interest income generated from municipal bonds is generally exempt from federal income taxes and may even be exempt from state or local taxes if the bonds are issued within your state of residency.

- Ideal for: High-income earners in higher tax brackets who want to preserve capital and earn tax-free income.

- Example: If you’re in a 35% federal tax bracket, tax-free municipal bond income has the equivalent taxable yield of a much higher-paying taxable investment.

2. Roth IRAs and Roth 401(k)s

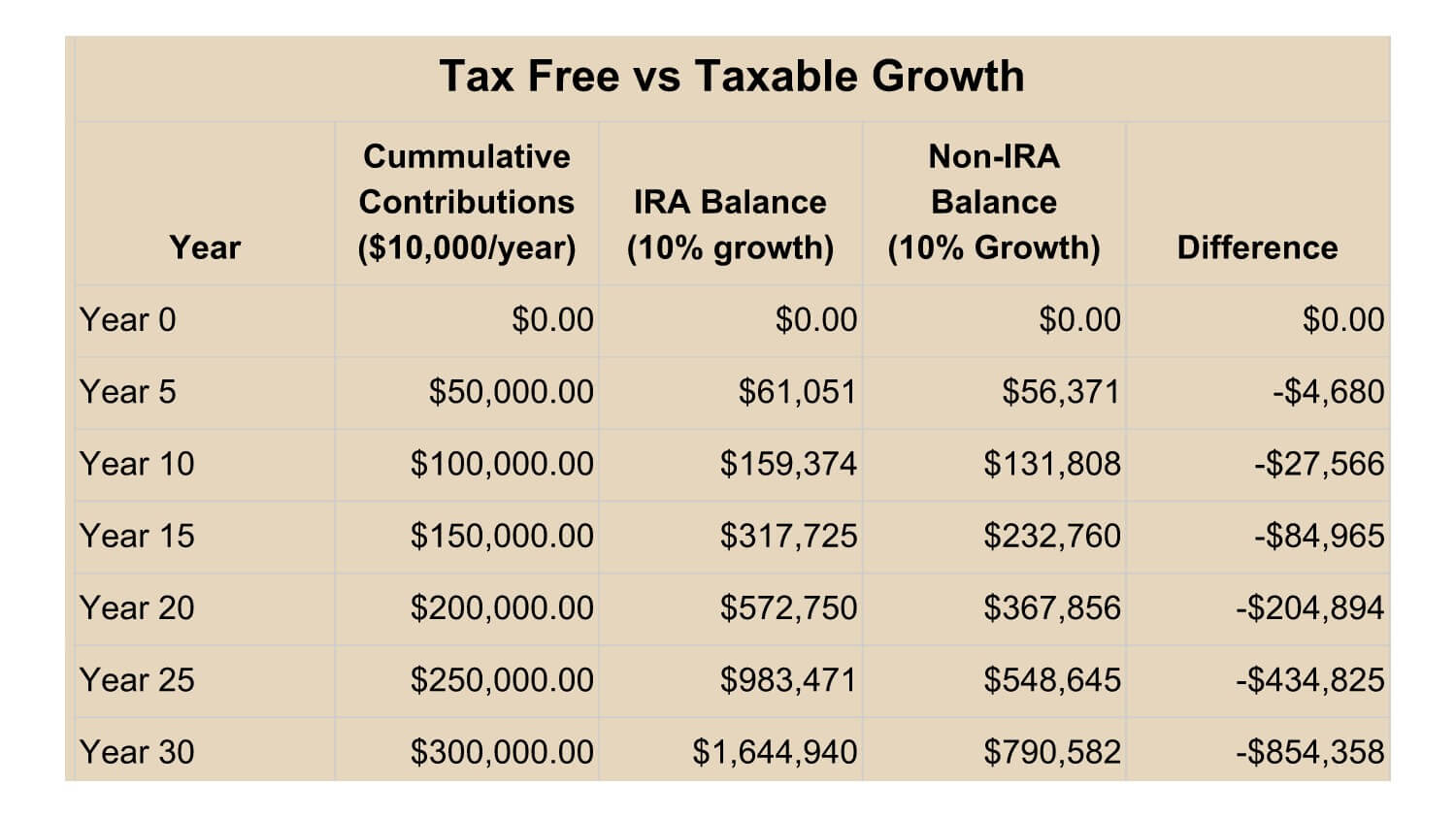

A Roth IRA or Roth 401(k) allows you to contribute after-tax dollars, but the returns grow tax-free, and qualified withdrawals in retirement are tax-exempt. Unlike traditional IRAs or 401(k)s, Roth accounts offer long-term tax advantages because they eliminate future tax liability on accumulated gains.

- Ideal for: Long-term savers and those who expect to be in higher tax brackets during retirement.

- Example: Contribute $6,500 annually (or $7,500 if you’re over 50) to grow investments tax-free and keep all your withdrawals down the line.

3. Health Savings Accounts (HSAs)

HSAs are triple-tax-advantaged accounts designed for individuals with high-deductible health plans (HDHPs). Contributions are tax-deductible, the earnings grow tax-free, and withdrawals used for qualified medical expenses are tax-exempt.

- Ideal for: Individuals looking to save for future healthcare costs while reducing their taxable income today.

- Example: Contribute up to $3,850 annually for individuals or $7,750 for families in 2025, allow it to compound, and withdraw funds tax-free for medical costs in retirement.

4. Treasury Bonds and Series I Bonds

Treasury bonds and Series I savings bonds are issued by the federal government and are exempt from state and local income taxes. They’re low-risk investments that provide modest, tax-efficient returns, making them a reliable option for conservative portfolios.

- Ideal for: People in high-tax states looking to diversify their portfolios with low-risk investments.

- Example: Series I bonds offer an inflation-adjusted rate, keeping your money tax-efficient and ahead of rising costs.

5. Education Savings Accounts (529 Plans and Coverdell Accounts)

529 Plans and Coverdell Education Savings Accounts (ESAs) are designed to help families save for education expenses. Investments grow tax-deferred, and withdrawals are tax-free if used for qualified educational purposes, such as tuition or textbooks.

- Ideal for: Parents and guardians planning to cover education expenses for their children while minimizing tax liabilities.

- Example: Contribute to a 529 Plan to save for a child’s college education and avoid taxes on both the earnings and withdrawals.

Benefits of Non-Taxable Investments

Opting for non-taxable investments is not just a tax-saving measure; it can also be a crucial strategy for financial growth and stability. Here are some of the core benefits:

1. Maximize Returns

Without tax deductions eating into your investment gains, every dollar you earn works harder, compounding over time for exponential growth.

2. Tax Diversification

Including non-taxable investments in your portfolio provides flexibility when it comes to managing future tax liabilities. For instance, in retirement, you could withdraw from tax-free accounts like Roth IRAs to reduce your taxable income.

3. Steady Income Streams

Investments like municipal bonds provide reliable, tax-free interest income, making them a stable source of revenue for retirees and conservative investors.

4. Risk Mitigation

Many non-taxable investments, such as Treasury and municipal bonds, are low-risk tools designed to protect your capital from market fluctuations.

How to Incorporate Non-Taxable Investments Into Your Portfolio

If you’re considering non-taxable investments, it’s essential to strategize wisely. Here are a few actionable steps to get started:

1. Assess Your Tax Situation

Review your current tax bracket and projected future taxes. Work with a financial advisor or accountant to identify opportunities to lower your taxable income through non-taxable investments.

2. Balance Taxable and Non-Taxable Investments

Not all investments should go into tax-advantaged accounts. For example, put high-dividend stocks or actively traded funds in tax-advantaged accounts while keeping municipal bonds or Series I Bonds in taxable accounts.

3. Leverage Contribution Limits

Max out contributions to accounts like Roth IRAs, HSAs, and 529 Plans each year to take full advantage of tax-saving opportunities.

4. Diversify Your Portfolio

Combine different types of non-taxable investments to mitigate risk and achieve a balance between growth and security.

5. Stay Updated on Tax Laws

Tax laws are constantly evolving, and staying informed ensures that your strategy remains compliant and optimal.

The Role of Financial Advisors in Non-Taxable Investments

Given the complexity of tax laws and investment options, consulting with a financial advisor can make a significant difference. They can tailor strategies to your unique financial goals, help manage risks, and ensure compliance with regulations.

Final Thoughts

Non-taxable investments are powerful tools for securing your financial future while optimizing your tax efficiency. Whether you’re planning for retirement, saving for education, or seeking a steady income stream, incorporating these investments into your portfolio can maximize both your returns and peace of mind.

Start exploring non-taxable investment opportunities today. Speak to a financial advisor or use online tools to identify the best fit for your financial goals. By making tax-efficient decisions now, you’ll enjoy greater financial flexibility and security in the years to come.