f you’re a tech enthusiast or just starting to learn about financial standards, encountering terms like “FAS 123R” might seem daunting. But don’t worry, let’s break it down step by step and explain how FAS 123R works, its implications, and why it matters.

What is FAS 123R?

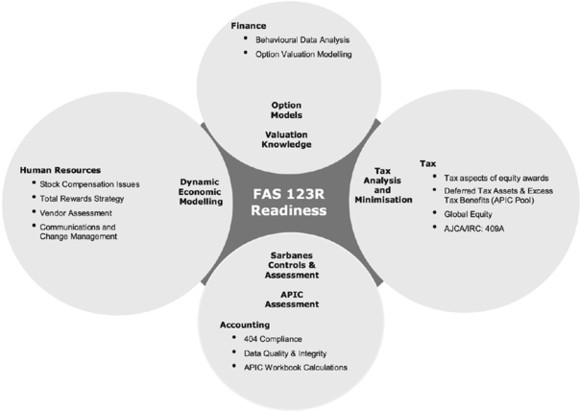

FAS 123R, introduced in 2006 by the Financial Accounting Standards Board (FASB), is a financial standard that requires companies to account for equity-based (share-based) payments granted to employees as an expense in their financial statements. Essentially, it ensures that the cost of employee stock options or other share-based compensations is properly reflected, emphasizing transparency in a company’s financial performance.

Before FAS 123R, equity compensation wasn’t recorded as an expense, which led to skewed financial reports. FAS 123R ensures that shareholders see the genuine financial impact of such compensations.

Key Points:

- Requires companies to expense equity-based compensation.

- Aims to reflect the true costs of share-based payments on financial statements.

- Helps align executive compensation with shareholder interests.

Why FAS 123R Matters for Beginners

If you’re new to the concepts of accounting or technology-driven finance, it might be hard to see why FAS 123R is essential. Here’s why it should matter to you, whether you’re an investor, an employee, or just someone curious about financial processes:

- Transparency

FAS 123R ensures financial transparency by showing the real cost of equity compensation in financial reports. Transparent reporting means investors and stakeholders have a clearer picture of a company’s profitability.

- Equity Dilution Awareness

If you’re an investor, understanding FAS 123R helps you see how share-based incentives impact shareholder value. Dilution happens when new shares are issued for compensation, reducing the ownership percentage of existing shareholders.

- Impacts on Employee Compensation

Many companies now think carefully about how they structure compensation packages. Rather than relying solely on stock options, companies are exploring other forms of rewards that balance employee motivation with financial performance.

How FAS 123R Works

Under FAS 123R, companies need to calculate and report the fair value of share-based payments as expenses. This calculation must incorporate variables such as stock price, market volatility, and the term of stock options.

For instance:

- A company grants 500,000 stock options to an executive, valued at $10 per share.

- Total expense = 500,000 options x $10 = $5 million.

- This $5 million must now be deducted from the company’s profits to comply with FAS 123R.

The calculated expense directly impacts financial statements, reducing reported earnings and, potentially, stock prices.

Advantages of FAS 123R

From a shareholder or tech-savvy reader’s perspective, here are the benefits:

- Enhanced Financial Accuracy

By including the cost of equity-based compensations, companies provide more accurate financial reports.

- Improved Decision-Making

Transparent data helps investors make informed decisions about where to invest their capital.

- Encourages Fair Compensation

Companies now consider more balanced employee compensation plans, ensuring alignment between executive and shareholder interests.

Challenges and Disadvantages

While the benefits are notable, critics of FAS 123R also highlight its drawbacks:

- Complexity

The rules add a layer of complexity to accounting and financial reporting, making it challenging for small businesses or startups to comply.

- Shift in Compensation Plans

Some argue that FAS 123R discourages the use of stock options, potentially limiting tools that align employees with company success.

- Impact on Reported Earnings

Equity compensation expenses can lower a business’s profitability on paper, which may affect stock prices and investor confidence.

How FAS 123R Influences Innovation and Technology

FAS 123R isn’t just limited to accounting; it has implications for technology-driven companies, especially startups and enterprises in innovation-heavy industries. Startups frequently rely on stock options to attract top talent without impacting cash flow. With FAS 123R, these expenses are visible, encouraging startups to explore innovative ways to compensate employees.

For tech enthusiasts, this highlights how financial regulations intersect with the broader innovation landscape. While rules like FAS 123R might seem restrictive, they drive companies to find creative solutions, making financial and operational systems more robust.

FAS 123R for Investors and Entrepreneurs

Are you an investor with a portfolio or an entrepreneur running your first company? Here’s how FAS 123R can affect you:

- For Investors:

Equity-based compensations impact shareholder equity and potential returns. FAS 123R clarifies these impacts, helping you gauge the financial health of tech or finance companies.

- For Entrepreneurs:

Complying with FAS 123R means planning compensation structures carefully. Businesses must balance rewarding employees with maintaining shareholder value.

The Future of FAS 123R

Financial standards like FAS 123R evolve alongside the business landscape. As more companies experiment with blockchain, AI, and other cutting-edge technologies, there’s potential for new forms of equity compensation. FAS 123R might adapt to accommodate these innovations, ensuring fairness and transparency in whatever direction businesses head.

Final Thoughts

FAS 123R ushers in clearer, more accountable financial reporting. For beginners, tech enthusiasts, investors, and entrepreneurs, understanding its applications and implications is vital to navigating today’s business and investment landscape.

Whether you’re looking to decode a balance sheet or build a startup from scratch, getting familiar with financial standards like FAS 123R equips you with tools for smarter decision-making.

For more beginner-friendly guides on technology and innovation, stay tuned to our blog!