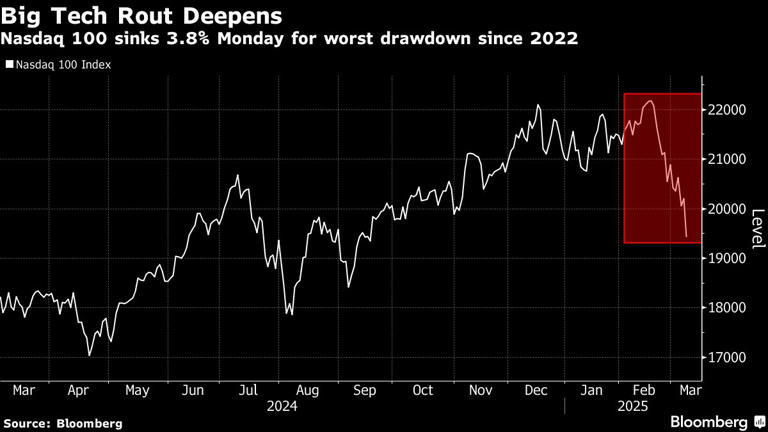

The stock market experienced a seismic shift today, leaving investors and analysts in tense deliberations. The Dow Jones Industrial Average plummeted by an alarming 900 points, while the tech-heavy Nasdaq suffered a significant 4% drop, marking its worst performance since 2022. This downturn reflects mounting fears and increased volatility as the market faces a challenging landscape.

Key Highlights of the Day:

- Dow’s Steep Decline

The Dow Jones Industrial Average tumbled 900 points, resulting in an approximate 2.7% drop. This drastic movement has raised concerns about the broader implications for the market, particularly for blue-chip stocks.

- Nasdaq’s Tech Plunge

The Nasdaq Composite plunged 4%, showcasing a sharp decline in technology sector stocks. This drop has heightened investor apprehension, particularly as some of the largest tech names failed to show resilience in today’s market downturn.

- Market Sentiment on Edge

These losses contribute to March’s ongoing struggles in the stock market. Persistent selling pressure has led to broad-based losses in most sectors, leaving investors uneasy about future market trends.

Factors Behind Today’s Selloff:

Investors are grappling with a series of economic and global developments that appear to be driving today’s losses:

- Anticipated Federal Reserve Actions

Continued speculation about the Federal Reserve’s next moves regarding interest rates has fueled uncertainty in the markets. Concerns over prolonged tightening or potential surprises have left traders on edge.

- Earnings Season and Economic Indicators

With mixed corporate earnings and underwhelming economic data emerging in recent weeks, investor sentiment has turned increasingly cautious. This nervousness has been reflected in the rapid selloff witnessed today.

- Geopolitical Uncertainty

Lingering global tensions and market unease over geopolitical risks are further contributing to the sharp declines across major U.S. indexes.

Broader Market Implications:

Today’s staggering losses highlight the fragile sentiment currently dominating Wall Street. The selloff from technology stocks, which have historically been strong growth drivers, has intensified concerns over the sustainability of market valuations. Additionally, this bearish trend could lead to a broader recalibration of investor strategies in the days to come.

Market watchers are closely observing how these developments might influence short-term trends and potentially reshape the investment landscape. Investors will undoubtedly be cautious as they await further clarity on economic conditions and key policy decisions.

What Should Investors Do Now?

For investors, days like today call for deliberate action and a calm approach. Here are a few strategies to consider:

- Revisit Your Portfolio

Take the opportunity to ensure your portfolio aligns with your long-term financial goals. Diversification and balance are critical during periods of volatility.

- Focus on Fundamentals

Stay grounded by evaluating the fundamentals of the companies you are investing in. Quality stocks with strong revenue and earnings potential are often better equipped to weather market turbulence.

- Stay Updated

Follow credible sources for updates on market conditions, Federal Reserve decisions, and global developments. Being informed allows you to make calculated and strategic decisions.

Looking Ahead:

While days like today can be unnerving, it’s important to remember that markets go through cyclical periods of growth and decline. The sharp losses seen today may very well set the stage for a correction or rebound depending on how economic indicators, corporate performance, and monetary policy evolve in the coming weeks.

Investors, analysts, and market watchers will be keeping a close eye on future movements in the Dow Jones, Nasdaq, and broader markets to gain deeper insight into whether this dramatic plunge signifies a continued trend or an isolated event.

Stay tuned as we follow the story closely and provide updates on market dynamics and actionable insights for navigating this challenging environment.