The concept of “burning coins” has become an increasingly popular strategy in the cryptocurrency world. For investors, altcoin traders, and blockchain enthusiasts, keeping an eye on a coin burn list can be crucial for understanding market dynamics and making informed decisions. But what exactly is a coin burn, and why should it matter to you? Let’s explore.

What is a Coin Burn?

A coin burn is the process of permanently removing a certain number of tokens or coins from circulation. This is typically achieved by sending the coins to an inaccessible wallet address, often referred to as a “burn address.” The goal of coin burns is to reduce a token’s supply, which can potentially increase its value over time by creating scarcity.

Many blockchain projects conduct regular burns to demonstrate their commitment to supply control, align with tokenomics strategies, or incentivize long-term holding.

How Does a Coin Burn Work?

The coin burn process generally follows these steps:

- A portion of tokens is removed from the circulating supply.

- The tokens are sent to a “burn address,” which is completely inaccessible and verifiable through the blockchain.

- The project announces the burn (or regularly updates through scheduled burns).

Coin burns are transparent, and anyone can verify the transaction on the blockchain. This transparency helps build trust within a project’s community and among investors.

The Benefits of Coin Burns

Coin burns can provide several benefits to both the cryptocurrency project and its investors:

- Deflationary Pressure: By reducing supply, coin burns can theoretically boost a token’s value over time, assuming demand remains consistent or rises.

- Reward for Holders: The reduced supply can make existing tokens more valuable, indirectly rewarding long-term holders.

- Community Trust: Regularly burning coins can signal a commitment to the project’s longevity and sustainability, fostering trust with investors.

- Ecosystem Health: Some projects burn tokens to manage inflation, stabilize the economy of their platform, or redistribute value for other ecosystem participants.

Coin Burn List and Why It’s Important

A coin burn list is essentially a schedule or record of past and upcoming token burns for specific cryptocurrency projects. These lists provide valuable information, such as:

- The number of tokens to be burned.

- The frequency of token burns (e.g., quarterly, ad hoc, or event-driven).

- The total supply pre- and post-burn.

Keeping track of these updates can help you identify potential investment opportunities or assess market trends.

Current Highlights from the Coin Burn Landscape

Here are some notable examples of recent coin burns from well-known projects:

- Floki (FLOKI) – The team’s burn removed 2% of the token’s circulating supply, driving prices up by 100%.

- Flare Network (FLR) – A scheduled burn will eliminate over 2.1 billion FLR coins by 2026 to improve ecosystem health.

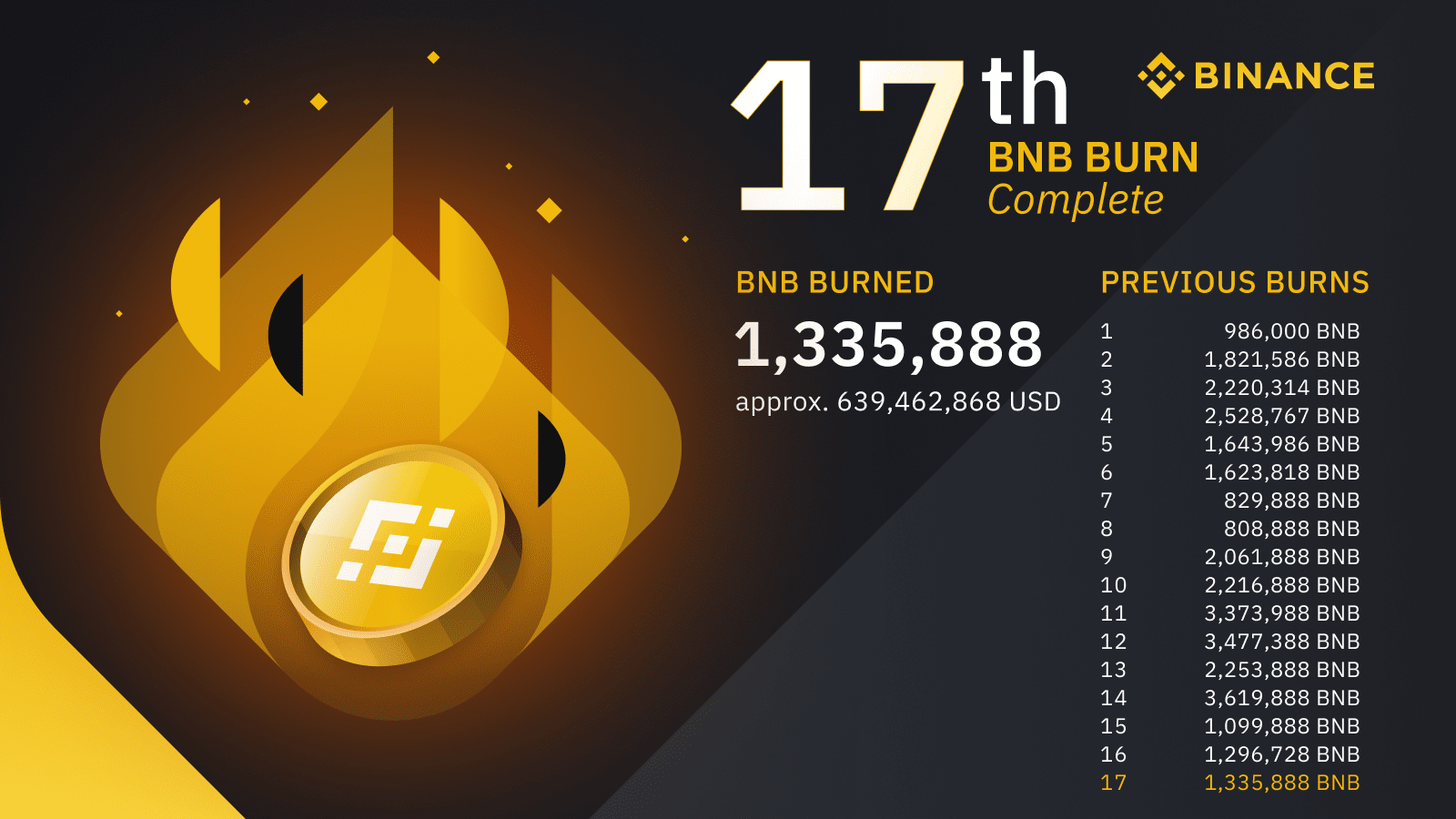

- BNB Coin – The BNB Chain burns tokens under its BEP95 mechanism, with over $575M worth of BNB burned in a single event.

- KIN Token – This project burned approximately 70% of its total token supply, significantly impacting its circulating count.

- OKB – OKX performed a record-breaking $258M token buyback and burn to manage supply and enhance value for token holders.

How to Monitor a Coin Burn List

If you’re an investor or trader looking to stay on top of upcoming burns, here’s what you can do:

- Follow Project Announcements: Most projects publish their token burn plans on social media, official websites, or forums.

- Use Blockchain News Outlets: Platforms like CoinDesk often cover significant token burns and their effects on the market.

- Leverage Third-Party Tracking Tools: Some platforms actively track coin burns across multiple projects, providing regular updates on future events.

- Monitor the Blockchain: Because burns are permanent and verifiable, tools like Etherscan or BscScan can help you track specific burn transactions.

Are Coin Burns Right for You as an Investor?

While coin burns often have a positive impact on value, they’re not always a guarantee of long-term success. Consider the following when evaluating whether to invest in a token based on coin burns:

- Project Fundamentals – Look beyond coin burns to assess a project’s roadmap, utility, and team legitimacy.

- Market Sentiment – Sudden price surges from burns can be short-lived if not backed by solid fundamentals.

- Tokenomics – Ensure the burn strategy aligns with the token’s long-term utility and supply mechanisms.

For crypto traders and blockchain enthusiasts, coin burn lists provide essential insights into market positioning, scarcity mechanics, and price potential.

Final Thoughts

Coin burns are a powerful tool that many crypto projects use to manage supply and drive engagement within their ecosystems. The next time you stumble upon a coin burn list, don’t just skim the numbers. Dig deeper into the strategy behind the burn and the potential it holds for the project’s future.

For investors and traders, staying informed about coin burn schedules and their broader implications could help in making smarter investment decisions. Whether you’re analyzing a top-tier cryptocurrency or a budding altcoin, understanding the mechanics and motivations behind a coin burn is key.

By keeping an eye on trusted burn lists and leveraging news hubs like CoinDesk for updates, you’ll be better equipped to make informed decisions while navigating the exciting world of blockchain and cryptocurrencies.