Taxation is an integral part of any economic system. It funds public services, shapes market behavior, and impacts consumer and producer decisions. Yet, not all taxes affect stakeholders equally. This is where the concept of “tax incidence” comes into play. Whether you’re an economics student, policy analyst, or business owner, understanding tax incidence is crucial for evaluating how taxes influence various groups and markets.

But what does “tax incidence” actually indicate? This article will explore that question, breaking down the concept, its practical implications, and its relevance to different sectors of the economy.

What Is Tax Incidence, and What Does It Indicate?

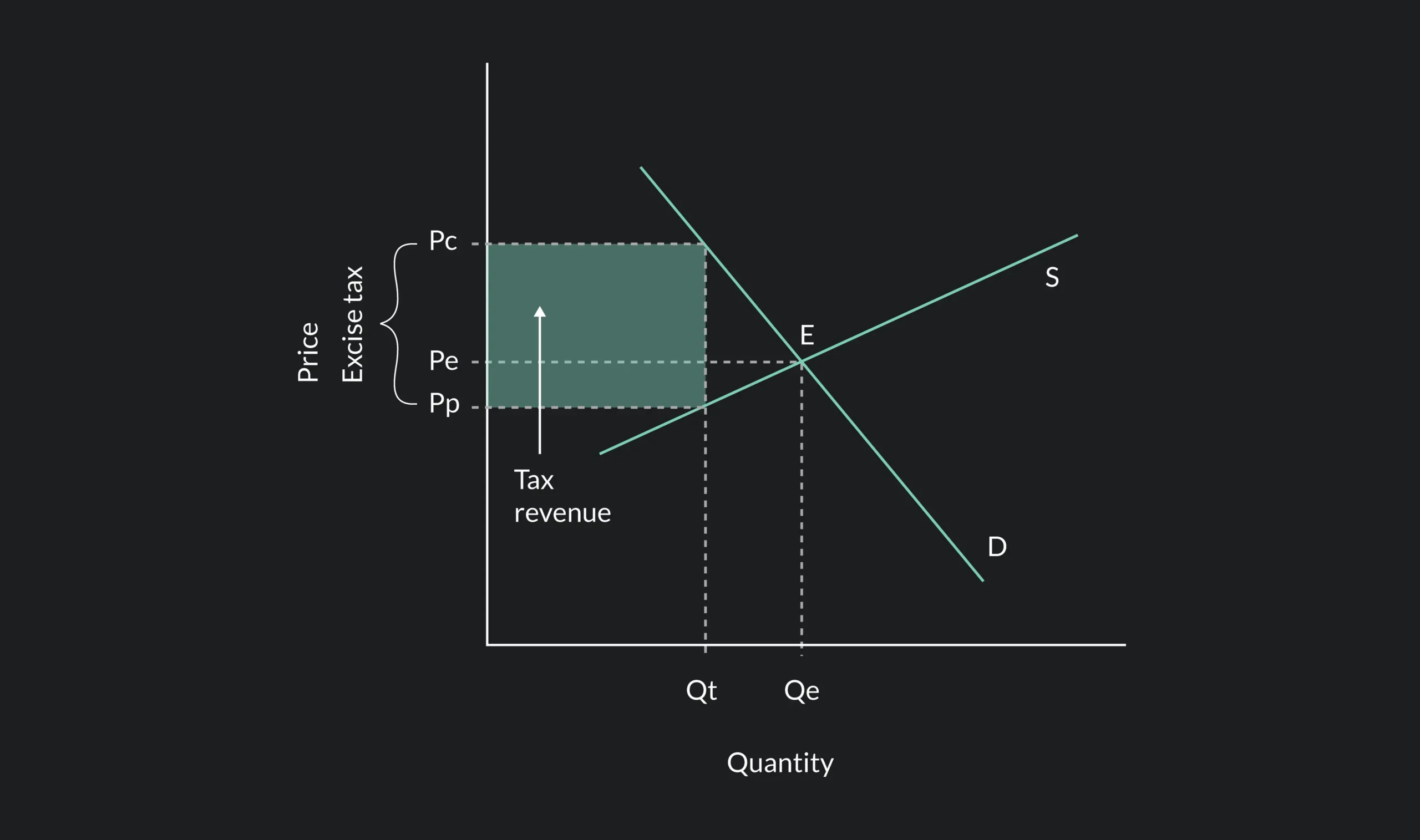

“Tax incidence” refers to the study of how the burden of a tax is divided between different stakeholders, typically consumers and producers. The question at the heart of tax incidence is not who submits the tax payment, but rather who bears the true economic burden of the tax.

For instance, when a sales tax is introduced, it might seem like the consumer bears the entire burden because they are paying the tax at the checkout. However, tax incidence analysis reveals the actual burden depends on factors like price elasticity of demand and supply, which we’ll explore below.

What Tax Incidence Indicates:

- Economic Burden Distribution: It shows how much of the tax each party (producers and consumers) shoulders, shedding light on the real impact beyond who directly pays the government.

- Market Dynamics: It indicates how supply and demand react to taxation, altering prices and market equilibrium.

- Fairness of Tax Systems: Tax incidence can also reveal inequalities in taxation. For instance, is the tax regressive or progressive?

Factors That Influence Tax Incidence

Key elements determine who bears the tax burden:

- Price Elasticity of Demand

Price elasticity measures how much consumer demand responds to price changes. If demand is inelastic, meaning consumers will pay for the product regardless of price changes (e.g., gasoline or prescription medication), most of the tax burden falls on them. Conversely, if demand is elastic and consumers easily switch to alternatives (e.g., luxury goods), producers often absorb much of the tax to keep prices competitive.

- Price Elasticity of Supply

Similarly, elasticity of supply measures how much producers can adjust their production levels in response to price changes. If supply is inelastic, producers can’t easily reduce goods supplied, and they are more likely to bear the tax burden. If supply is elastic, producers can reduce production to avoid losses, often shifting the tax burden to consumers.

- Nature of Goods – Elastic vs. Inelastic

-

-

- Elastic goods: Products like fine jewelry or luxury cars have substitutes and are nonessential. The demand for these goods drops quickly if prices rise, meaning suppliers often bear the tax burden to prevent losing customers.

- Inelastic goods: Essential items like food or medicine tend to have constant demand even with price hikes. Thus, consumers carry most of the tax burden.

-

Applications of Tax Incidence in Policy and Business

Tax incidence is not just an academic concept; it has far-reaching implications in policy-making and business strategies.

For Policymakers

Tax incidence analysis enables governments to design equitable tax systems and assess their consequences. For instance:

- When taxing inelastic goods (e.g., cigarettes), governments know the tax will likely fall on consumers, which can deter consumption but also disproportionately impact low-income groups.

- Taxing luxury goods (e.g., yachts) typically shifts the burden to producers. Policymakers weigh this tradeoff against potential economic advantages like job creation.

By understanding tax incidence, policymakers can ensure tax policies are both effective and equitable.

For Business Owners

Businesses subject to taxation on their products need to anticipate how their customers will react. For example:

- Pricing Decisions: Companies selling inelastic goods know they can pass the tax burden onto consumers without drastically reducing sales.

- Market Competitiveness: Businesses offering highly elastic goods may choose to keep prices stable and absorb part of the tax burden to maintain their market position.

By factoring in tax incidence when planning pricing or production strategies, businesses can remain competitive and profitable.

For Economics Students

Tax incidence forms the foundation of public finance and market analysis. Understanding tax incidence provides insight into how markets function and the broader implications of taxation on economic welfare.

Real-World Examples of Tax Incidence

- Cigarette Taxes (Inelastic Demand): When the government imposes higher taxes on cigarettes, producers transfer most of the tax to consumers through higher prices. Despite the price hike, demand remains relatively constant because cigarettes are addictive and considered inelastic.

- Taxes on Luxury Cars (Elastic Demand): If a government imposes new taxes on luxury vehicles, producers absorb much of the tax. High prices could discourage demand, and buyers may opt for substitutes, hurting sales.

- Connecticut’s Tax Incidence Report (Fairness in Tax Systems): A 2022 report revealed that Connecticut’s local taxes disproportionately affected working- and middle-class families compared to the wealthy, highlighting systemic inequities from a tax incidence perspective.

Analyzing Tax Incidence and Policy Design

When governments and businesses consider taxes, they must examine tax incidence to:

- Predict how taxes affect consumer behavior.

- Mitigate unintended consequences for disadvantaged groups.

- Avoid disruptions in markets where demand is inelastic yet essential (e.g., healthcare or fuel).

By leveraging findings from tax incidence studies, economists and policymakers can craft more effective taxation strategies that balance government revenue needs with fairness and economic stability.

Formula for Tax Incidence

Economists use the following formulas to calculate tax burden:

- Consumer’s Tax Burden:

\( \frac{E(supply)}{E(demand) + E(supply)} \)

- Producer’s Tax Burden:

\( \frac{E(demand)}{E(demand) + E(supply)} \)

Where \( E \) stands for elasticity. These equations help quantify how much of the tax burden falls on consumers vs. producers.

Conclusion

Tax incidence indicates much more than just the financial burden of a tax. It reveals the intricate dynamics between buyers and sellers, the role of market elasticity, and the fairness of taxation policies. For economics students, it offers a critical framework for understanding public finance. For policymakers, it provides an essential tool for crafting targeted taxes. And for business owners, it gives a competitive edge for pricing and strategy.

By mastering the concept of tax incidence, we can better understand who truly pays the price when taxes are levied and ensure taxation policies are fair, efficient, and economically sound.