The financial and cryptocurrency worlds are filled with terms and concepts that traders need to understand to make informed decisions. One such concept is the “CME gap.” If you’ve heard this term but aren’t quite sure what it means or why it matters, stick with us as we break it down and explain its significance in markets, particularly in cryptocurrency trading.

Understanding CME and Its Futures Market

CME stands for the Chicago Mercantile Exchange, one of the largest derivatives exchanges in the world. The CME allows traders to buy and sell futures contracts, which are financial agreements that obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined date and price in the future.

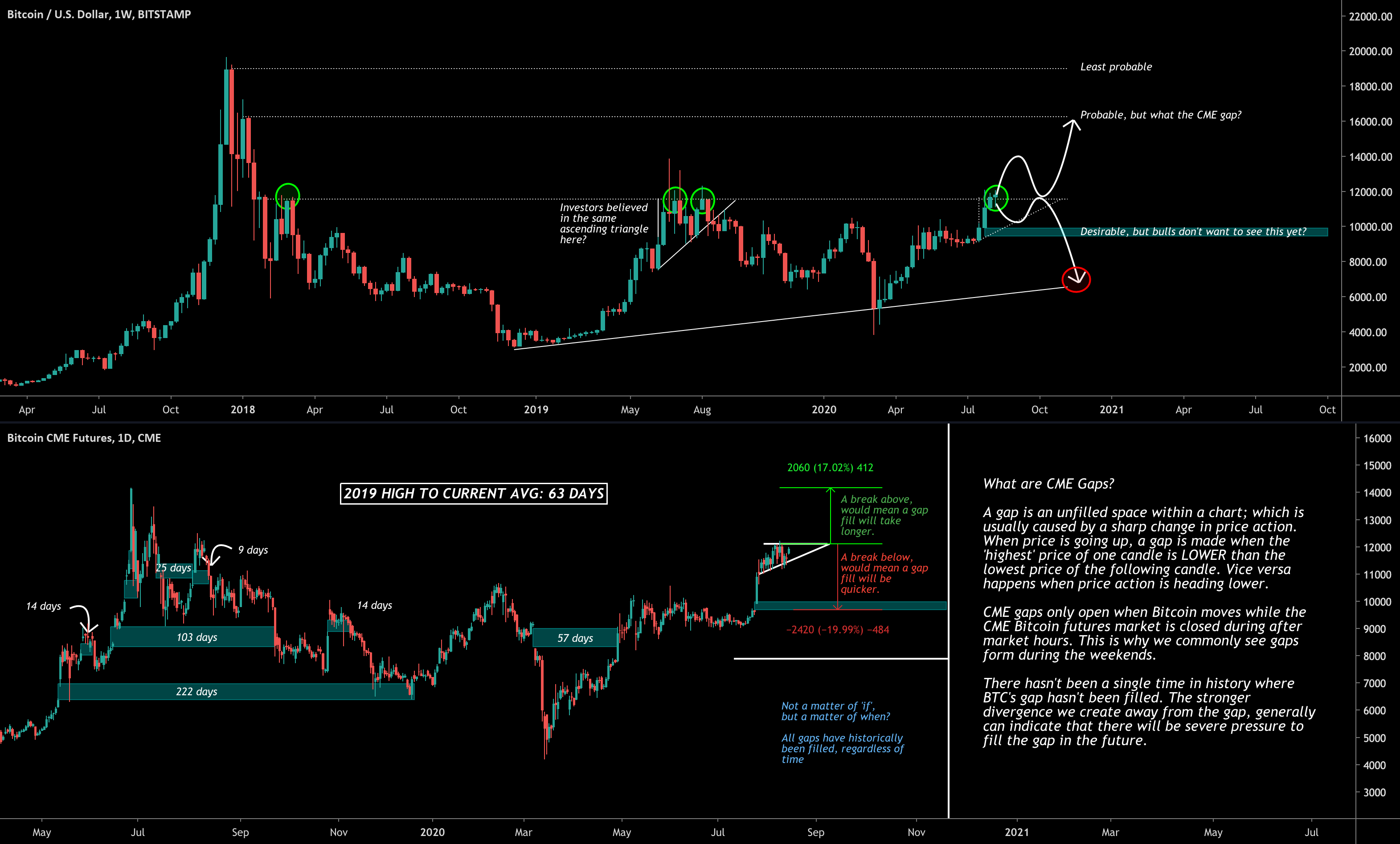

While cryptocurrency markets operate 24/7 globally, the CME futures market closes over the weekend. This difference in operating hours leads to periodic price discrepancies when the CME Bitcoin futures market reopens on Sunday evening. These price discrepancies are what we call CME gaps.

What is a CME Gap?

A CME gap is a difference between the closing price of a futures contract on the CME at the end of its trading session (typically Friday) and the opening price of that contract when the market resumes trading on Sunday evening. If the spot price of the underlying asset (such as Bitcoin) moves significantly over the weekend while the CME futures market is closed, a gap is left in the price chart when the market reopens.

For example:

- If the CME closes on Friday with Bitcoin futures priced at $84,000 and reopens on Sunday at $95,000 due to weekend market activity, a CME gap exists between $84,000 and $95,000.

These gaps are not unique to cryptocurrency futures and can happen in other markets as well.

Why Do CME Gaps Matter?

CME gaps have gained attention in trading and investing communities because they often act as price magnets. Historically, the price of the underlying asset, such as Bitcoin, tends to revisit the price range of the gap to “fill” it. This phenomenon has become a critical signal for many traders when determining potential market movements.

Here’s why CME gaps are significant:

- Price Behavior Prediction:

Traders often rely on CME gaps as indicators of where the price might move next. If a gap exists, they may anticipate that the price will retrace to that level before continuing its trend.

- Volatility Markers:

Large CME gaps can signal increased volatility. For example, during periods of extreme market sentiment, such as sudden bullishness or bearishness, gaps tend to form more frequently.

- Market Equilibrium:

Filling a gap reflects the market’s tendency to seek balance. It shows the process of the market “retesting” a previous price level to confirm whether it holds as support or resistance.

Examples of CME Gaps in Action

CME gaps have become especially relevant in the cryptocurrency space. For instance, Bitcoin has historically shown a strong tendency to fill gaps in its CME futures chart. A notable recent example occurred when a significant price gap formed between $84,500 and $95,300 on a weekend rally fueled by institutional interest and policy announcements. Within days, Bitcoin’s price retraced to $83,500, filling the gap and signaling a possible market correction.

Similarly, gaps below key levels, such as $80,000, have often drawn attention as traders anticipate prices to fill these gaps before moving higher.

Strategies for Traders

For traders and investors, CME gaps present opportunities when crafting strategies. Here’s how you can use CME gaps in your trading:

- Monitor Weekend Moves:

Keep an eye on price movements during the weekend when the CME market is closed. Significant swings in spot market prices may indicate the formation of a CME gap.

- Look for Confluence:

Don’t rely solely on CME gaps. Use them alongside other indicators like support, resistance levels, and technical patterns to develop your strategy.

- Beware of Assumptions:

While many CME gaps eventually fill, not all of them do. Take historical trends into account but remain cautious when making trading decisions.

- Understand Risk:

Leveraged trading strategies based on CME gaps can be risky. Markets can overshoot your expectations and leave positions vulnerable to liquidation.

The Limitations of CME Gaps

Despite their usefulness, CME gaps are not foolproof indicators. Here are some caveats to keep in mind:

- Not all gaps fill immediately; some may take weeks or months to close.

- External circumstances, such as macroeconomic events or regulatory changes, can override technical signals like CME gaps.

- They are more relevant to short-term traders and may not have long-term implications for investors.

CME Gaps and Cryptocurrency Markets

Cryptocurrency markets are particularly susceptible to CME gaps due to their highly volatile nature and 24/7 trading. Events such as regulatory announcements, macroeconomic shifts, or sudden changes in market sentiment often occur when futures markets like CME are closed, creating opportunities for large gaps.

For instance, in early March 2025, a sharp rally in Bitcoin prices driven by institutional announcements left behind a record CME gap. Following this rally, the gap was filled as the market retraced during the following trading sessions. Such examples highlight the importance of understanding these gaps for crypto traders.

Final Thoughts

CME gaps are powerful tools for traders, offering insights into potential price movements and market behavior. For day traders, swing traders, and even long-term investors, understanding what a CME gap is and how it impacts the market can provide an edge in navigating volatility, particularly in emerging markets like cryptocurrencies.

However, like any trading strategy, CME gap analysis should not be used in isolation. Combining it with other technical and fundamental tools will ensure a more comprehensive market approach.

Interested in trading smarter using insights like this? Take the next step in refining your strategy and stay ahead of market trends. Understanding concepts like CME gaps may be just the beginning of uncovering opportunities in dynamic markets.