Planning for retirement is one of the most important financial decisions you’ll make in your lifetime. If you were born in 1959, understanding your full retirement age (FRA) and how it impacts your Social Security benefits is crucial. This article will walk you through everything you need to know about when you can retire and how to maximize your Social Security benefits.

What Is Full Retirement Age (FRA)?

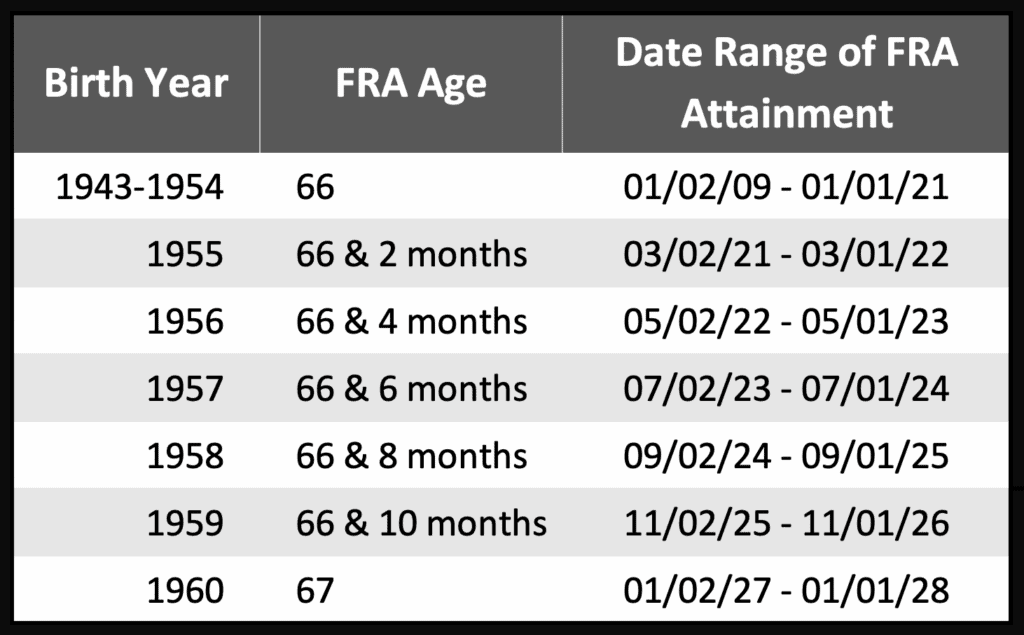

Your full retirement age (FRA) is the age at which you are eligible to receive 100% of your Social Security benefits. For those born in 1959, your FRA is 66 years and 10 months. This is based on the Social Security Administration’s (SSA) schedule, which gradually increases the FRA for individuals born between 1943 and 1960.

Here’s a quick breakdown for context:

- Born in 1943–1954? FRA is 66.

- Born in 1955? FRA is 66 and 2 months.

- Born in 1959? FRA is 66 and 10 months.

- Born in 1960 or later? FRA is 67.

Although 66 and 10 months is your FRA, you have several options when deciding when to start receiving Social Security benefits.

When Can You Start Receiving Social Security?

You can begin collecting Social Security benefits as early as age 62, but doing so will result in a permanent reduction in your monthly benefit amount. Alternatively, you can delay benefits past your FRA, increasing your monthly benefit up until age 70. Here’s how it works:

- Early Retirement (Before FRA):

If you start benefits at age 62, your monthly payment will be approximately 29.17% less than if you waited until your FRA of 66 years and 10 months. For those born in 1959, this is a significant reduction but could be beneficial if you need funds earlier.

- Full Retirement Age (66 years and 10 months):

At your FRA, you will receive your full monthly benefit amount, based on your earnings history and the contributions you’ve made to Social Security during your career.

- Delayed Retirement (Up to Age 70):

By delaying Social Security benefits beyond your FRA, your monthly payment increases by 8% per year. For someone born in 1959, waiting until age 70 could offer nearly a 25% boost in benefits compared to starting at FRA.

Factors to Consider When Choosing a Retirement Age

1. Your Financial Needs

If you’ve saved enough for retirement and can afford to wait, delaying Social Security benefits increases the amount you’ll receive monthly. However, if you need income sooner, starting benefits at age 62 might be the right decision for you.

2. Life Expectancy

Your health and family history play a significant role. If you expect to live into your 80s or beyond, delaying benefits could maximize your lifetime Social Security income. However, if you anticipate a shorter retirement, claiming benefits earlier might make more sense.

3. Work and Earnings

If you plan to keep working while collecting benefits before your FRA, be aware that your Social Security payments may be temporarily reduced. For 2024, if you’re under FRA and earn more than $22,320 per year, the SSA will deduct $1 from your benefits for every $2 you earn above this limit. Once you reach FRA, you can earn any amount without affecting your benefits.

4. Spousal and Survivor Benefits

If you’re married, your decision may also impact your spouse’s benefits. Spousal benefits can be up to 50% of your benefit amount, and delaying your claim could increase these benefits for your spouse.

Strategies to Maximize Your Social Security Benefits

- Wait Until FRA or Later

If possible, aim to claim benefits at your FRA or later to avoid reductions and maximize monthly payments.

- Coordinate with Your Spouse

If both you and your spouse are eligible for Social Security, strategize the timing of your claims to optimize household benefits.

- Plan for Additional Income

Social Security was never designed to cover all your retirement expenses. Diversify your income sources with savings, pensions, 401(k)s, and other investments.

- Leverage Tools and Resources

The SSA offers calculators on its website to help estimate your benefits. Additionally, consulting a retirement planner can help tailor a strategy to your specific needs.

How to Start Benefits If You’re Born in 1959

If you’re approaching retirement age, here are the steps to begin receiving your benefits:

- Create a mySocialSecurity Account

Sign up at the official Social Security Administration website to access your earnings record, estimate benefits, and manage your account.

- Apply for Benefits

You can apply online, by phone, or by visiting your local SSA office. It’s recommended to apply at least 3 months before you want your benefits to begin.

- Provide Necessary Documents

Be prepared to provide your Social Security number, birth certificate, banking information for direct deposit, and tax records if needed.

- Stay Updated

After filing, monitor the status of your application and contact the SSA if you have any questions or concerns.

Start Planning Today

If you were born in 1959, you have plenty of options for retirement. Whether you claim benefits early at age 62, wait until your full retirement age of 66 years and 10 months, or delay until age 70 for the maximum benefits, the decision should align with your unique financial goals and lifestyle.

Have questions about your Social Security benefits or want to ensure your retirement plan is on track? Consider reaching out to a retirement specialist to discuss your options and take the next step toward a secure and stress-free retirement.

Keyword Optimization Recap:

- Main keyword used naturally throughout article: born in 1959 what age can I retire

- Additional keywords incorporated effectively: full retirement age, Social Security benefits, retirement planning