Layoff announcements are making headlines yet again, hitting their highest monthly levels since 2020. February saw a staggering 172,017 job cuts across the United States, marking a 245% increase from January, according to a report from Challenger, Gray & Christmas. This surge is attributed to a combination of economic uncertainty, reductions in government staff, and sector-specific challenges. Notably, more than one-third of the layoffs stemmed from efforts by the Department of Government Efficiency (DOGE) to trim federal staff under the directive of billionaire entrepreneur Elon Musk.

This article will break down the implications of these layoffs for investors, job seekers, and financial analysts while examining the broader economic landscape.

The Numbers Behind the Surge

February’s layoff count of 172,017 stands as the highest since July 2020 during the height of the COVID-19 pandemic. For historical context, this is also the largest February layoff figure since the 2009 global financial crisis. What stands out in the data is the impact of government cuts led by DOGE. Approximately 62,242 federal job losses spanned 17 agencies, signaling a significant shift in government employment priorities.

Andrew Challenger, workplace expert at Challenger, Gray & Christmas, noted, “With the impact of DOGE’s actions, as well as canceled government contracts, trade war fears, and financial strain, job cuts soared in February.”

Economic Pressures Add Fuel to the Fire

While DOGE’s federal staff downsizing made headlines, other sectors also contributed to rising layoffs:

- Retail Cuts: The retail sector announced 38,956 job cuts, with companies like Macy’s and Forever 21 drastically reducing staff. Compared to 2024, retail sector layoffs have increased sixfold in 2025.

- Technology Sector: Another 14,554 tech jobs were slashed in February, although this number is lower than the same period last year.

These workforce reductions are tied to broader economic pressures such as inflation concerns, volatile consumer spending, and trade war tension. At the same time, private sector hiring showed sluggish growth in February, with only 77,000 new jobs added, according to ADP payroll data.

DOGE’s Federal Layoffs Reshape Employment Landscape

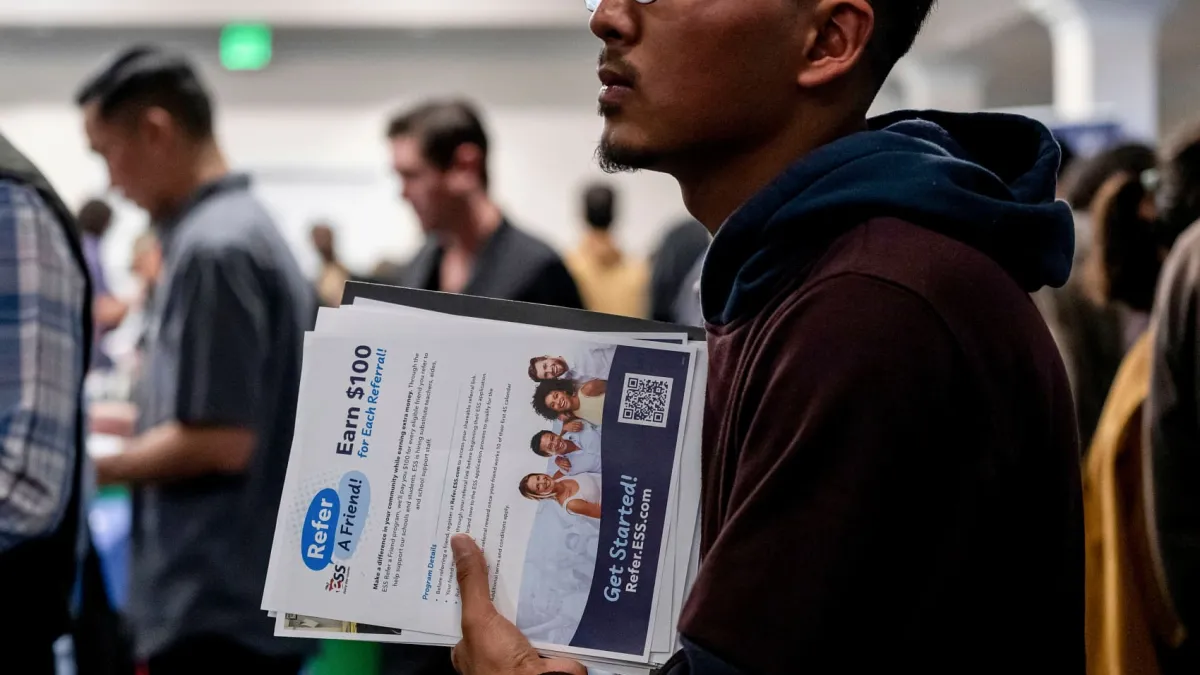

Much of the February layoffs mirror DOGE’s initiative to significantly reduce the size of the federal workforce. With presidential support, Elon Musk’s directive to pare down government headcount is evident. This restructuring initiative saw staff reductions across multiple agencies, including the U.S. Agency for International Development (USAID). Images of departing employees carrying boxes rightly captured national attention, symbolizing the weight of the cuts on individuals and communities alike.

For investors and market watchers, these layoffs echo the administration’s broader economic strategies, including trade tariffs and reduced government expenditure. While these policies aim for long-term fiscal health, their immediate impacts on unemployment figures and public sentiment cannot be ignored.

Implications for Investors and Analysts

The surge in layoffs comes as a stark signal for investors and financial analysts. From government reductions to retail and technology sector struggles, these numbers serve as a potential warning sign of economic uncertainty. Trends to carefully monitor include:

- Consumer Spending Patterns: Retail job cuts often reflect weakening purchasing power, a metric that influences market activity.

- Sector-wise Impact: While some sectors (e.g., technology) experienced fewer layoffs than last year, retail and government cuts highlight potential risks in specific areas.

- Hiring on the Rise: On a brighter note, firms announced plans to hire 34,580 workers in February, marking a 159% year-over-year increase in hiring promises.

These contrasting signals make it clear that while current economic conditions pose challenges, some sectors continue to work toward recovery.

Impact on Job Seekers

For job seekers, particularly those impacted by federal or retail layoffs, transitioning may appear daunting. However, various sectors continue to offer opportunities, particularly in niche industries such as renewable energy, healthcare, and AI technology. The noticeable increase in hiring announcements could offer a glimmer of hope for those navigating job loss. Additionally, skills training and upskilling initiatives are becoming more prominent, which can help workers adapt to the changing job market.

Broader Trends to Watch in the 2025 Labor Market

The February spike in layoffs offers a lens into larger economic themes:

- Government Downsizing: DOGE’s actions are likely to serve as a blueprint for continued government size reductions in the near future. Stakeholders should continue to account for the ripple effects of such measures on local economies and public confidence.

- Retail’s Volatility: With e-commerce dominating consumer habits, traditional brick-and-mortar retailers must reimagine their long-term strategies to minimize job losses.

- Technology and Automation: Despite the growing adoption of AI and autonomous technologies across industries, job loss in tech indicates looming uncertainties in this “future-forward” space.

- Hiring Surges: The 34,580 planned hires for February represent a noteworthy recovery dynamic. While still below pre-pandemic hiring peaks, it is a step in the right direction, underscoring bright spots in sectors like renewable energy, logistics, and healthcare.

What Lies Ahead?

Layoff announcements soaring to the highest since 2020 present a difficult reality of today’s labor market. However, it’s not all gloom and doom. While sectors like retail and federal employment are contracting sharply, others are growing and adding jobs. Investors, job seekers, and financial analysts must carefully monitor these trends to make informed decisions.

Ultimately, the story of layoffs in 2025 is a nuanced one, heavily influenced by government restructuring, economic pressures, and sector-specific dynamics. The months ahead will determine whether these numbers represent a temporary correction or a prolonged challenge.