For employees, independent contractors, and business owners alike, understanding the difference between a W9 and W2 form is crucial. These forms serve different purposes when it comes to tax reporting, affecting how taxes are withheld, filed, and managed. If you’re unsure which one applies to your situation, this guide will break down the key differences to help you stay compliant and avoid costly mistakes.

What Is a W9 Form?

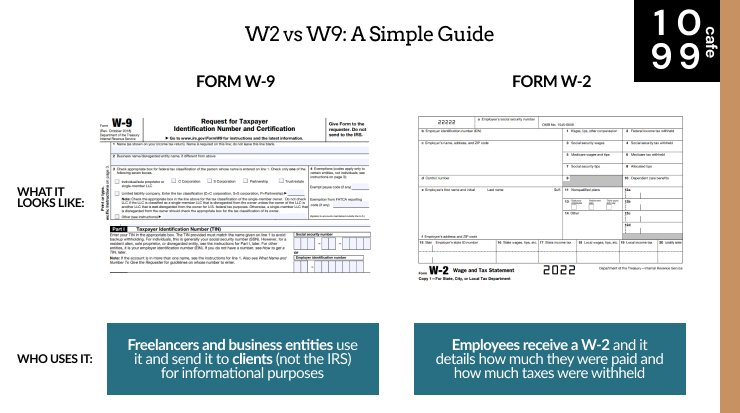

A W9, or IRS Form W-9, stands for Request for Taxpayer Identification Number and Certification. Businesses use this form to collect important taxpayer information from anyone they hire for freelance or contract work. It’s typically required when a company pays non-employees (like independent contractors or freelancers) $600 or more annually.

Key Facts About W9 Forms:

- Used By Independent Contractors: If you’re not part of the company’s payroll as a full-time or part-time employee, you’ll likely be asked to fill out a W9.

- Tax Responsibility: Unlike employees, those who receive a W9 are responsible for handling their own tax obligations, including Social Security, Medicare, and income tax.

- Information Required: Name, address, taxpayer identification number (TIN), and federal tax classification are some of the details required. For sole proprietors, your Social Security number or Employer Identification Number (EIN) may be needed.

- Purpose: The information provided on a W9 is used to issue Form 1099-NEC, which summarizes non-employee earnings for tax purposes.

Who Needs to Fill Out a W9 Form?

W9 forms aren’t limited to independent contractors. You might also be asked to provide a W9 if you:

- Are a freelancer or self-employed worker.

- Receive earnings from interest, dividends, or real estate transactions.

- Win prizes or awards requiring IRS tracking.

- Have canceled debts with financial institutions.

Notably, W9 forms are not submitted to the IRS directly. Instead, businesses use the information to create required tax documents, such as 1099 forms.

What Is a W2 Form?

A W2, or Forms W-2, summarizes earnings for employees. It’s critical for calculating how much tax was withheld from an individual’s paycheck throughout the year. Employers generate W2s and provide them to both employees and the IRS.

Key Facts About W2 Forms:

- Used By Employees: If you’re on the company’s payroll, you’ll receive a W2. This covers part-time, full-time, and sometimes temporary workers.

- Employer’s Responsibility: Unlike independent contractors, employees benefit from tax withholding. The employer deducts income taxes, Social Security, Medicare, and other contributions from wages.

- What It Includes: W2s summarize total earnings, tax withholdings, retirement plan contributions, and any additional income like bonuses.

- Reporting to IRS: Employers send W2 forms to the IRS, while employees use this document to file their annual tax returns.

Why Do W2s Matter?

Primarily, W2s ensure employees’ taxes are accurately reported and paid throughout the year. Based on W2 information:

- The IRS verifies whether tax filings match reported earnings.

- Employees can claim deductions or refunds as applicable.

W9 vs. W2: Key Differences

The distinction between W9 and W2 boils down to employment status and tax handling. Here’s a breakdown of the key differences:

| Features | W9 | W2 |

|---|---|---|

| Who Uses It? | Independent contractors, freelancers, etc. | Full-time and part-time employees |

| Tax Withholding |

| Taxes are not withheld | Taxes are withheld by the employer |

| Purpose | Collect taxpayer information for 1099s | Summarize earnings and taxes paid |

| Tax Responsibility | Self-managed | Employer handles withholding |

| Issued By | Businesses requesting non-employee services | Employers |

| IRS Filing | W9 info creates 1099 (filed by the business) | Sent by employers, used for annual tax filings |

Why It’s Important to Know the Difference

Using the correct form isn’t just a bureaucratic technicality; it directly impacts how income and taxes are reported and managed. Misclassifying workers or using the wrong form could lead to:

- Tax Penalties: The IRS imposes hefty fines for failing to report income correctly.

- Improper Employee Classification: Businesses might attempt to classify workers as independent contractors to avoid taxes, potentially resulting in legal consequences.

- Tax Calculation Errors: Self-employed professionals must ensure they report income accurately to avoid IRS scrutiny or overpayment.

Tips for Businesses and Workers

If you’re a business or a professional trying to determine which tax form you need, here are some actionable tips:

For Businesses

- Know Your Workforce:

-

-

- W9 for independent contractors and freelancers.

- W2 for employees on payroll.

-

- Ensure Proper Classification:

Misclassification, whether intentional or accidental, can lead to IRS penalties. Review IRS guidelines if you’re unsure whether someone should be a contractor or an employee.

- Request Accurate Information:

Always verify W9 forms for accuracy, as incorrect taxpayer information can delay filing and trigger audits.

For Workers

- Understand Your Role:

-

-

- You’re likely a W9 worker if you set your schedule and are paid per project without company-provided benefits.

- If taxes are withheld from your paycheck and you have an employer-employee relationship, you’ll receive a W2.

-

- Protect Sensitive Data:

When filling out W9 forms, always confirm the business’s legitimacy to avoid phishing scams and identity theft.

- Plan for Tax Payments:

Independent contractors should calculate and pay estimated quarterly taxes to avoid penalties.

Closing Thoughts: Which Form Applies to You?

Whether a W9 or W2 applies to you depends entirely on your employment status. While W2s offer the convenience of tax withholding and employer-managed contributions, independent contractors must stay proactive about handling taxes when they provide W9s.

Understanding these forms ensures tax compliance, smoother income reporting, and, ultimately, fewer headaches come tax season.

If you’re still unsure whether to fill out a W9 or W2, consult a tax professional for personalized advice. Making the right choice now can save you time, money, and stress later.