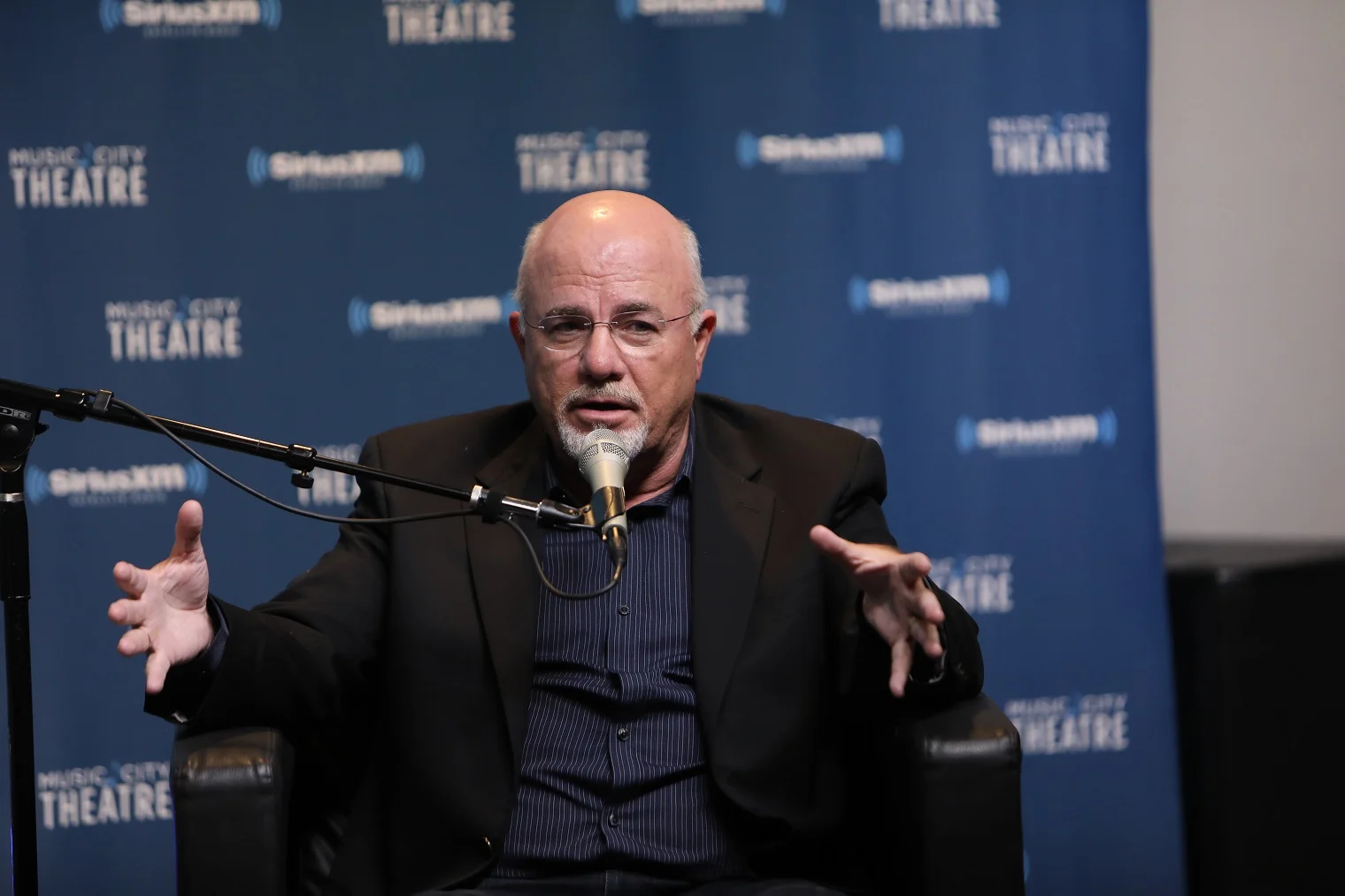

Dave Ramsey, a renowned financial advisor, author, and radio personality, has established himself as a leading figure in personal finance. From hitting millionaire status in his mid-20s to overcoming bankruptcy and building a $200 million fortune, Dave Ramsey’s net worth by age is a fascinating story of resilience, strategy, and hard work. Below, we’ll explore how Ramsey’s net worth evolved over the decades, his financial philosophy, and the lessons entrepreneurs and individuals can learn from his approach.

Early Life and Financial Beginnings

Dave Ramsey was born on September 3, 1960, in Tennessee. From a young age, Ramsey exhibited entrepreneurial tendencies. At 12 years old, he started a lawn care business and sold leather bracelets, learning the importance of customer service and keeping his word. These early ventures laid the foundation for his success.

At age 18, Ramsey earned his real estate license and used the commissions from selling properties to help fund his college education. By his mid-20s, he ventured fully into real estate, amassing an impressive portfolio and net worth that placed him among young millionaires.

Age 26 – The First Millionaire Milestone

By the age of 26, Dave Ramsey had built an impressive $4 million real estate portfolio with a net worth exceeding $1 million. His financial strategy involved aggressively buying and flipping properties with financing sourced from local banks. However, this rapid growth was accompanied by high leverage, with much of his portfolio funded by short-term loans and significant debt.

Ramsey’s early financial success demonstrates the power of entrepreneurship and leveraging opportunities. However, his use of debt would later present major challenges.

Age 28 – A Financial Setback

Just two years later, at 28, Dave Ramsey faced a life-defining financial crisis. After a series of bank acquisitions, his lenders began calling in his loans, demanding full payment within 90 days. Despite paying off the majority of his debts, he was unable to meet all these obligations and ultimately filed for personal bankruptcy protection in 1988.

This period marked a pivotal turning point in his financial philosophy:

- He transitioned away from debt-driven growth.

- He began focusing on financial discipline and sustainable wealth-building strategies guided by biblical principles.

Age 30–40 – The Rebuilding Years

Following bankruptcy, Ramsey rebuilt his life and career from the ground up. Fueled by his personal experience, he turned to financial counseling and helping others avoid the pitfalls that had led to his financial collapse.

During this time, he:

- Founded The Lampo Group, a financial counseling service.

- Began teaching money management classes with just 37 students, which later grew to over 350 members.

- Published his first book, Financial Peace, to share his story and financial strategies.

By his mid-30s, Ramsey had transitioned into a new career, gaining traction as a radio personality and financial advisor, which set the stage for his future wealth creation.

Age 40–50 – Building a Financial Empire

During his 40s, Dave Ramsey’s financial empire took shape. He launched “The Dave Ramsey Show,” a syndicated radio program that now reaches over 20 million weekly listeners across 600+ stations. His ability to deliver financial advice rooted in both personal experience and biblical principles resonated deeply with audiences.

Key accomplishments during this period:

- Published best-selling books like The Total Money Makeover, which has sold millions of copies.

- Expanded The Lampo Group into Ramsey Solutions, offering financial education tools and programs.

By the end of this decade, Ramsey had steadily grown a diversified portfolio including investments in mutual funds, rental properties, and intellectual property rights tied to his books and media content.

Age 50–60 – Reaching Multi-Millionaire Status

Dave Ramsey cemented his status as a financial guru and multi-millionaire during his 50s. By this time, his net worth climbed to approximately $50 million, thanks in part to:

- Profits from his growing publishing and media empire.

- Strategic real estate investments, all purchased debt-free.

- Diversification into mutual funds, focusing on long-term gains.

Ramsey became a leading advocate for debt-free living, using his platform to teach Americans how to build wealth through discipline and consistent saving.

Age 60–Present: $200 Million Net Worth

At the age of 60 and beyond, Dave Ramsey’s net worth is estimated at $200 million. This includes income from:

- Ramsey Solutions, now employing over 1,000 team members and offering renowned programs like Financial Peace University.

- Ongoing royalties and book sales from his publishing catalog.

- His real estate portfolio, managed with a debt-free philosophy.

- National speaking engagements and his syndicated radio show, which remains one of the top financial programs in the U.S.

Dave Ramsey’s Financial Philosophy

The cornerstone of Ramsey’s wealth-building strategy is his “7 Baby Steps,” which emphasize financial discipline, saving, and debt elimination. His philosophy centers on the belief that anyone can achieve financial freedom by following these principles.

Key principles include:

- Avoid debt entirely, using cash or savings to fund major purchases.

- Build an emergency fund to prevent reliance on credit during tough times.

- Consistently invest 15% of income into retirement accounts.

- Buy properties outright instead of financing them with debt.

Ramsey also advocates for investing in mutual funds and avoiding speculative assets like individual stocks. He advises looking for mutual funds with a proven track record of long-term growth, ensuring stability and consistent returns.

Lessons to Learn from Dave Ramsey’s Journey

- The Risks of Leverage

Early in his career, Ramsey made the mistake of over-leveraging his portfolio, leaving him vulnerable to shifting market conditions. His bankruptcy taught him the value of avoiding debt and building wealth conservatively.

- A Diversified Portfolio

Today, Ramsey’s investments span mutual funds, rental properties, and intellectual property, which provide multiple streams of stable income.

- Resilience and Rebuilding

Ramsey’s ability to recover from bankruptcy and build a $200 million net worth is a testament to perseverance and refining one’s strategies after setbacks.

- Education Over Transactions

By focusing on educating others, Ramsey created a business model that doesn’t just generate passive income for himself but also transforms lives, further strengthening his credibility and brand value.

Final Thoughts

Dave Ramsey’s net worth by age reflects a story of ambition, losses, recovery, and long-term consistency. He leveraged what he learned from failure to build not only personal wealth but also a legacy of empowering others through financial education.

For those inspired by Ramsey’s journey, his advice is clear:

- Build your wealth steadily, avoid shortcuts, and live within your means.

- Prioritize education and community over materialism.

- Achieve financial freedom by living debt-free and practicing disciplined investing.

Whether you’re just starting out or well on your way, there’s something in Ramsey’s philosophy that can help every individual or family achieve their financial goals.