Financial planning for retirement is a subject that impacts everyone at some point in their lives. Among the numerous options available to help you secure your financial future, annuities often stand out as a dependable choice. If you’re wondering, “Why buy annuities?”, this article will help you explore the benefits, challenges, and features that make annuities a compelling option for many retirees.

What Is an Annuity?

Before we jump into the benefits, let’s define what an annuity actually is. An annuity is a financial product sold by insurance companies that provides a stream of regular income in exchange for a lump-sum payment or a series of payments over time. It’s essentially a contract between you and the insurer, making it a predictable way to secure income, especially during your retirement years.

There are two main types of annuities:

- Immediate Annuities: Payments start almost right away after your initial investment.

- Deferred Annuities: Payments begin at a future date, allowing your investment to grow over time.

Additionally, annuities can be fixed (offering guaranteed returns) or variable (returns depend on market performance). This flexibility allows individuals to choose the option that best fits their needs.

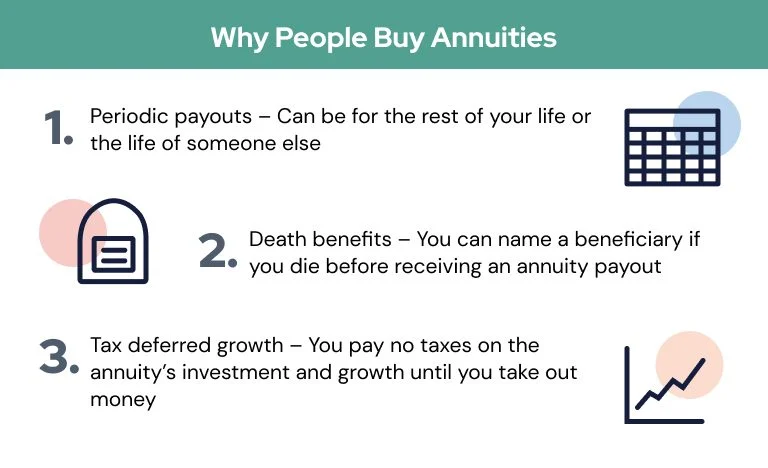

Now, why should you consider adding an annuity to your retirement portfolio? Here’s what makes them worth a second look.

Why Buy Annuities? The Key Benefits

1. Guaranteed Reliable Income

One of the most compelling reasons to buy annuities is the guaranteed income they provide. Unlike market-based investments, annuities ensure you receive consistent payments for a set duration—or even for life. For retirees looking to eliminate the stress of budgeting unpredictable income, annuities can serve as the financial foundation of a stable retirement.

No matter how long you live, the insurance company is obligated to make these payments. This makes annuities particularly appealing for those worried about outliving their savings.

2. Customizable to Meet Your Needs

Annuities offer flexibility to match your unique financial goals. You can add features like:

- Death Benefits for beneficiaries, ensuring your heirs receive payments if you pass early.

- Inflation Protection Riders to keep your payouts aligned with inflation.

- Joint and Survivor Options to continue payments to a spouse after your death.

While these customizations typically come at an additional cost, they give you options that can cater to your long-term financial security.

3. Tax Advantages

Annuities come with tax-deferred growth. This means your investment earnings grow without being taxed until you begin withdrawing the money, allowing your funds to compound more effectively over time. This is especially beneficial if you’re in a lower tax bracket during retirement.

4. Peace of Mind

For many retirees, the psychological benefit of “set it and forget it” income cannot be understated. Annuities remove the uncertainty of market fluctuations and deliver predictable financial assurance, freeing you from retirement-related stress.

Potential Drawbacks of Annuities

While annuities provide unmatched reliability, there are some downsides worth mentioning. Being informed will help you decide if an annuity aligns with your overall financial strategy.

1. High Fees

Annuities often come with significant fees for management and customization. Annual fees, administrative costs, and other charges can add up, affecting your overall returns. Some advanced features (such as guaranteed minimum income riders) may push costs even higher.

2. Surrender Charges

If you need to access your funds before the end of the contract’s surrender period (typically six to eight years), expect to pay steep surrender fees. This lack of liquidity makes annuities less suitable for people who need quick access to their funds in emergencies.

3. Limited Growth Potential

Compared to other investments like mutual funds or ETFs, fixed annuities specifically provide lower returns. Your money is safe but may not grow significantly over time, which can be a drawback for individuals with a higher risk tolerance.

4. Complexity

Annuity contracts are often lengthy and complex. Every detail—from fees to payout structures and optional riders—is buried in the fine print. Understanding the terms of your contract is essential before you commit.

Comparing Annuities to Other Retirement Options

Still not convinced? Let’s draw some comparisons to other popular retirement options:

- 401(k)s and IRAs typically come with lower fees and broader investment choices but lack guaranteed income.

- Dividend-Paying Stocks can potentially yield higher returns but don’t guarantee income, and market volatility may impact dividends.

- Mutual Funds offer great flexibility for growth but are more susceptible to market downturns compared to annuities.

The truth is, annuities excel in their ability to provide steady income regardless of market performance. For this reason, many financial advisors recommend pairing annuities with other investments. Doing so allows you to balance steady income with growth potential.

Who Should Buy Annuities?

Annuities are not a one-size-fits-all solution. They work particularly well for:

- Retirees Who Need Income Stability: If you’re worried about having enough to cover essential expenses during retirement, annuities can provide peace of mind.

- Risk-Averse Investors: Annuities offer a safer alternative to market-based investments while still providing a reasonable return.

- High Earners Looking for Tax Deferral: If you’ve maxed out contributions to your 401(k) or IRA, annuities provide additional opportunities for tax-deferred growth.

- Couples Planning for Long-Term Care: Joint annuities ensure both partners are financially covered for life.

How to Get Started

If the idea of an annuity appeals to you, take the following steps to ensure it fits with your overall retirement plan:

- Shop Around: Compare offerings from reputable insurance providers.

- Read the Fine Print: Pay close attention to fees, surrender periods, and payment schedules.

- Consult a Financial Advisor: An objective expert can help you determine whether an annuity aligns with your goals.

The Bottom Line on “Why Buy Annuities”

While annuities aren’t for everyone, they can play a vital role in helping you achieve financial security during retirement. Their primary benefit is the assurance of guaranteed income, which is invaluable for many retirees. However, the associated costs and potential drawbacks highlight the importance of researching thoroughly and consulting with professionals before purchasing.

Looking for long-term stability and peace of mind? An annuity might just be the answer to your financial needs.

If you’re ready to explore options further or want personalized advice, speak with a reliable financial advisor who can help you create the perfect plan tailored to your goals.