Forex trading offers endless opportunities to profit from the global currency markets. But before you begin, it’s crucial to understand the types of forex traders and their unique strategies. Each type of trader has their own approach, goals, and methods, which can significantly impact your success.

This article explores the three most common types of forex traders—Day Traders, Swing Traders, and Position Traders—to help you find your ideal trading style.

What Are the Main Types of Forex Traders?

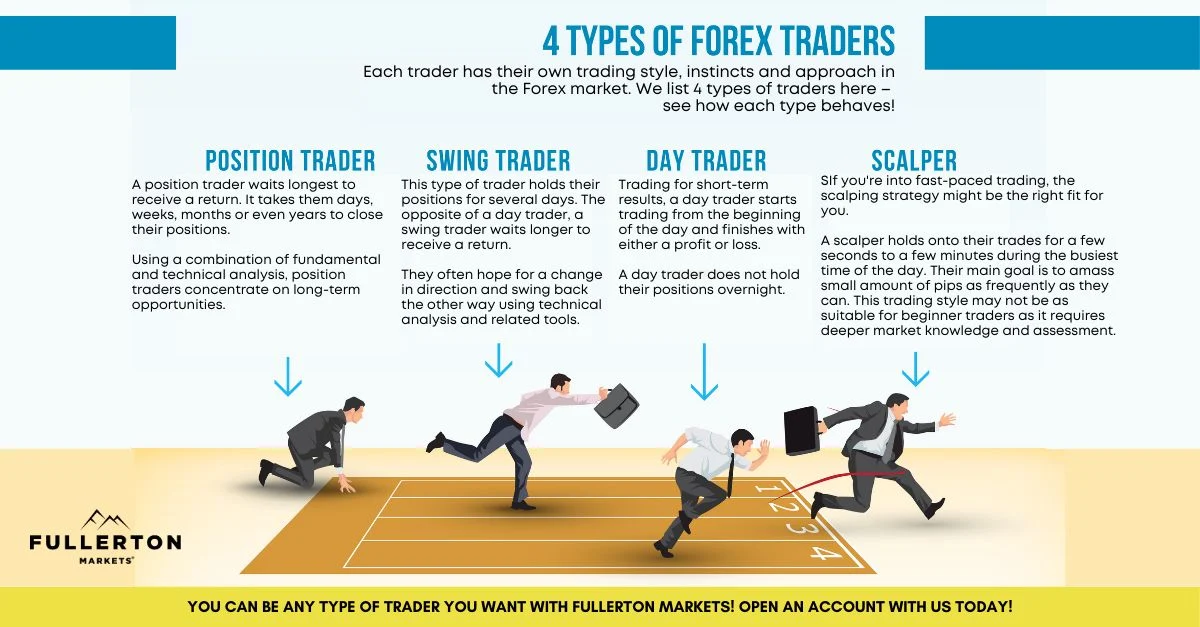

Forex traders generally fall into three categories based on their timeframes and strategies:

- Day Traders

- Swing Traders

- Position Traders

Each type has specific goals, techniques, and levels of risk tolerance. Understanding their key characteristics will help you decide which one aligns with your skills and lifestyle.

1. The Day Trader

Day trading is one of the most fast-paced and dynamic strategies in forex trading. Day traders aim to profit from short-term price fluctuations, and they never hold a position overnight.

Key Characteristics of Day Traders:

- Short-Time Horizons: Trades typically last anywhere from a few minutes to several hours.

- High Trade Volume: Day traders often make multiple trades daily, taking advantage of small pricing movements.

- Focus on Volatile Pairs: They prefer currency pairs like GBP/JPY, which experience large swings within a single day.

- Tools and Analysis: Shorter time-frame charts (1-, 5-, or 15-minute) are used, and technical analysis is their go-to strategy.

Who Is It Best For?

Day trading demands sharp focus, fast decision-making, and a strong grasp of technical patterns. It’s best suited for those who thrive under pressure and have the time to monitor markets during trading hours.

Example: A day trader might make several quick trades in response to intraday price changes in the British pound. Even a movement of just 10 pips can create profit when leveraging the right amount of capital.

Pro Tip: Always manage risks carefully. The fast pace of day trading means losses can accumulate quickly without proper risk controls.

2. The Swing Trader

Swing trading sits between the short-term intensity of day trading and the long-term commitment of position trading. Swing traders look for profit by capturing medium-term price movements over several days.

Key Characteristics of Swing Traders:

- Holding Periods: Swing traders hold positions for anywhere between a few hours to a few days.

- Trend Analysis: They often rely on technical patterns and indicators to pinpoint market entry and exit points.

- Strategic Timing: Unlike day traders, swing traders are more focused on catching significant turning points in the market.

- Preference for Stability: Swing traders gravitate toward liquid pairs like GBP/USD for their predictable trends.

Who Is It Best For?

Swing trading is ideal for those who prefer a slightly slower pace, have limited time during the day, and are willing to wait for opportunities. It offers a good balance between the intensity of day trading and the patience required for long-term positions.

Example: A swing trader might identify a “double bottom” pattern on a GBP/USD currency chart. They would enter the trade at a support level, hold the position for two days, and exit after gaining 1,400 pips during a directional trend change.

Pro Tip: Use stop-loss orders to protect yourself from sudden market reversals. Swing trades often require weathering temporary losses before the market moves in your favor.

3. The Position Trader

Position traders take the long view of the forex market, holding trades for weeks, months, or even years. They analyze broader economic trends to make decisions, focusing on long-term profitability over day-to-day price movements.

Key Characteristics of Position Traders:

- Long-Time Horizons: They hold trades for extended periods, from months to years.

- Fundamental-Driven Strategies: Position traders rely heavily on macroeconomic data, such as interest rates, governmental policies, and global economic trends.

- Stable Currencies: They often stick to major currency pairs like USD/EUR or USD/JPY due to their high liquidity.

- Reduced Emotional Impact: Short-term volatility and news rarely influence their strategy, making this approach less stressful.

Who Is It Best For?

Position trading is perfect for those who prefer well-researched, low-stress strategies. It appeals to individuals with other full-time responsibilities who cannot monitor markets daily but are still looking to profit long-term.

Example: A position trader might analyze weak economic conditions in the U.K. and predict a prolonged bearish trend for GBP/USD. They would enter a short position, holding it for months as the currency continues to decline.

Pro Tip: Patience is the key to position trading success. Ensure you have a clear long-term strategy and are prepared to weather temporary price fluctuations.

Which Forex Trading Style Is Right for You?

Choosing the right trading style depends on several factors, including your personality, lifestyle, and risk tolerance:

- If you enjoy fast-paced action and can dedicate hours to monitoring charts, consider day trading.

- If you prefer a balanced tempo with medium-term opportunities, swing trading is likely a great fit.

- If you’re patient, analytical, and unfazed by market noise, position trading might be best.

Pro Tip: You don’t have to stick to one trading style. Many forex investors combine approaches, such as conducting long-term market analysis like a position trader while capitalizing on short-term opportunities like a day trader.

Final Thoughts on the Types of Forex Traders

Understanding the types of forex traders is the first step toward finding your unique trading strategy. Whether you’re a day trader, swing trader, or position trader, mastering the nuances of your trading style will help you make informed decisions and maximize profits.

Want to enhance your forex trading skills? Sign up for a free trial of our comprehensive forex trading tools and take your strategy to the next level today!