When it comes to understanding personal finance, few figures are as influential as Dave Ramsey. From his syndicated radio show to his books and courses, Ramsey has used his personal experiences, financial philosophies, and Christian values to reshape how millions of Americans approach money. Through his teachings, “Dave Ramsey financial literacy” has become synonymous with effective money management and achieving financial independence.

This article will explore the fundamentals of Dave Ramsey’s approach to financial literacy, his famous “7 Baby Steps,” and how his practical advice can lead to improved financial well-being.

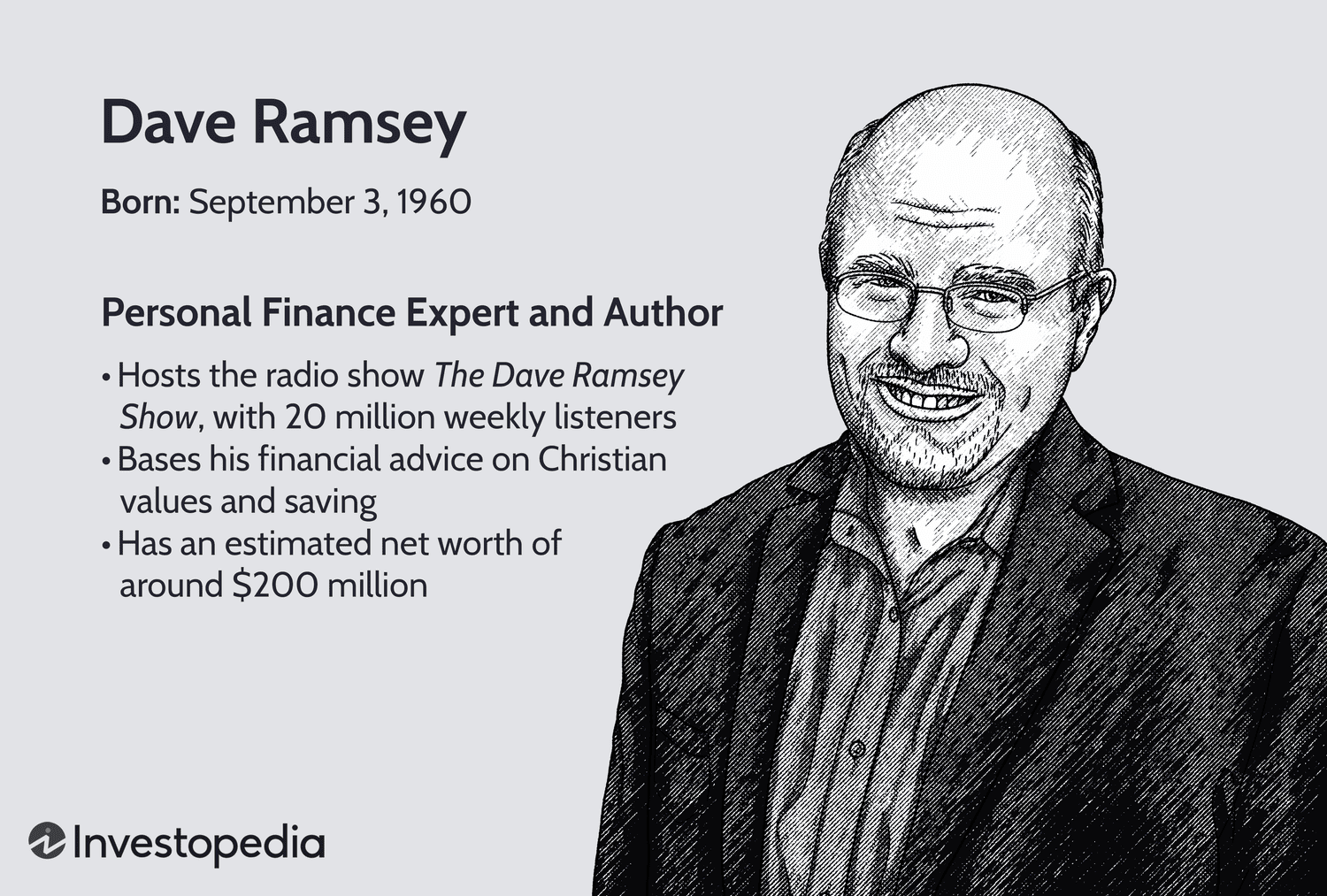

Who is Dave Ramsey?

Dave Ramsey is a personal finance guru, radio host, and author. His story is nothing short of inspiring. At just 26, Ramsey had built a $4 million real estate portfolio, only to lose it all and file for bankruptcy two years later due to overwhelming debt. However, he rebuilt his financial stability and created a career dedicated to helping others avoid the mistakes he once made.

Ramsey founded his company, Ramsey Solutions, authored several best-selling books, and began hosting his nationally syndicated radio show, The Dave Ramsey Show, which reaches millions of listeners weekly. Through these mediums, he breaks down complex financial topics into actionable, straightforward advice that anyone can follow.

The Foundations of Dave Ramsey Financial Literacy

At the core of Dave Ramsey’s financial philosophy is one simple idea: live debt-free and build wealth steadily. His teachings emphasize budgeting, saving, and disciplined financial planning. Unlike many traditional financial advisors, Ramsey integrates Christian principles into his advice, including insights from the Bible that emphasize the importance of avoiding debt.

Key Principles

- Avoid Debt at All Costs

Ramsey is outspoken against accumulating unnecessary debt and believes it is a hindrance to financial security. His perspective stems from his personal experience and aligns with the Biblical teaching, “The borrower is a slave to the lender” (Proverbs 22:7).

- Live Below Your Means

Ramsey advises living on less than you earn to free up money for saving, investments, and meaningful purchases. This disciplined approach prevents overspending while putting financial goals within reach.

- Build a Safety Net

One of his central teachings is establishing an emergency fund, ensuring that unforeseen expenses (like medical bills or car repairs) don’t derail long-term plans.

- Follow the 7 Baby Steps

For Ramsey, financial literacy boils down to actionable tasks. His “Baby Steps” provide a roadmap for anyone looking to achieve financial freedom.

The 7 Baby Steps for Financial Freedom

Dave Ramsey’s “7 Baby Steps” is one of his most recognized contributions to financial literacy. The steps simplify the personal finance journey into manageable milestones, empowering individuals to make steady progress.

Baby Step 1 – Save $1,000 for Your Starter Emergency Fund

Begin by saving an initial $1,000 for unexpected expenses. This small safety net acts as a financial buffer while tackling larger goals.

Baby Step 2 – Pay Off All Debt Using the Debt Snowball Method

List your debts, except for your mortgage, from smallest to largest. Pay off the smallest debt first while making minimum payments on others, then roll that payment into the next debt. This method builds momentum and a sense of accomplishment.

Baby Step 3 – Save 3–6 Months of Expenses for a Fully Funded Emergency Fund

Once you’ve eliminated debt, focus on saving enough to cover three to six months of expenses. This ensures financial stability in emergencies like job loss or unexpected events.

Baby Step 4 – Invest 15% of Your Household Income in Retirement

Prioritize future security by investing 15% of your yearly income into retirement accounts, such as a 401(k) or IRA.

Baby Step 5 – Save for Your Children’s College Fund

Avoid student loans by contributing to an Education Savings Account (ESA) or a 529 plan, laying the foundation for your children’s future academic success.

Baby Step 6 – Pay Off Your Home Early

Accelerate mortgage payments and eliminate housing debt, ensuring that one of your largest expenses is no longer a financial burden.

Baby Step 7 – Build Wealth and Give Back

Now that financial obligations are behind you, focus on growing your wealth through investments while giving generously to causes that matter to you.

Applications of Dave Ramsey’s Financial Literacy

Ramsey’s principles apply to various aspects of financial planning, from budgeting to investments. Below are some ways his strategies can help transform financial habits:

1. Budgeting and Spending

Dave Ramsey advocates for the zero-based budgeting method, where every dollar has a designated purpose. This approach ensures accountability and maximizes control over expenses. Tools like his app, EveryDollar, simplify the process.

2. Debt Elimination

The debt snowball method addresses the psychological burden of debt. By focusing on small wins (paying off the smallest debts first), individuals build confidence to tackle larger financial challenges.

3. Saving and Investing

Ramsey’s financial literacy extends beyond saving. He encourages disciplined investing in mutual funds with a proven track record, focusing on long-term growth rather than high-risk investments.

4. Generosity and Giving

Once financial freedom is achieved, Ramsey emphasizes the joy and fulfillment that comes from giving back. His followers often credit this step as the most rewarding part of the process.

Why Dave Ramsey’s Financial Literacy Resonates

Dave Ramsey’s financial advice goes beyond numbers and spreadsheets. His teachings address the emotional and behavioral aspects of money management. Here’s why his approach stands out:

- Simplified Advice

Ramsey’s step-by-step framework makes financial planning approachable, even for those overwhelmed by their current situation.

- Relatable Story

Ramsey’s personal story of success, failure, and rebuilding resonates with those struggling to regain control of their finances.

- Community Support

Through Ramsey Solutions, his radio show, and financial peace classes, individuals join a supportive community of like-minded people committed to financial improvement.

- Actionable Results

The 7 Baby Steps and zero-based budgeting method have helped millions of people pay off debt, save for emergencies, and retire comfortably.

Final Thoughts on Dave Ramsey Financial Literacy

Dave Ramsey’s financial literacy teachings bring clarity and structure to personal finance. Whether you’re drowning in debt or striving to build wealth, his principles provide a clear path forward. By focusing on discipline, planning, and faith, Ramsey has helped millions transform their financial lives for the better.

If you’re ready to take control of your finances, you can start with one of his common rallying cries, “Live like no one else now so that later, you can live and give like no one else.”

Take your first step towards financial independence today. Implement these principles, focus on your goals, and watch as you achieve the financial peace you’ve always dreamed of.